Written by Alicia

Updated 24 April 2024

Written by Alicia

Updated 24 April 2024

SARS have recently become a lot stricter with late filers and have changed their rules for administrative penalties. You can read more about these changes here. There used to be some leeway for taxpayers who missed the deadline, but sadly these days are certainly over.

If you received a notification of debt from SARS, and you are unsure what this relates to, follow these simple steps to retrieve your Administrative Penalty Statement of Account. It might be that SARS has granted you a penalty for missing the deadline.

1. Log into your SARS eFiling profile.

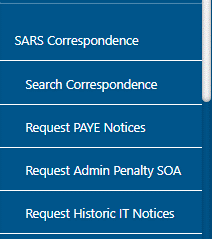

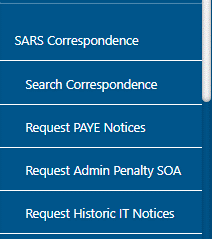

2. Click on the "SARS Correspondence" tab and then click on "Request Admin Penalty SOA".

3. Select the tax year e.g., "2025 "and click "Continue".

4. On the next screen click "Submit"

5. Then click on "Click here to view your Statement of Account"

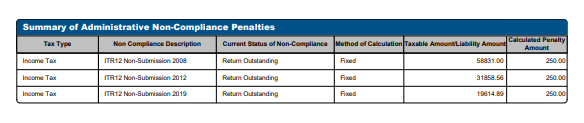

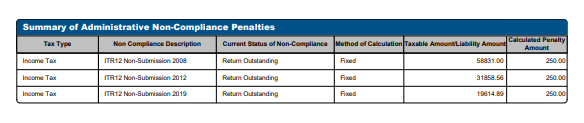

6. The next screen will open the Penalty Statement of Account which will show the penalty amount issued by SARS.

If you'd like to dispute this penalty, please see our Guide to dispute an admin penalty

This entry was posted in TaxTim's Blog

and tagged Penalties, SARS & eFiling.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Alicia

Written by Alicia