Written by Alicia

Posted 6 November 2023

Written by Alicia

Posted 6 November 2023

If your 2023 individual income tax return was auto-assessed by SARS earlier this year, and you intended to include extra income or expenses/ deductions but missed the deadline, don't be dismayed, there might still be a way to fix things!

Is SARS rejecting your tax return submission and your dispute too?

Have you requested an extension, but SARS granted it for a day before they replied to you? i.e, you asked for an extension till 10 November 2023, but SARS gave you an extension till the 4th of November and sent you a letter stating that your extension was granted to the 5th of November 2023 only?

If any of the above situations apply to you, you might feel like you've exhausted your options. However, there is an alternative approach to have SARS review your tax return submission after the auto-assessment: you can file a Request for a Reduced Assessment.

Follow these easy steps below.

1. Log into your eFiling profile:

2. Click on “Returns”:

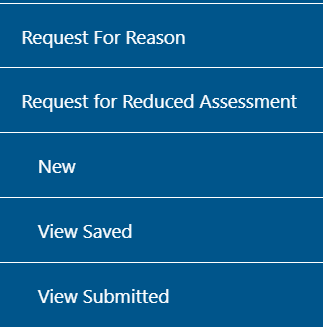

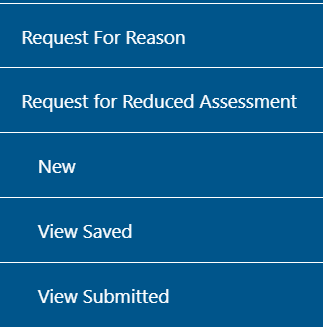

