To create your company profile you will not need to have a separate profile for it anymore. SARS has now created a shared platform.

To set up a new eFiling profile for a company you will need to ensure that you have all your valid documents ready to use during the process.

You will need the following:

1. Name of the company

2. The address and contact number

3. The SARS tax number

4. The registration number

STEP 1: Get started by logging in

Go to www.sarsefiling.co.za.

Type in your unique username and password - you will have decided on these when you registered for eFiling.

Didn't register yet to eFile? See how to register your company for SARS eFiling step-by-step

If you previously used a tax practitioner or tax firm to file your company tax returns, you must request your SARS eFiling login details from them - they belong to you. See how to get back control of your SARS eFiling profile

Otherwise call SARS ZA on 0800 00 7277 (0800 00 SARS), provide your ID number and some other security details and they will restore access to your eFiling.

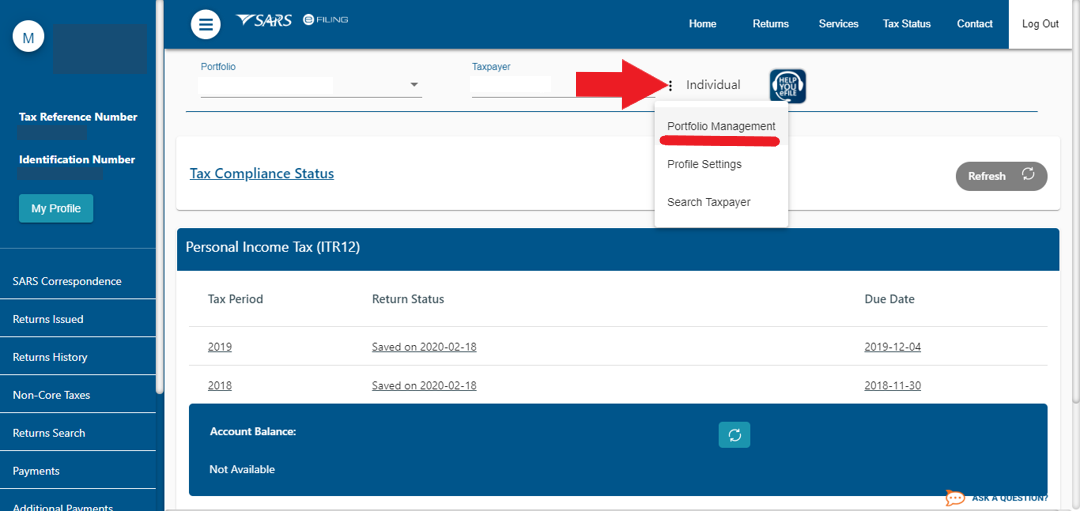

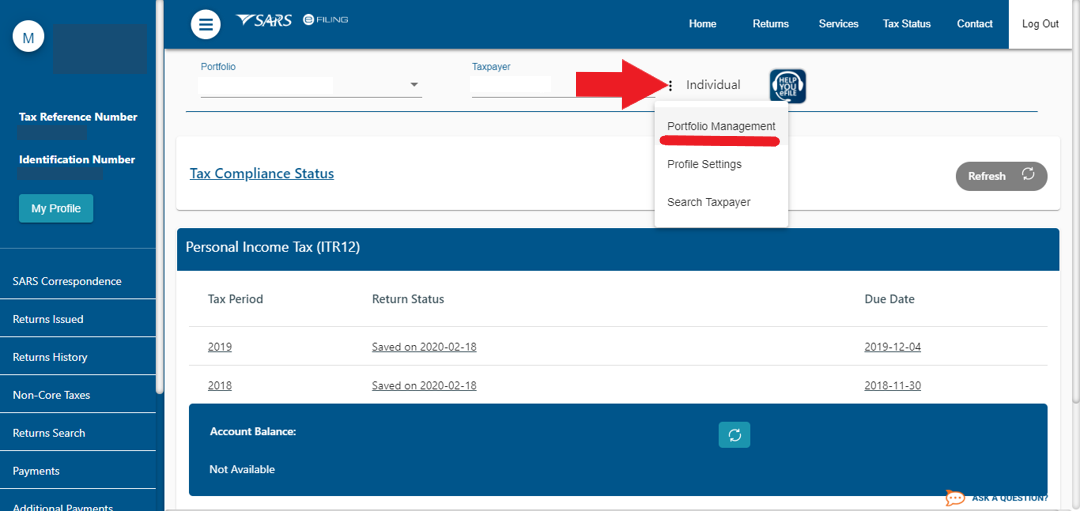

STEP 2: Setting Up

Once you're are on the landing page, click on the 3 (three) dots on top next to the word Individual.

