Written by Alicia

Updated 14 June 2023

Written by Alicia

Updated 14 June 2023

Last year, we noticed that many taxpayers filed their tax returns before the tax season officially began (i.e July). However, doing so caused delays and problems with their tax refunds.

There are only three specific instances where you can file your tax return (ITR12) directly on eFiling before tax season starts:

- If you have been declared insolvent / sequestrated or,

- If you need to file a tax return for a deceased estate or,

- If you are emigrating and need to submit your tax compliance status to your bank.

If you are not insolvent, emigrating or filing a tax return for a deceased estate, we suggest that you DO NOT file your tax return before tax season officially opens (this year it opens on 7 July 2023 at 8pm) as SARS may take any of the following steps:

- Your tax return will be routed to their manual assessment centre and you will need to wait for 6 months to receive an outcome

- SARS will include the income you declare on your tax return and remove the related employee's tax (this would happen if they have not yet received an IRP5 from your employer)

- SARS will finalise your tax year and remove the option to submit a correction. You will need to lodge a dispute against the assessment they issued for you. This process could take anything from 3 months to 12 months, depending on when you lodge the dispute.

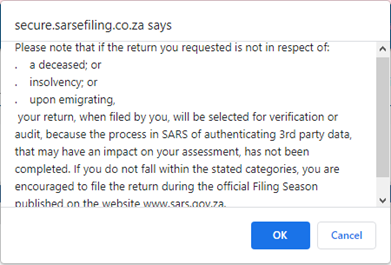

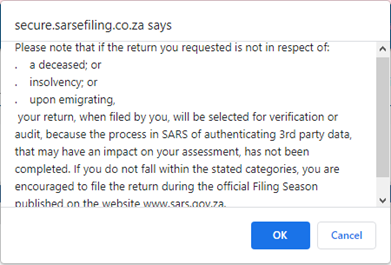

This is the box you should see on eFiling if you try to request your tax return before tax season opens:

If you requested the tax return by accident, you can click on "Cancel" and this will remove the tax return from your eFiling profile.

Another reason not to submit early is due to the auto-assessment process. From 1 July to 7 July, SARS will be sending notifications for auto-assessments. If you submit your tax return before 7 July, it may confuse the auto-assessment process and lead to delays in resolving your tax return with SARS.

Important: You can submit your 2023 tax return on TaxTim prior to 7 July. We will store it in our filing queue, so it's ready for submission to SARS when the tax season officially opens.

This entry was posted in TaxTim's Blog

and tagged Salary / IRP5, Audit / Verification, SARS & eFiling, Tax Refund .

Bookmark the permalink.

10 most popular Q&A in this category

Written by Alicia

Written by Alicia