3. Then click on “Request for Reduced Assessment” in the menu on your left, click on “New”:

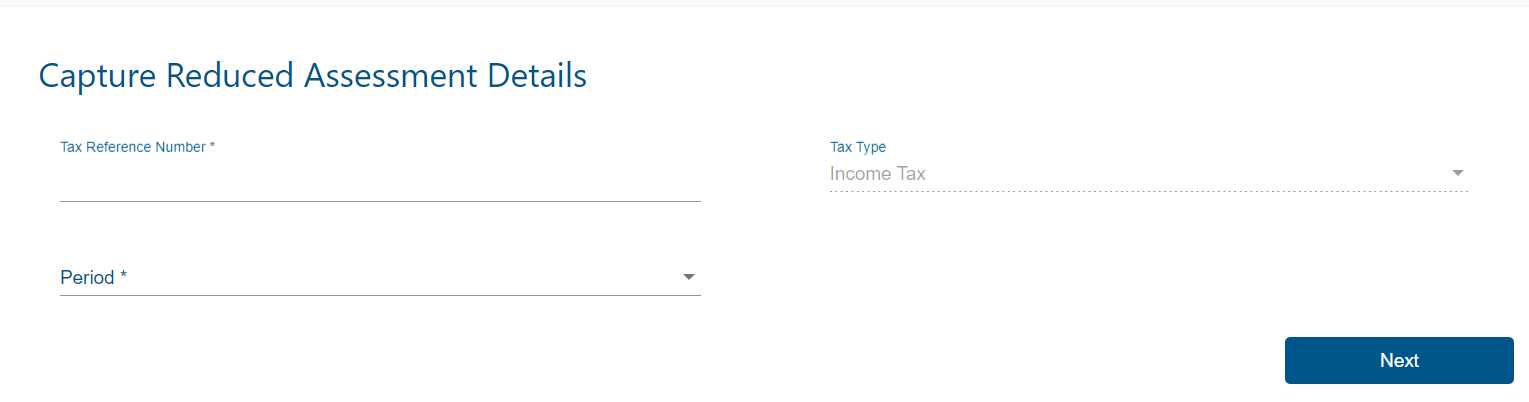

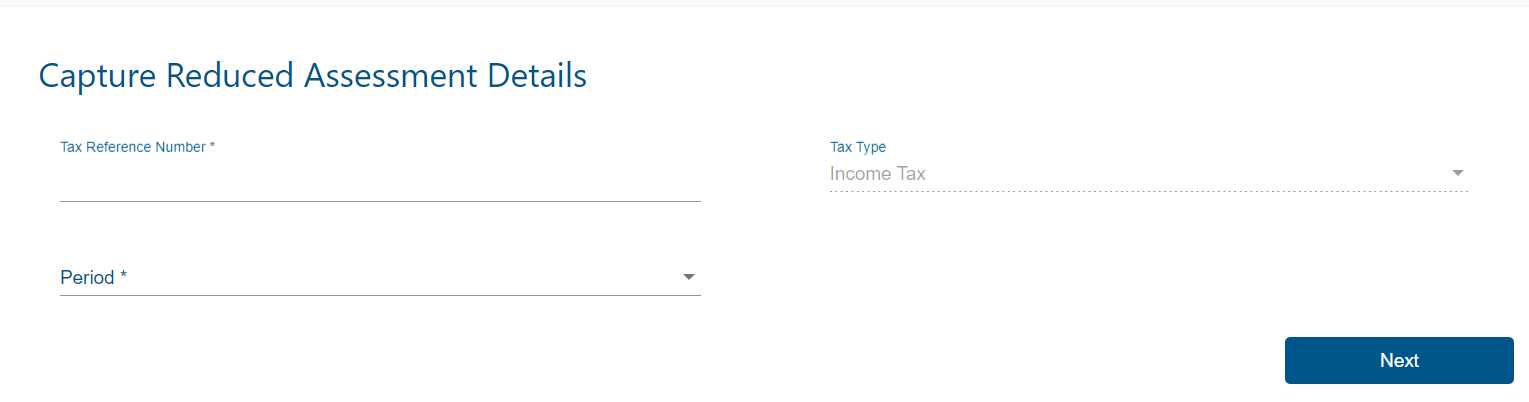

4. Your tax reference number, the Tax Type and the period should be showing, please choose the 2023 tax year:

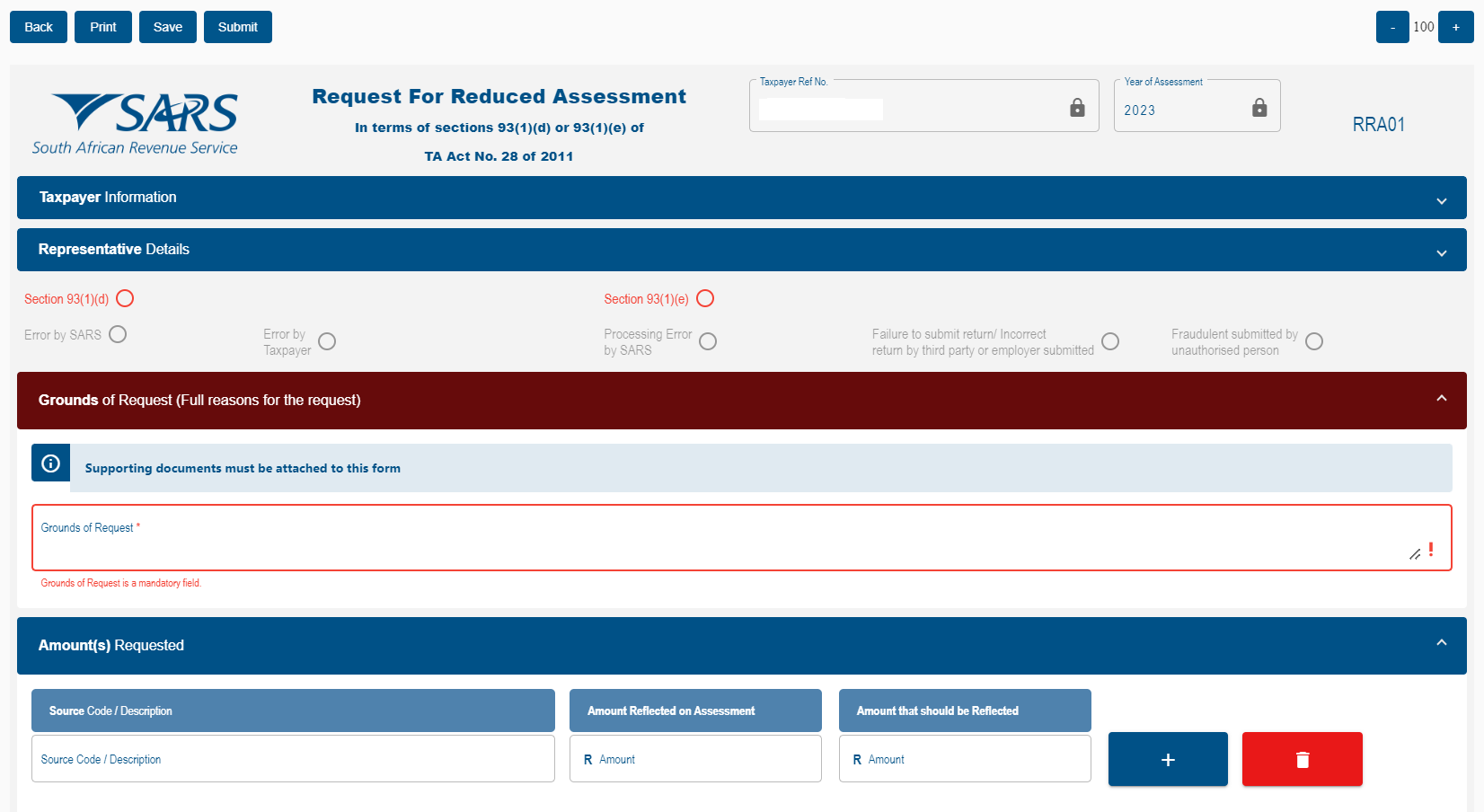

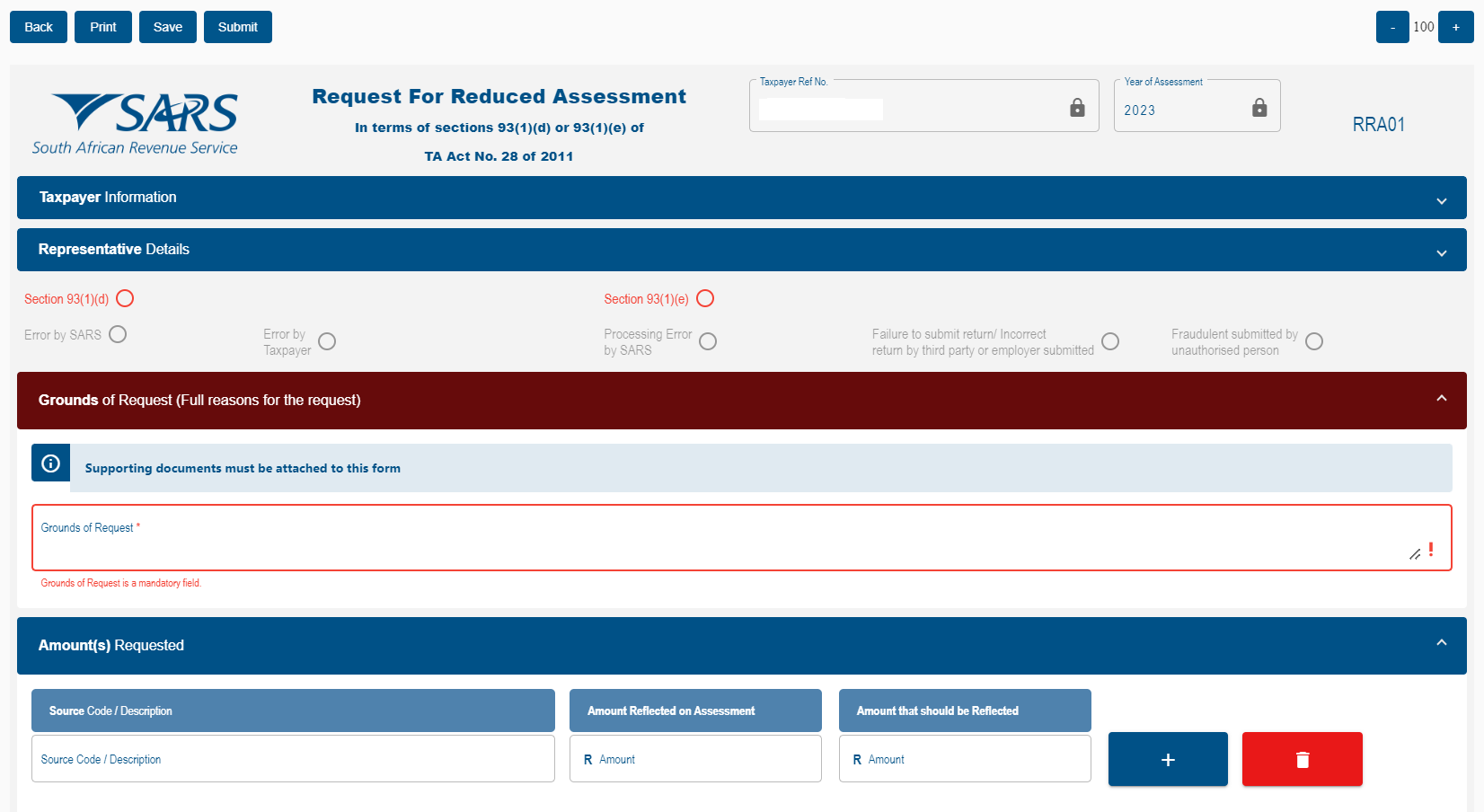

5. Please tick either Section 93(1)(d) or Section 93(1)(e), depending on the reason you need SARS to relook at your tax return. Read below for an explanation of each section:

Section 93(1)(d) – if there is a readily apparent undisputed error in: i) The return submitted by the taxpayer; or ii) The assessment issued by SARS.

Section 93(1)(e) – if SARS is satisfied that an assessment was based on: i) The failure of an employer/third party to submit a return ii) An incorrect return submitted by an employer/third party iii) A fraudulent return submitted by an unauthorised person iv) A processing error by SARS.

Enter the grounds for the request and amounts and source code then click on “Submit”.

Please note: If you don't agree with you auto-assessment or want to submit a correction, you would select Section 93(1)(d).