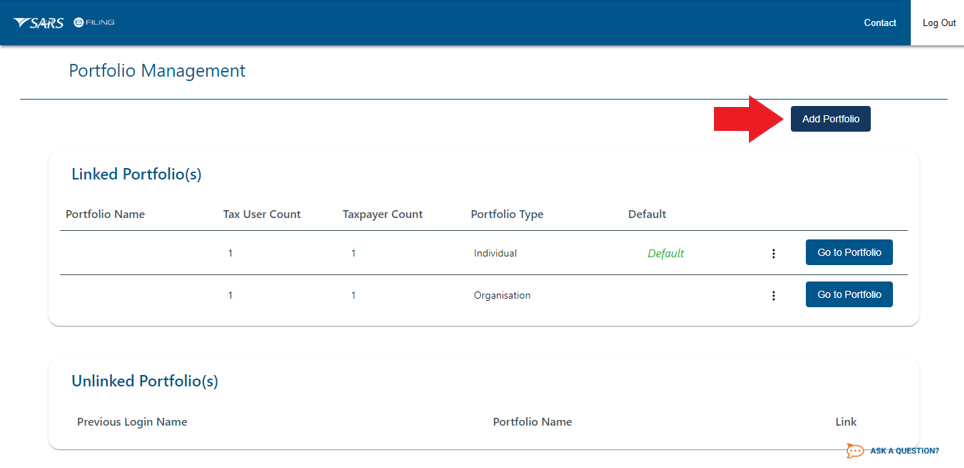

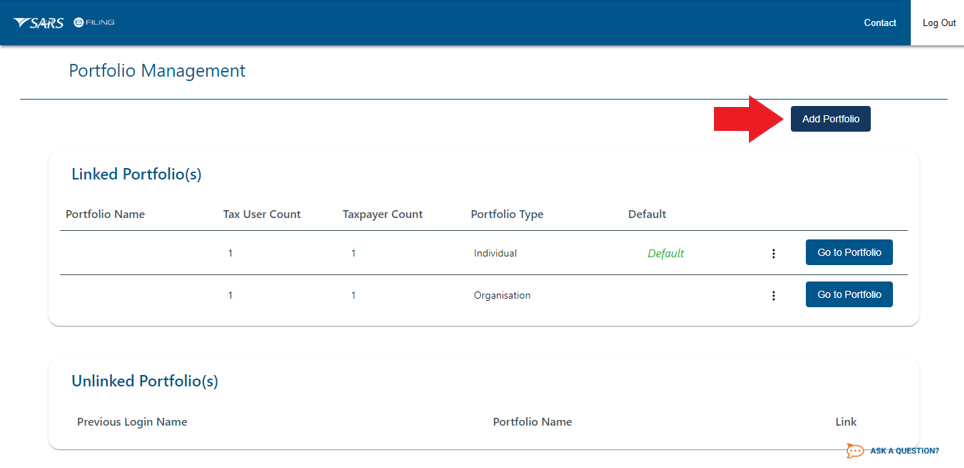

Step 3: Portfolio Management

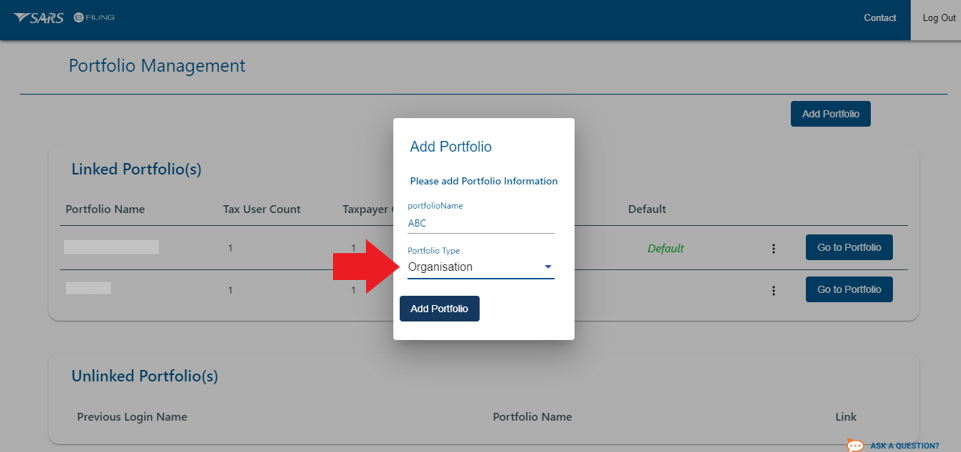

Click on Add Portfolio at the top right side and then you should create a portfolio.

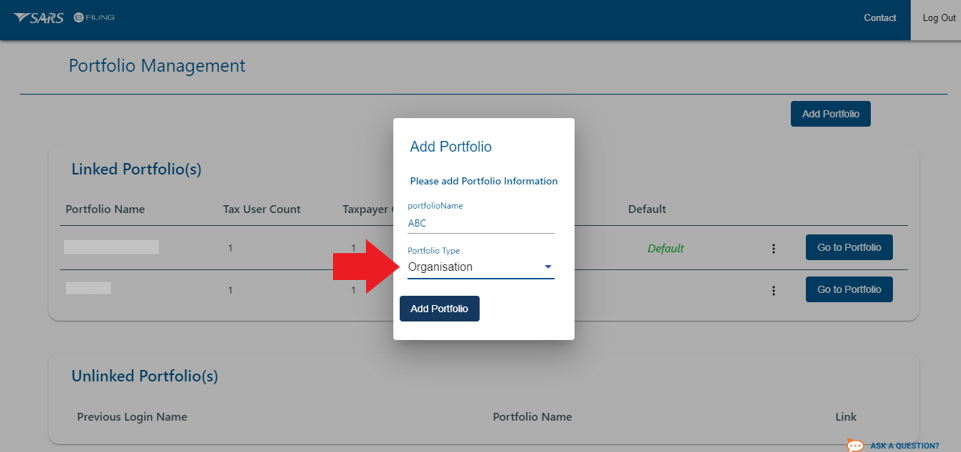

Step 4: Adding a portfolio

On the Portfolio block, under the Portfolio Type, you should then select the option for organisation.

