WARNING:

Filling out your tax return 100% correctly is of utmost importance.

We advise using a professional service like TaxTim for completing your tax return as it is essentially a legal document. Not using professional help may lead to an audit from SARS, harsh penalties, a reduced tax refund or worse.

Do it Right the Easy way by letting TaxTim fill in your Tax Return Instantly.

Maximise Refund, Maximise Compliance. First time users save 15%! Start Now →

Submitting an ITR14 Company tax return? See our eFiling instructions for companies

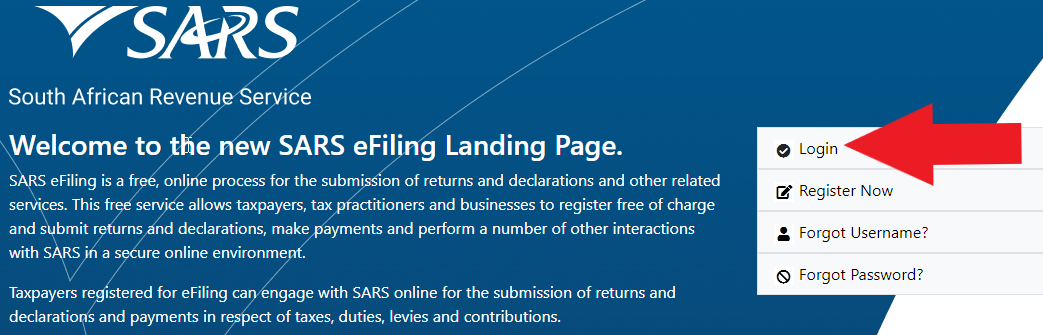

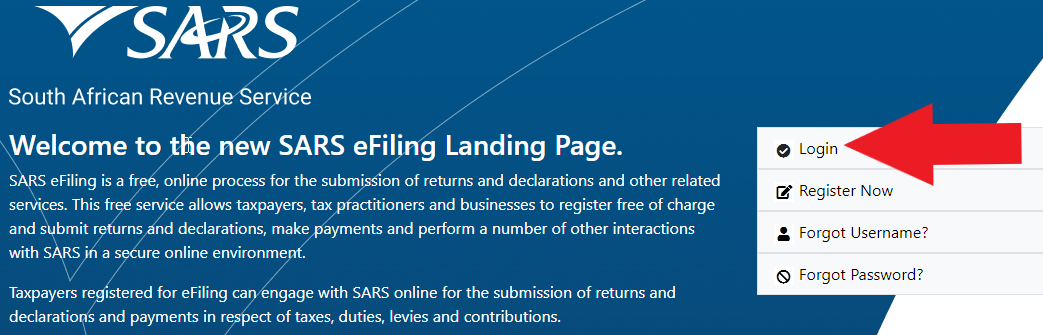

STEP 1: Get started by logging in

Go to www.sarsefiling.co.za.

On the right hand side of the screen you will see Log in, please click this option.

Then type in your unique username, click next and thereafter type in your password - you will have decided on these when you registered for eFiling. Then press login.

Didn't register yet to eFile? See how to register for SARS eFiling step-by-step

If you used to use a tax practitioner and they did this for you, you should request your SARS eFiling login details from them - they belong to you.

Otherwise call SARS ZA on 0800 00 7277 (0800 00 SARS), provide your ID number and some other security details and they will restore access to your eFiling.

STEP 2: Generate your ITR12 tax return

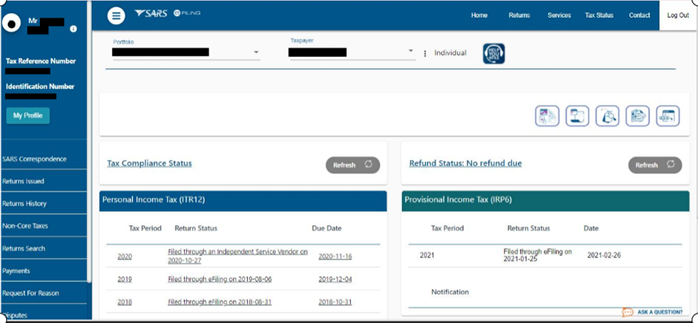

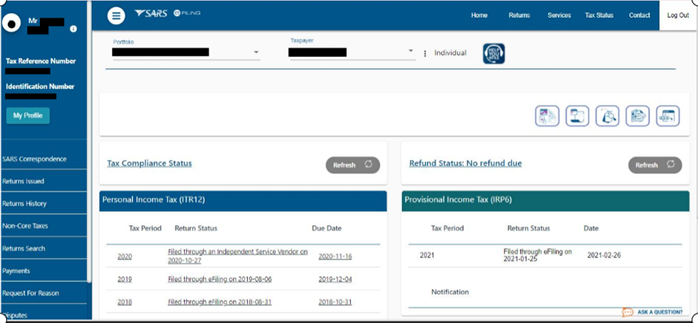

Make sure that your name appears at the top under Taxpayer List just in case you have logged onto someone else's SARS eFile page.

If the title of the page is not INCOME TAX WORK PAGE then click the RETURNS ISSUED button in the menu on the left hand side.