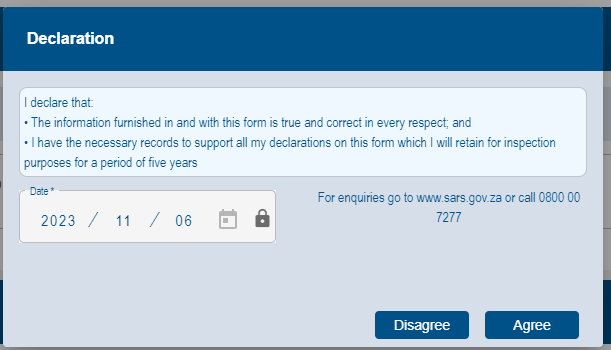

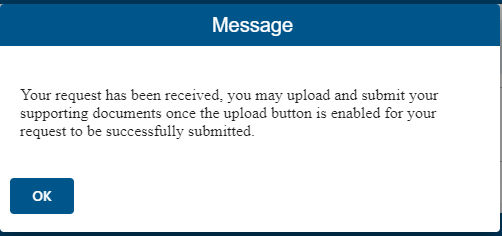

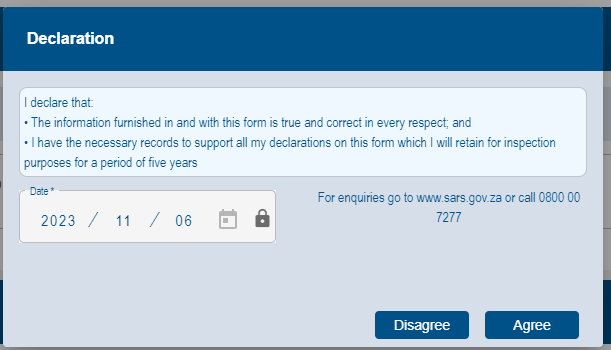

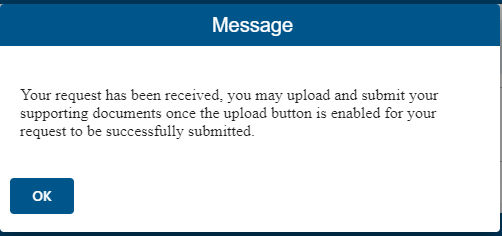

6. This message will pop up, please click on “Agree” and then “Ok”

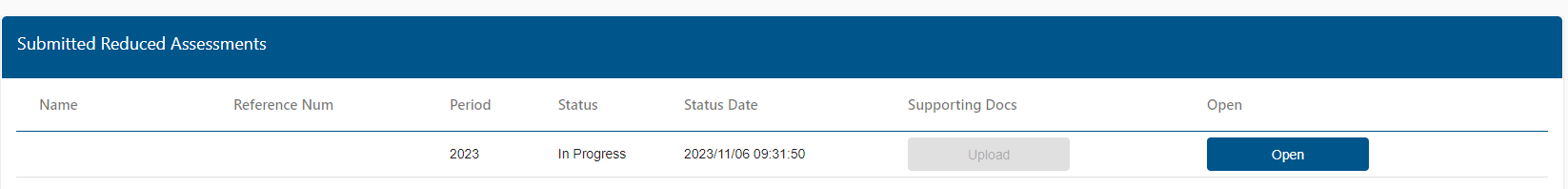

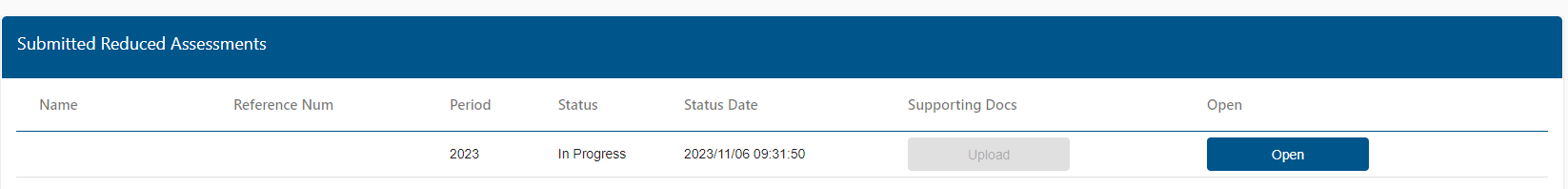

7. If the submission was successful, this is what your reduced assessments work page should look like:

NB: SARS will contact you should they need any documentation from you. If you receive an email requesting documents, please navigate to this page (Log into your eFiling profile, click on "Returns", on your left scroll down to "Request for Reduced Assessment" then click on “View Submitted”) and upload the documents.

It is important to note that a request to reduce an assessment does not replace the objection and appeal process. It merely offers a less formal method to resolve errors that are readily apparent and is only applied in limited circumstances where all the requirements are met.

This entry was posted in TaxTim's Blog

and tagged SARS & eFiling, Auto-Assessments.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Alicia

Written by Alicia