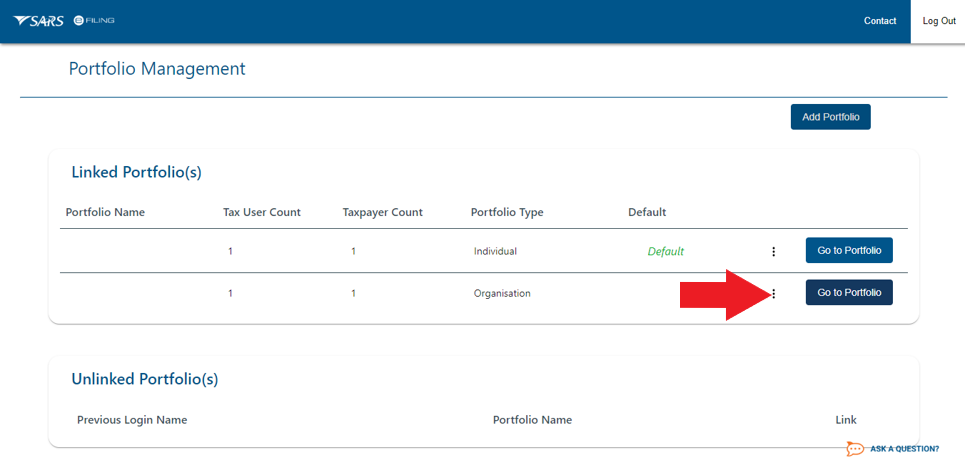

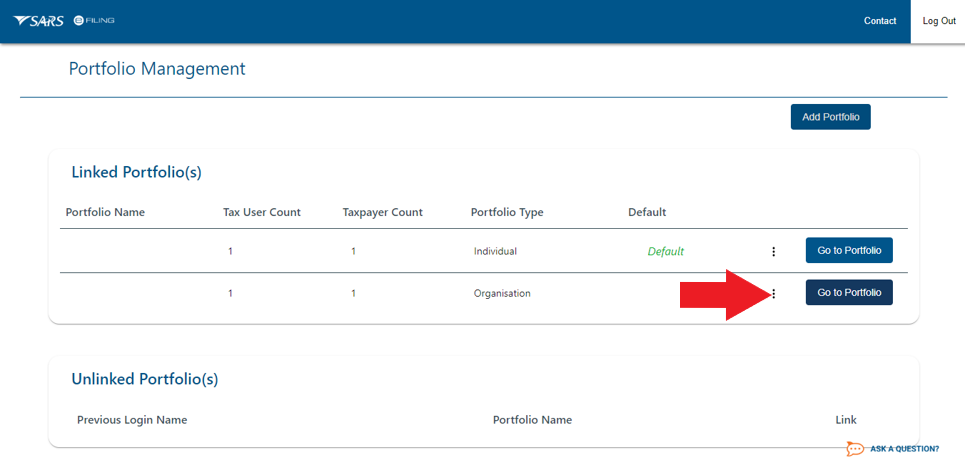

Step 5: Going to the Portfolio

Next you will need to click on the Go to portfolio button, the one next to the new organisation which you have just created.