In the menu on the left Returns Issued will open, showing Personal Income Tax (ITR12) - click Personal Income Tax (ITR12).

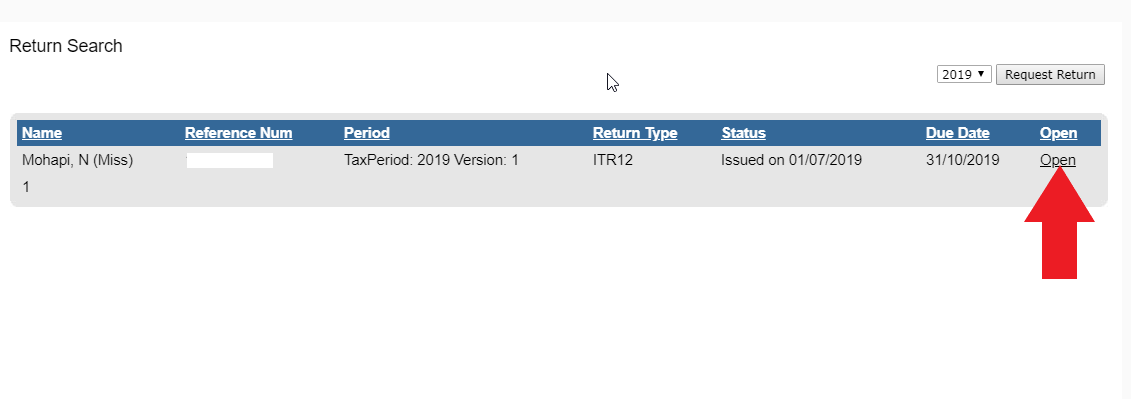

Once you've followed all the steps, the page title will now be Return Search and should show the ITR12 returns you are busy with.

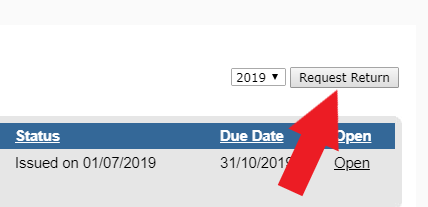

If you have already created your income tax return for the relevant year (it should be listed), jump to STEP 3 below.

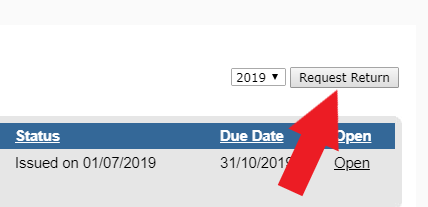

Otherwise, select a tax year from the drop down selector box on the right hand side of the page and click Request Return. This tells SARS you would like to complete a return for that year and they generate it for you.

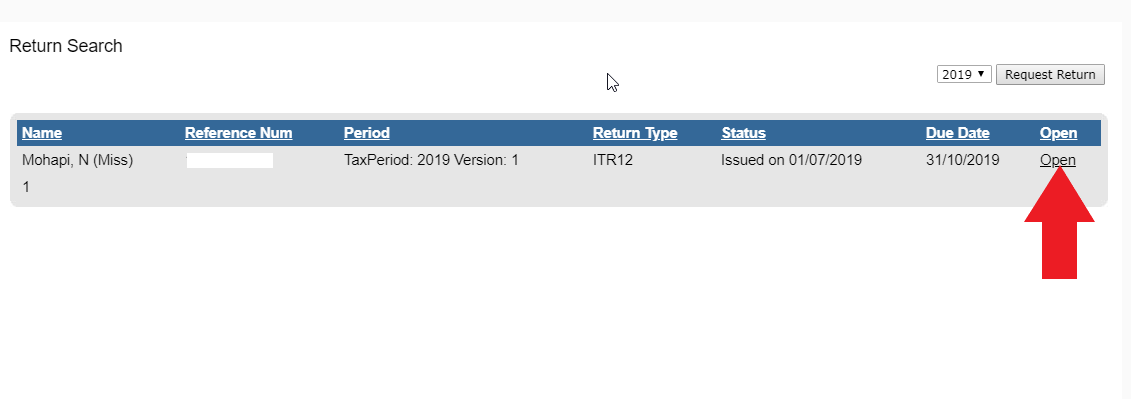

STEP 3: Start work on your income tax return

In the long blue box you will see the requested return showing your name, reference number, return type, status and due date. Click Open on the right hand side.

