Written by Neo

Updated 24 April 2024

Written by Neo

Updated 24 April 2024

So, you’ve recently submitted your tax returns and shortly thereafter you receive a message from SARS informing you about admin penalties that have been charged against you. This has most probably come as a shock to you. We’ve been inundated with questions from taxpayers asking about these penalties which have been charged against them. Below we’ve highlighted things you need to know as well as ways in which you can handle these penalties.

When are penalties charged?

If you fail to submit a tax return, SARS can charge an administrative penalty which can range from R250 to R16 000 per month or R3 000 to R192 000 per year.

It does appear though, at the moment, that SARS is issuing smaller penalties ranging between R500 and R2000, but we never know when this could change.

The simplest way to avoid SARS issuing a penalty for outstanding returns would be to file your tax return each year. Rather be safe than sorry.

What is the issue we are seeing for the 2023 tax returns?

Many taxpayers are receiving penalties for old unfiled tax returns even if they were not required to submit tax returns based on the two reasons explained at the end of this blog. Taxpayers, after filing their tax return are suddenly being issued penalty notices for outstanding returns for previous years.

The problem facing many taxpayers, however, is that they may no longer have the necessary documents to prove that they didn’t need to file a tax return. The five-year rule, where taxpayers have to keep their documentary proof only relates to returns that were filed and assessed. So, if no tax return was required in the first place, there’s no rule around retaining the documents.

This is all understandably very frustrating for taxpayers who are actually 100% compliant with the law. In the Penalty Admin notices issued by SARS, they're advising taxpayers to still submit the tax return for those outstanding years.

If you're in this predicament no need to worry, there are ways to deal with this frustration.

Step 1: Submit your outstanding tax return

If you're unable to remember, or obtain, the amounts earned in those years then submit what you can. Taxpayers often submit a Rnil return so that at least the return has been filed with SARS.

Step 2: Dispute the Penalty Amount issued by SARS.

What to do if you've received a penalty for a year you were not required to submit?

The first thing you need to do is file a “Request for Remission” which can be done by following these easy steps below, on SARS eFiling:

1. Log into your SARS eFiling profile.

2. Click on the -SARS Correspondence tab.

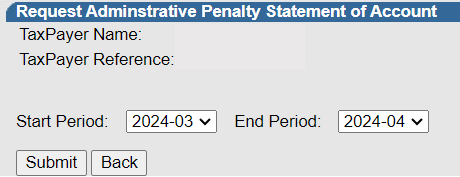

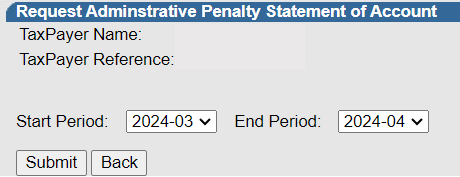

3. Then click on -Request Admin Penalty SOA.

4. Select the tax year e.g., 2025 and click continue.

5. On the next screen click submit.

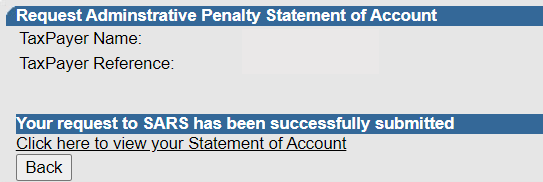

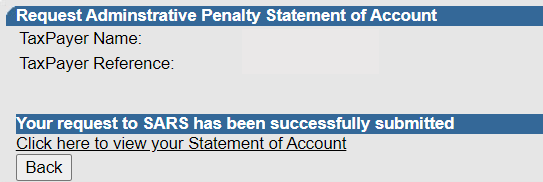

6. Then click on "Click here to view your statement of account"

7. The next screen will open the penalty statement of account which will show the penalty amount issued by SARS, then Click on Dispute.

8. Once you have clicked on Dispute it will take you back to the Dispute Summary eFiling screen, select "I would like to file a Request for Remission" and click Continue.

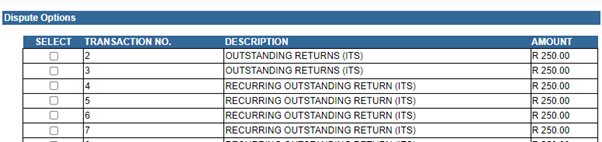

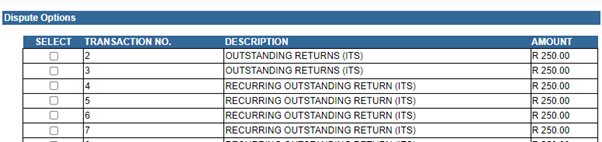

9. The next screen will take you to the list of penalties, select the item you are disputing and the amount you want to dispute

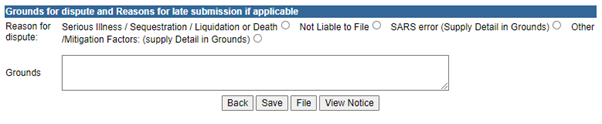

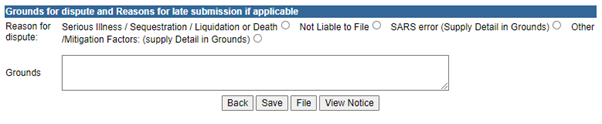

10. Type in your reasons for the dispute e.g. "I was not required to file a tax return because I earned R60 000 for 2016 which is below the tax threshold."

If you are happy with the information displayed, then click “File” to send your request for remission to SARS.

When are you not required to submit according to SARS?

There are two situations where according to SARS, taxpayers don’t need to submit a tax return:

1. SARS has communicated that certain taxpayers, who earn a gross salary of below R350 000 per year do not have to submit a tax return. However, in order to fall into this exemption, the following applies:

• No deductions or allowances;

• No other income;

• Worked for 1 single employer; and

• Worked a full 12 month period

What this means is that you only have an IRP5 with a source code 3601 and NOTHING else.

2. If your total earnings fall below the annual tax threshold, then you'll also not be required to submit a tax return.

However, we strongly recommend you always file your tax return whether it’s required or not. Please read our reasons why here.

This entry was posted in TaxTim's Blog

Bookmark the permalink.

Written by Neo

Written by Neo