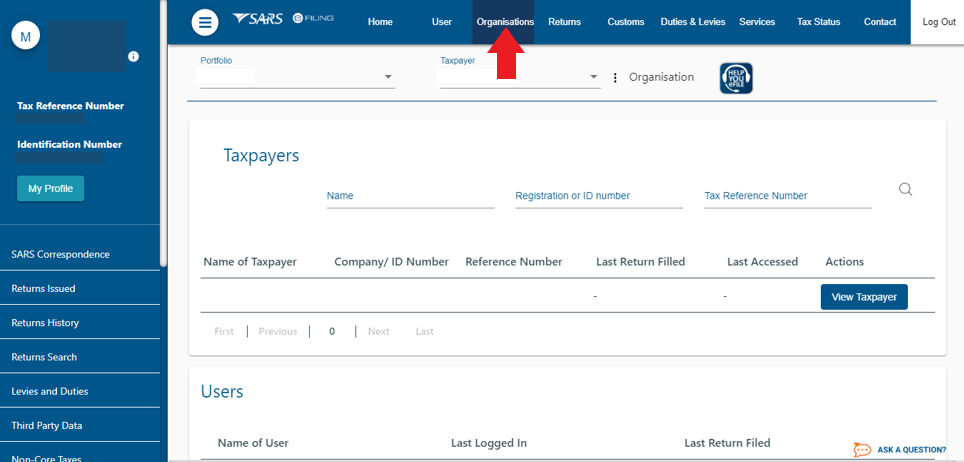

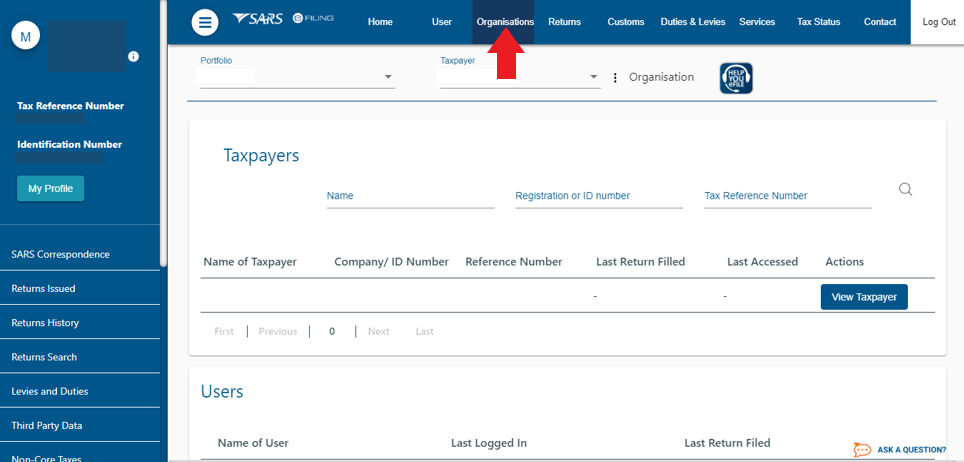

Step 6: Select Organisation

Thereafter, at the top of the screen, click on Organisation

