Written by Neo

Posted 19 July 2017

Written by Neo

Posted 19 July 2017

As you may be aware, SARS has implemented a few changes to the format of the tax return this year. One such change is the requirement for taxpayers to enter more details relating to their policies in the Medical and Retirement section. The source codes used for 2017 have also had their fair share of changes too.

With that said, SARS recently highlighted some issues and technical hiccups on the new tax return relating to these updates. Below is a 'step-by-step' guide on how SARS would want you to handle these updates:

1. Source Code 4582 has been left off IRP5 certificates in error

This will affect taxpayers who receive a travel allowance on their IRP5 with source code 3701 or 3702 as well as those who receive the use of an employer provided vehicle with source code 3802 or 3816. These taxpayers should also have source code 4582 on their IRP5, which represents the taxable portion of the benefit. However, this source code was left off IRP5 certificates in error. The taxable portion is usually 80% of the allowance/fringe benefit (and 20% where the employee travels more than 80% for work purposes).

What your employer needs to do:

The SARS software has recently been updated to include source code 4582. So, employers are required to resubmit IRP5s to SARS for the employees with source codes 3701,3702, 3802 or 3816 on their IRP5s.

What you need to do:

If you’ve not yet submitted your tax return:

Once your employer confirms they’ve resubmitted your IRP5, you should wait for at least 24 hours and then refresh your IRP5 data on eFiling to make sure source code 4582 is reflected. Make use of TaxTim to ensure that you’ve not just filed correctly, but easily as well. You’ll be guided through the entire filing process.

If you’ve already submitted your tax return:

Once your employer confirms that they’ve resubmitted your IRP5, wait for at least 24 hours for changes to take affect at SARS. Then log back onto TaxTim, click on your 2017 tax return and click on the button “Submit Correction” to capture the correct IRP5 details.

If you’ve filed your tax returns by yourself, using eFiling, you’d need to log back into it, navigate to your 2017 tax return and select the tab called “Request Correction”.

In some cases, eFiling will not allow taxpayers to submit a Correction – if this applies, you’ll have to submit a Notice of Objection (NOO) with relevant supporting documents.

Remember to ensure your employer sends you a copy of your latest IRP5

2. Medical data may be incorrectly pre-populated in your tax return

For the first time this year, SARS is using data from the Medical Aids to pre-populate some of the Medical Aid details in tax returns. However, there are cases where the pre-populated details (e.g. the number of dependents) don’t match what’s reflected on the Medical Aid Tax Certificate. In some instances, the medical scheme’s name has been pre-populated with the medical scheme administrators name instead.

Now, if you’re a TaxTim user, fortunately there’s no need to worry about this issue. As long as you answer our questions and enter your medical details per your medical tax certificate, you’re good to go. Our system is able to override any medical data that may be incorrectly populated on eFiling.

On the other hand, if you’re filing your Tax Return yourself, using eFiling, and you happen to notice a difference between your Medical Tax Certificate and the medical data already on your tax return, click on the ‘Refresh Medical Data’ button, to ensure that the latest data from your tax certificate is pulled into your tax return.

The ‘Refresh Medical Data’ button is next to the ‘Refresh IRP5 data’ button:

ITR12.png" alt="" width="557" height="166" border="0" />

ITR12.png" alt="" width="557" height="166" border="0" />

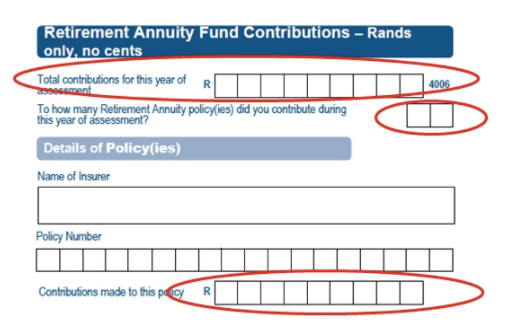

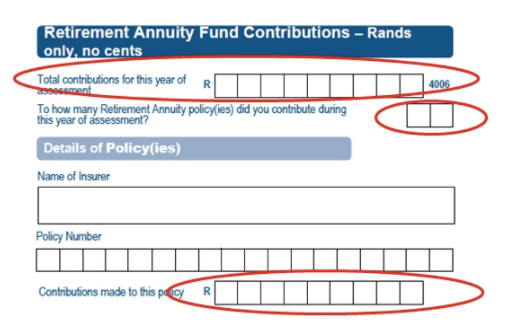

3. Changes relating to the Retirement Annuity section

If you contribute to a Retirement Annuity, you’ll be required to enter more details relating to your policy/policies than in the previous years e.g. name of fund, policy number and the contributions made to that specific fund.

Once again, if you’re making use of TaxTim, you’ll simply need to work your way through the questions in the Retirement section. If you’ve contributed to more than one fund, fortunately the system will guide you to give the details for each fund separately. Thereafter, it will add up the contributions for each fund and ensure your total retirement contributions, for all of your funds, is summed up accurately and populated in the correct field on your return.

And if you’re filing your tax return yourself using eFiling, make sure you enter the number of retirement funds you have contibuted to in the correct field. You’ll also need to ensure that you capture the total contributions for the year correctly. If you contributed to one fund only, the total would equal the amount you contributed to for that specific policy. However, if you contributed to more than one fund, you’d need to add up the contributions to each fund and enter the total amount in the correct field as indicated below.

This entry was posted in TaxTim's Blog

Bookmark the permalink.

Written by Neo

Written by Neo

ITR12.png" alt="" width="557" height="166" border="0" />

ITR12.png" alt="" width="557" height="166" border="0" />