Written by Patrick

Updated 7 March 2024

Written by Patrick

Updated 7 March 2024

As part of SARS’ mission to simplify the eFiling system, the Tax Type Transfer process was updated in 2020 for all Tax products in a bid to offer users complete control of their eFiling profiles.

What's new on eFiling?

Overall, you can expect to see the following key changes introduced to eFiling from the end of April 2021:

- Changes to adding taxpayers to a profile (Organisations, Practitioners & individuals)

- The removal of multiple capture fields to simplify the process

- Validation requirements for captured information to ensure alignment to SARS records, e.g. banking details, name and surname etc.

Changes to activating and requesting tax types (All products and return types):

- Registered Representatives will have access to their clients

- SARS will provide products on register– user activates selected products

One spin-off from these recent changes is that SARS has blocked adding a Company Tax Number without having a registered representative recorded on their internal system.

How to add a Company Tax Number to your eFiling profile

THEN: To add the Company Tax Type previously you would

- Log in to the eFiling profile, select "Organisations", then "Tax Types".

- Select the tax type you want to add to your profile and enter the tax number.

- Scroll down and click on "Register".

NOW: To activate a Company Tax Type currently

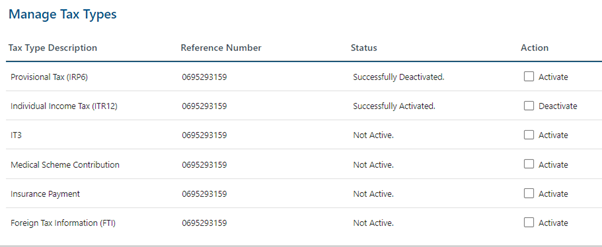

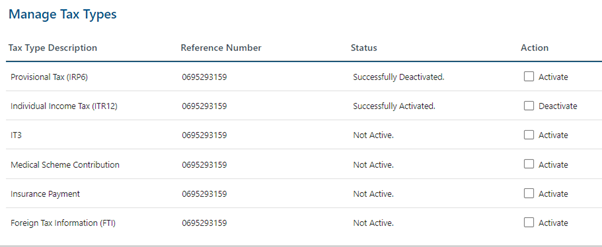

- Log in to the eFiling profile, select "Organisations", then "Tax Types".

- Click on "Manage Tax Types", on this page you should see the tax types.

- To action, check the box to "Activate" the Organisation Tax Type.

If you receive the following error message:

“The requested tax type is not available as the entity does not have a Registered Representative on record.”

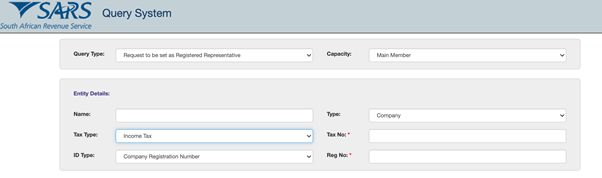

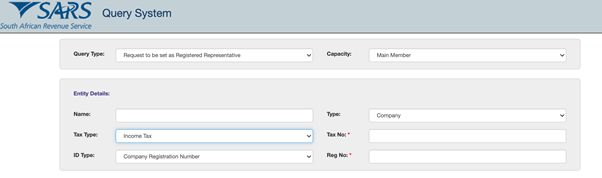

- Go to www.sars.gov.za

- Click “Online Services”

- Use our Digital Channels – click “Register a Representative”

- Enter the company and representative’s details

- Submit the following supporting documents:

- A certified copy of the ID of the company's representative

- A selfie of the Representative holding their ID

- Company registration documents

- Proof of address of the representative

- A copy of the minutes at the last annual general meeting in which the representative was appointed.

To proceed with adding a Registered Representative, the next step would be to make an online

telephonic appointment with SARS.

-Go to www.sars.gov.za

-click on Contact us and then “Book an Appointment” and make an appointment that suits you best.

These documents will be sent to the SARS manual processing centre and you should hear back from them within 21 business days.

Once SARS have confirmed that a Registered Representative has been recorded for your Company, you can repeat the process to activate your Company Tax Type and it should work.

This entry was posted in TaxTim's Blog

and tagged SARS & eFiling, Company Tax, technical.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Patrick

Written by Patrick