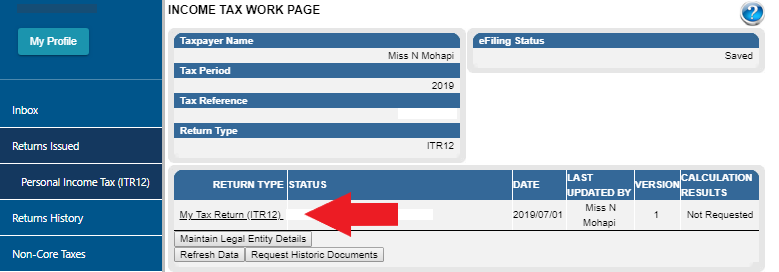

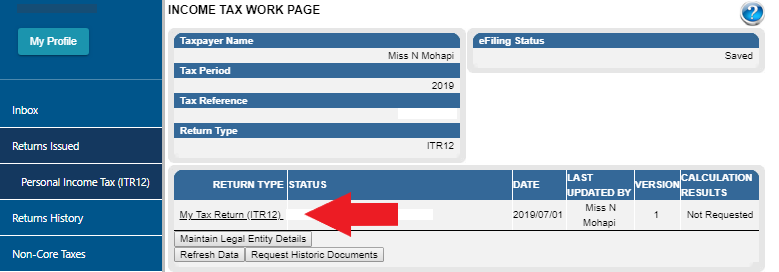

After reading the information pop-up (important info!), you will then find yourself on the INCOME TAX WORK PAGE of SARS eFiling.

This page summarises your tax return for the year.

Under return type, click ITR12. Note the Tax Period matches the tax season you are filing for.

Depending on your browser this will either open in a new window or tab and may take a while to load fully.

STEP 4: Using the Wizard to setup the sections of your return

You have finally gotten to your actual tax return!

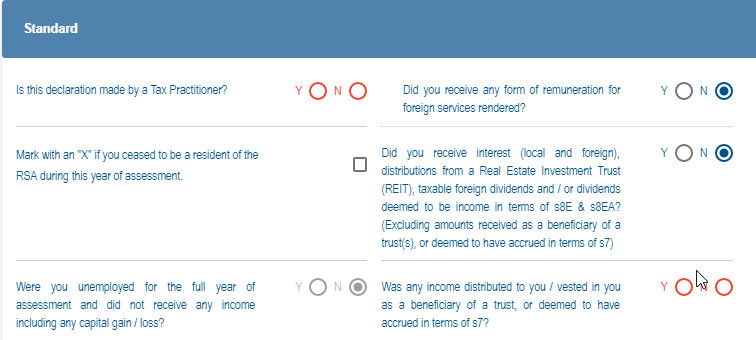

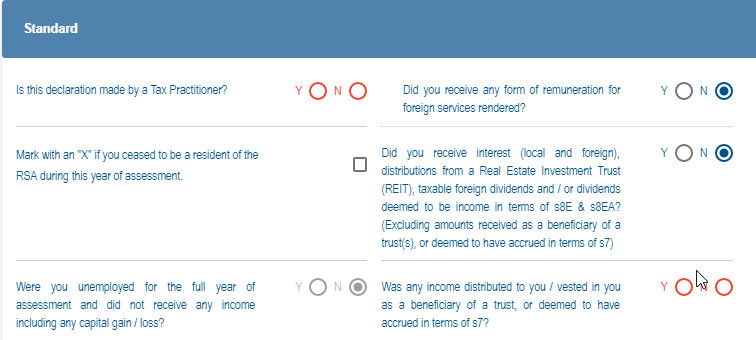

The very first page of your return on eFiling asks you a couple of questions in order to build a return that is specific to you personally.

For example, it will ask how many IRP5s you received from your employer, then the return that is generated will show that number of IRP5s on it for you to complete.

It will start out looking like this:

Then once you start filling it out - checking boxes and entering numbers - it will change, prompting you for more information.

By using TaxTim to complete your tax return, the Wizard page will also be completed for you, along with your whole ITR12 income tax return. It couldn't be simpler! Try TaxTim now

Following this page will be your personal details page. Complete this with your details.

If you do not have a local savings / cheque account, and you have checked this box on the personal details page, a secondary page called No Local Savings / Cheque Bank Account will appear. You will need to complete this too.

STEP 5: Complete your return in eFiling

WARNING: Filling out your tax return without help can result in you paying too much tax, or getting a lower tax refund. Let TaxTim complete and submit your tax return in 20 minutes or less. It's easy! Try TaxTim now →

Now that you have setup your return right, all you need to do is to take the ITR12 tax return that TaxTim completed for you and copy the values across into your eFiling (SARS website) return online. You can also let TaxTim file for you, quickly and easily straight into SARS eFiling.

Any items remaining uncompleted will need to be filled in.

In some cases SARS will block you from entering values into some blocks. This is due to your answers to previous questions. If you are blocked from entering something then you probably aren't meant to enter anything there, and can move along without doing so.

If you are unable to enter something important into eFiling contact 0800 00 7277 (0800 00 SARS) for technical assistance.

If you can't see your return / it is too small, click the + button or set the percentage zoom to 100%. This will make your return bigger.

Once you're happy that you have copied all the amounts, checkboxes and descriptions correctly into your eFiling return, click Save Return. You will see a confirmation message, click Continue to return to the INCOME TAX WORK PAGE.

SARS has a Tax Calculator for you to estimate if you are going to receive a refund, pay money in, or be square. Try it out.

STEP 6: Submit and you're done!

You can return to this page any time you like, click on your ITR12, make changes and save.

If you're 100% happy, don't click Save Return, click File Return and it's done - you just got tax compliant all on your own!

If there is a pop-up, read it - you may have left something out!

What happens next??? Click here to find out what happens after you have filed your tax return.