Written by Nicci

Updated 23 January 2025

Written by Nicci

Updated 23 January 2025

Step 1:

Log into your SARS eFiling pofile.

Step 2:

Navigate to your Tax Return which was auto-assessed.

You can do this by clicking "Returns" (top menu), then "Returns History" (side menu), then "Personal Income Tax ITR12" , then select the the relevant ITR12.

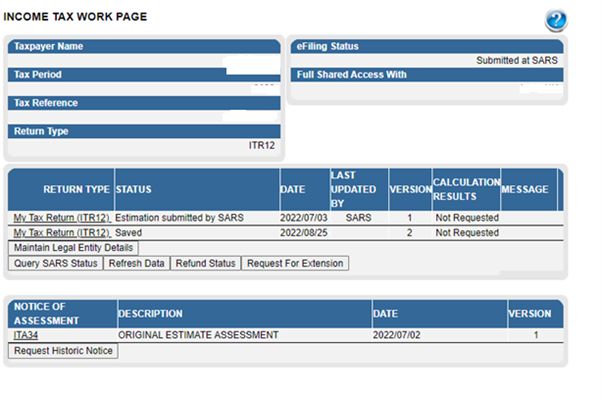

You will see the Income Tax Workpage which looks like this:

Step 3:

Click "Request For Extension"

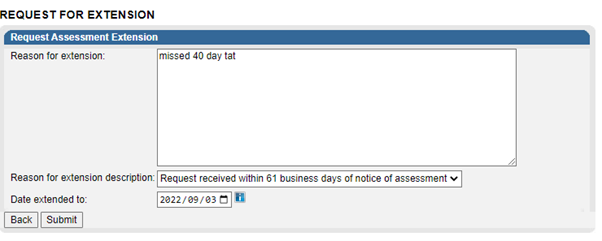

Enter a valid reason why you will not be able to submit within the 40 working day deadline.

Choose which date you’d like to file (this can't be more than 40 working days since your original deadline), then click "Submit".

You should immediately see the follow message pop up:

Step 4:

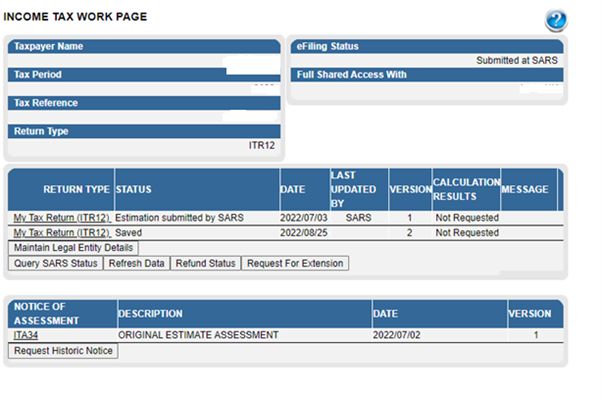

Return to the Income Tax Workpage, and click on "Request for Extension" again to check it went through successfully.

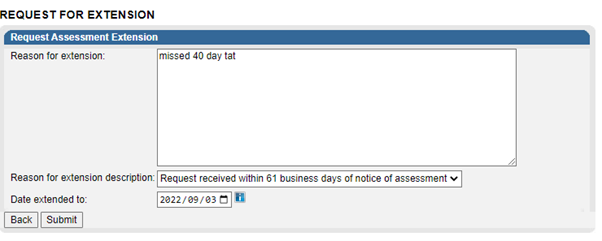

The following error message should pop up:

Step 5:

Check for SARS letters, you can do this by going to "SARS Correspondence", then "Search Correspondence".

You should receive a confirmation letter from SARS confirming that they had received your request, this should be issued in 24 hours:

You should receive your approval reply from SARS in 10 to 14 days

Step 7:

You can then continue to file your tax return.

This entry was posted in TaxTim's Blog

Bookmark the permalink.

Written by Nicci

Written by Nicci