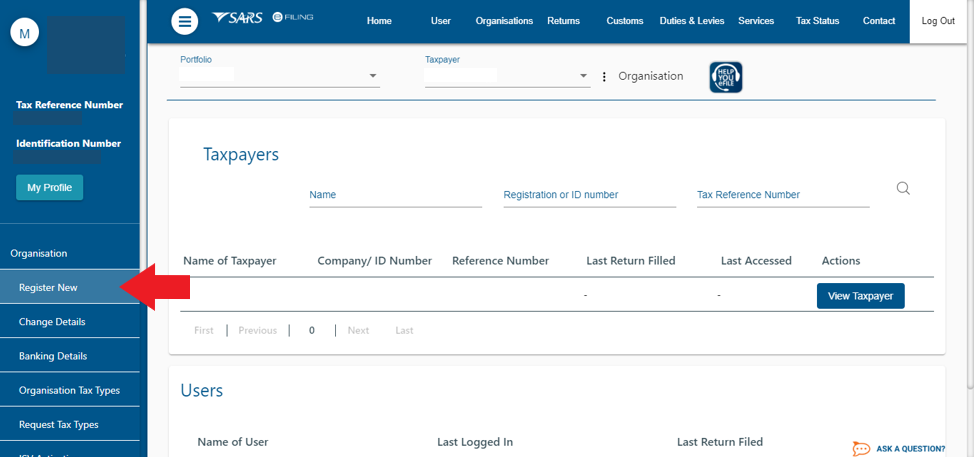

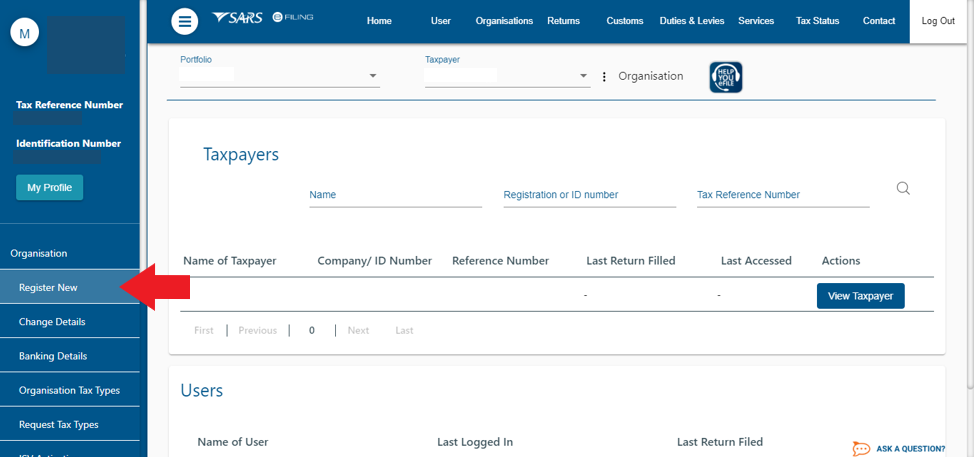

Step 7: Registration

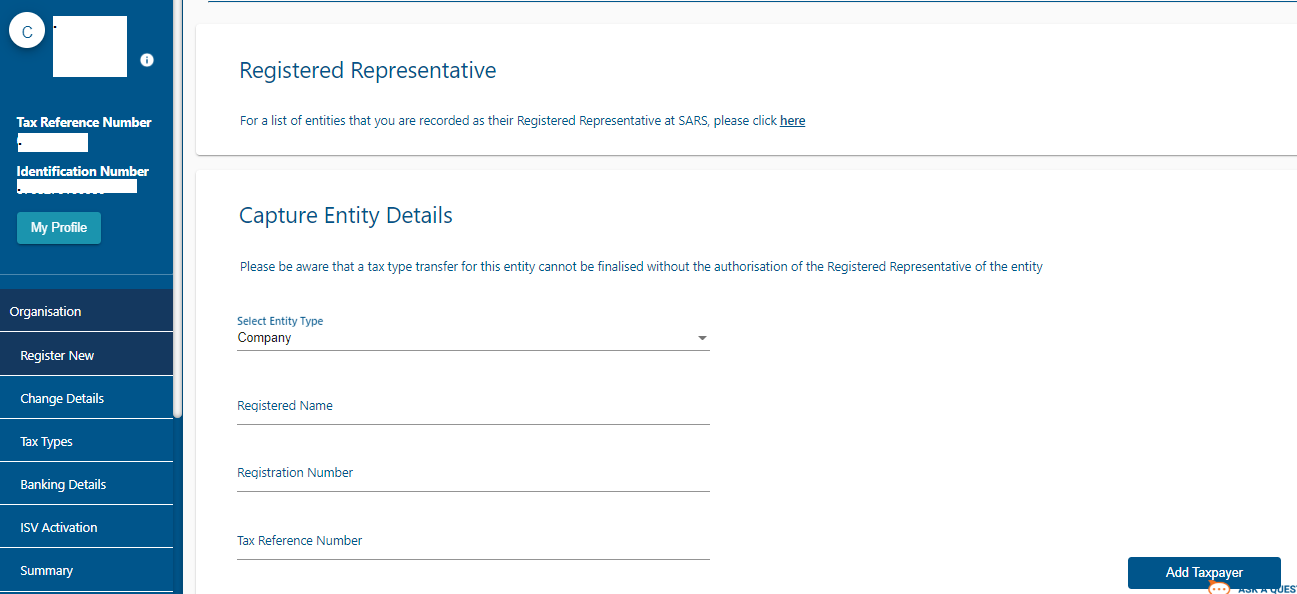

And then you should click on the Register New