Written by Neo

Posted 15 July 2019

Written by Neo

Posted 15 July 2019

TaxTim is seeing cases where taxpayers who had already submitted their documents in early July to SARS are, around ten days to two weeks later, receiving a further two letters from SARS requesting documents again. The one letter is the generic letter with the long list of documents, which was originally issued, while the second, contains a more specific request relating to the taxpayer’s tax return.

An example of a specific document request might be for a vehicle purchase contract, in the case where the taxpayer received a travel allowance and submitted only a logbook.

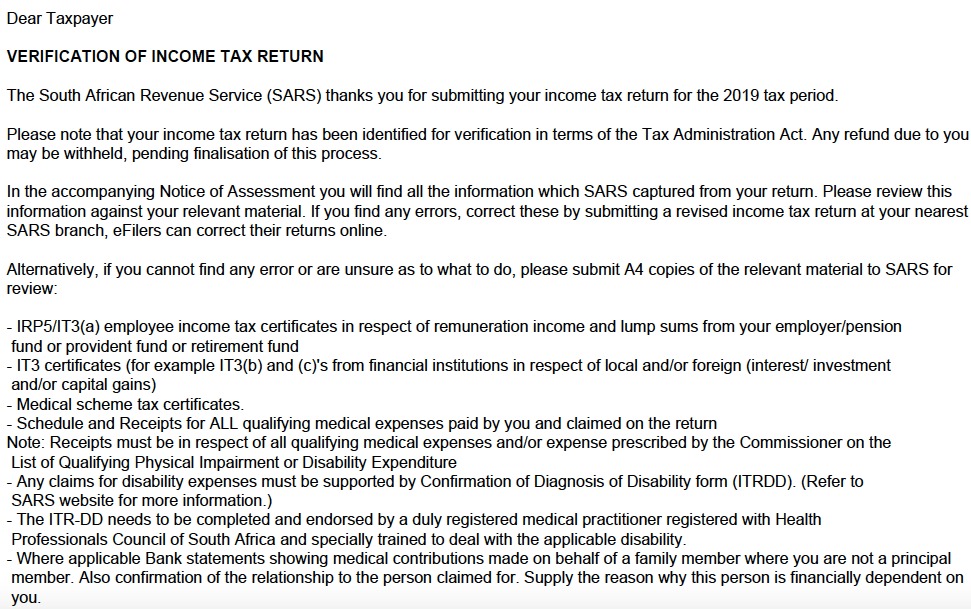

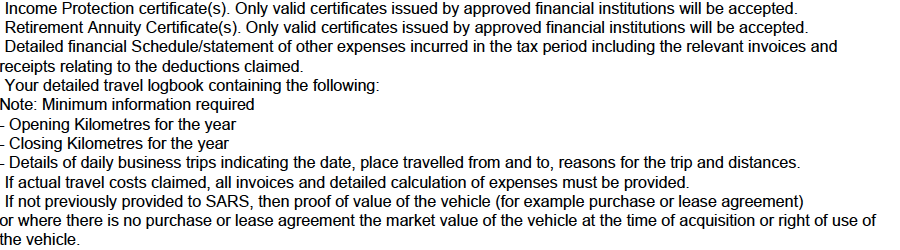

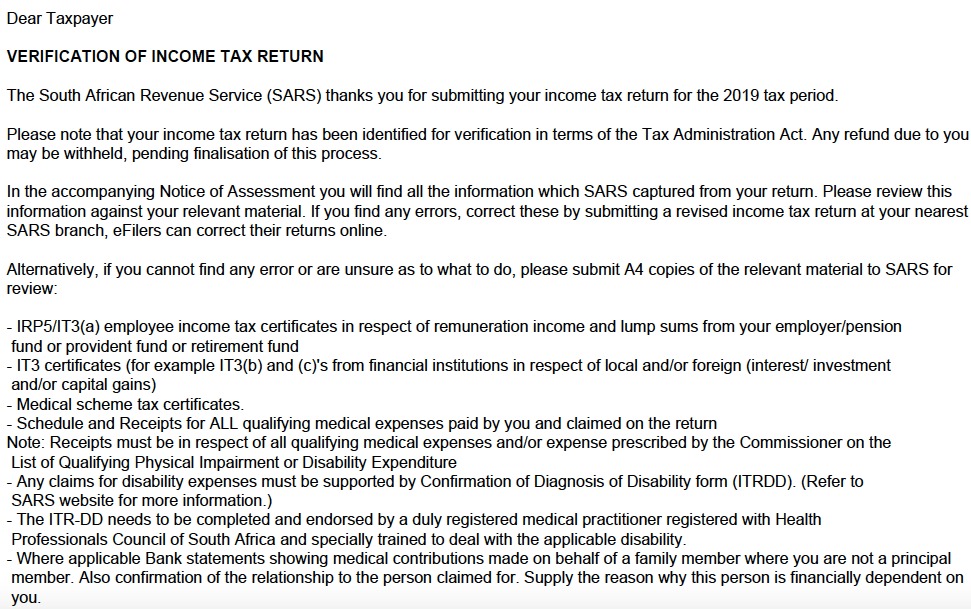

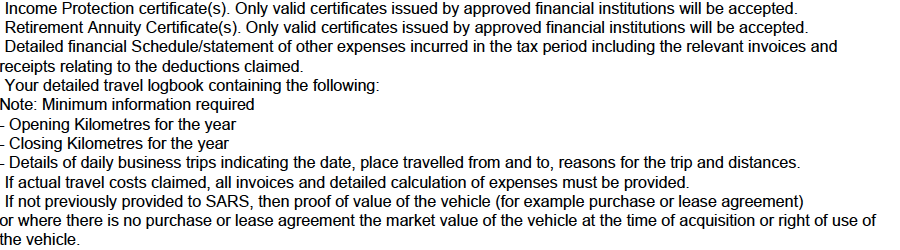

‘Generic’ Letter:

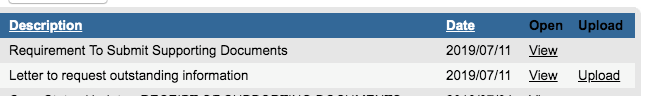

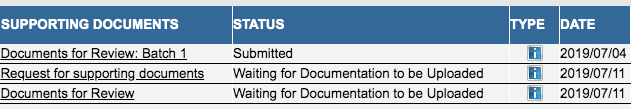

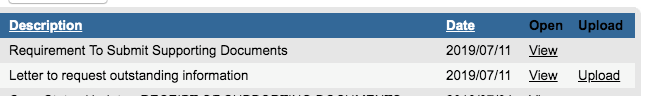

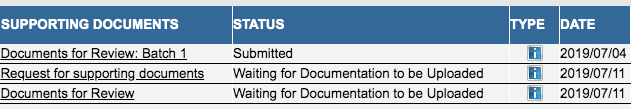

In eFiling, there are two letters issued on the same day, with two links to submit documents, also opened on the same day:

Many taxpayers are questioning whether their documents were submitted to SARS in the first place and if they need to submit them all again.

We have called SARS to discuss the issue. Due to the many changes they have implemented in eFiling, this is a technical glitch in their systems, which they are aware of and are working to resolve.

They advised that taxpayers can ignore the standard ’Requirement to Submit Supporting Documents’ letter (i.e. the generic letter) assuming of course, that their documents were already submitted earlier. Instead, they must focus their attention on the ‘Letter to request outstanding information’, which contains a new specific request from the SARS auditors after their review of the taxpayer’s original document submission.

Please note, that our system fetches all SARS correspondence from eFiling and summarises it into a simplified, more readable format for you. We do this to ensure you don’t miss any important correspondence that SARS has issued for your attention. The SARS system glitch we just described does mean that you may receive two emails from us requesting documents again. We hope it is now clear that you only need to attend to the specific document request and you can ignore the other email with the same document request you saw before.

Remember, that if you are using TaxTim, you can simply submit your documents quickly and easily via our website straight to SARS.

Please contact us if you have any questions about your supporting documents submission. Our team of experts will do their best to navigate you smoothly through your SARS audit.

This entry was posted in TaxTim's Blog

and tagged SARS & eFiling.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Neo

Written by Neo