button on the left of the screen.

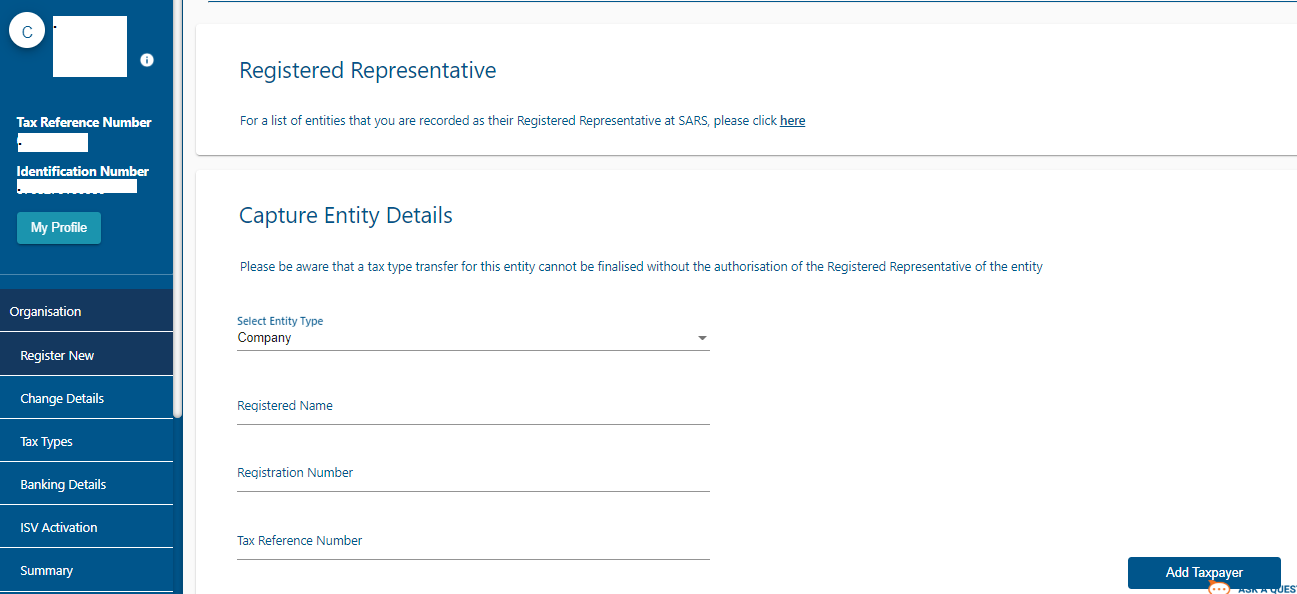

Select and complete the details of your business as shown below. Once completed, click on Add Taxpayer.

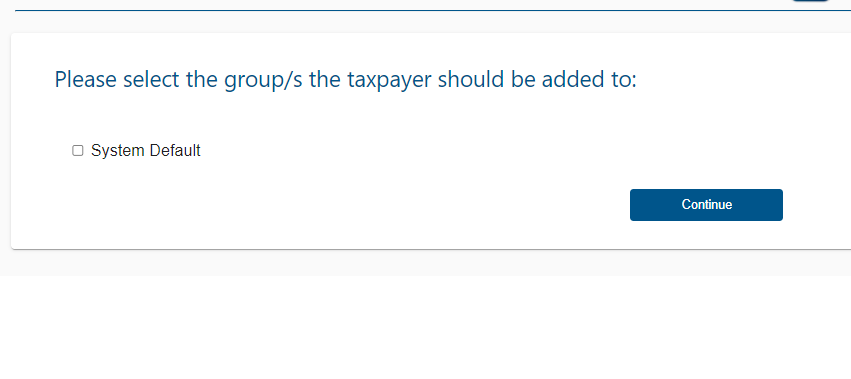

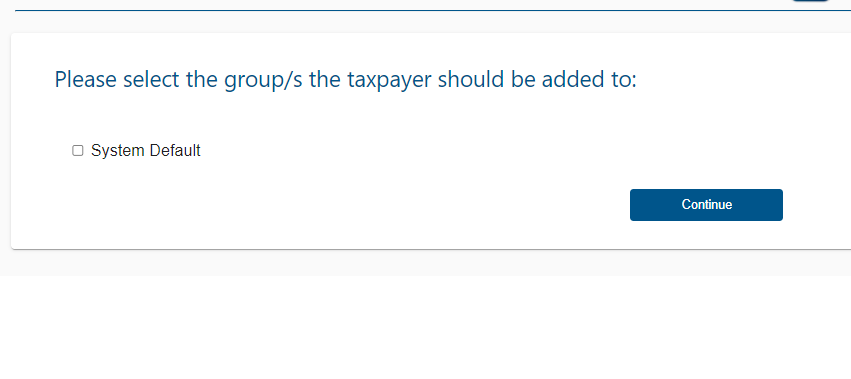

Tick the System Default box and click on Continue.

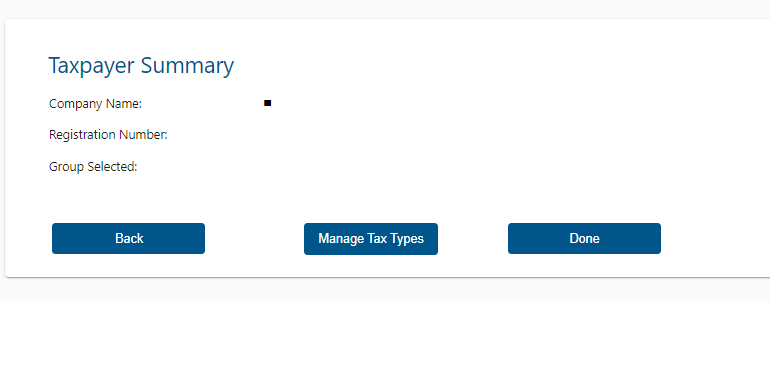

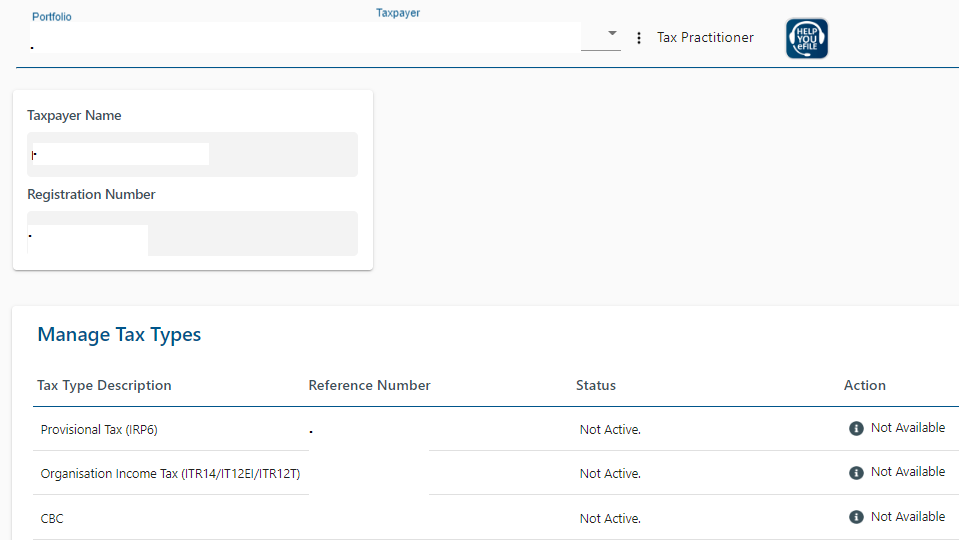

Step 8: Final Checks

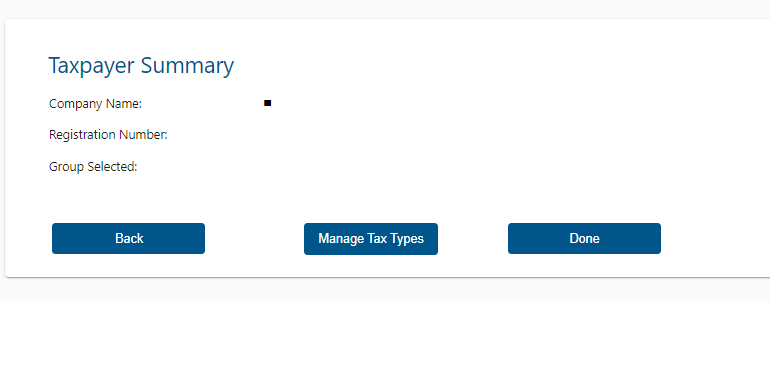

Finally in the middle of the screen, click on Manage Tax Types:

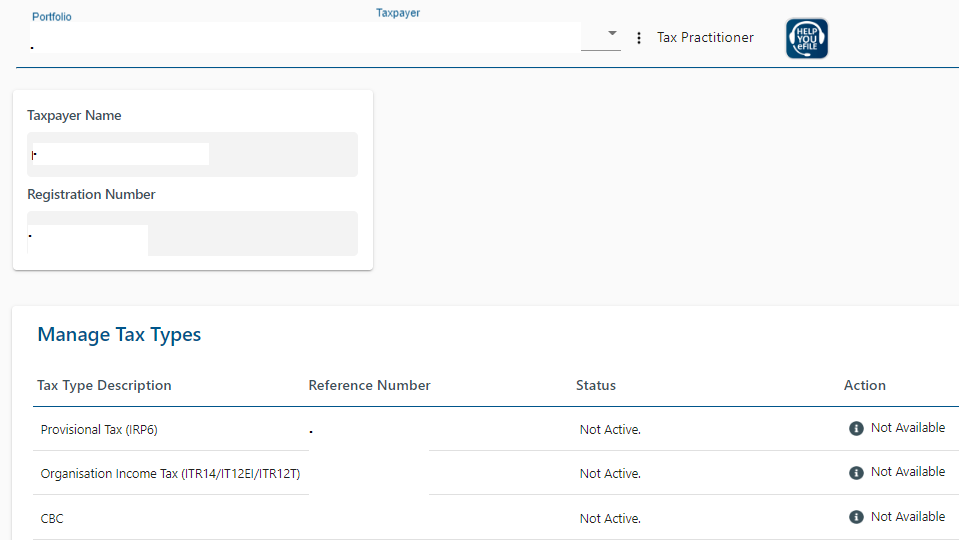

Select the following Tax Types:

1. Provisional Tax (IRP6)

2. Organisation Income Tax (ITR14) and click on Submit at the bottom of the page:

Should you for some reason not be able to click any tax types on this page, you first need to add the registered representative, by following these steps - How to add a registered representative