Written by Nicci

Posted 22 February 2023

Written by Nicci

Posted 22 February 2023

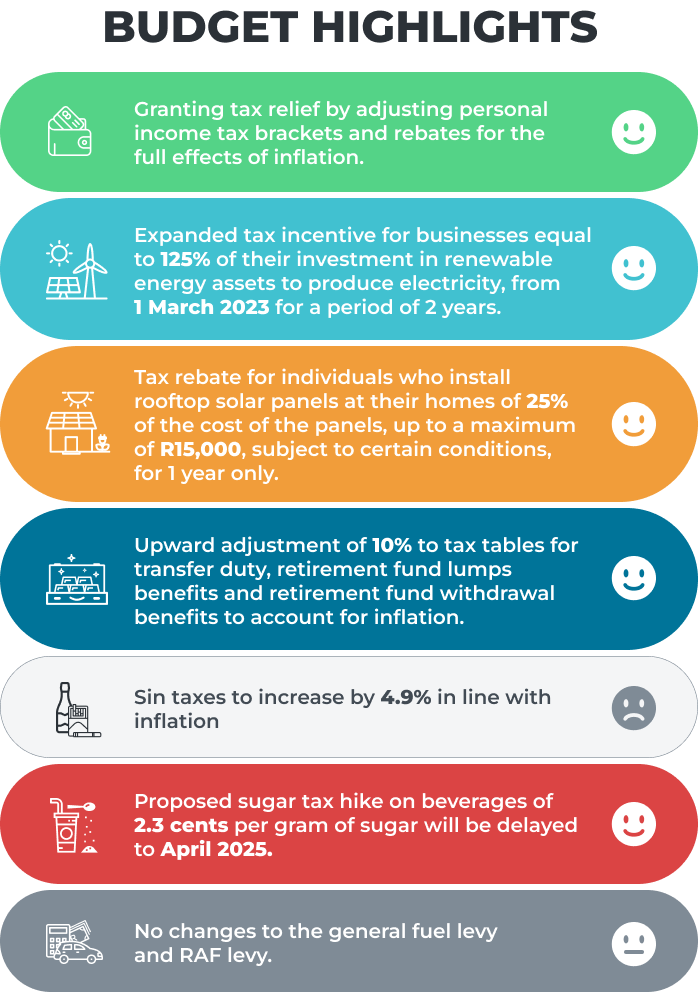

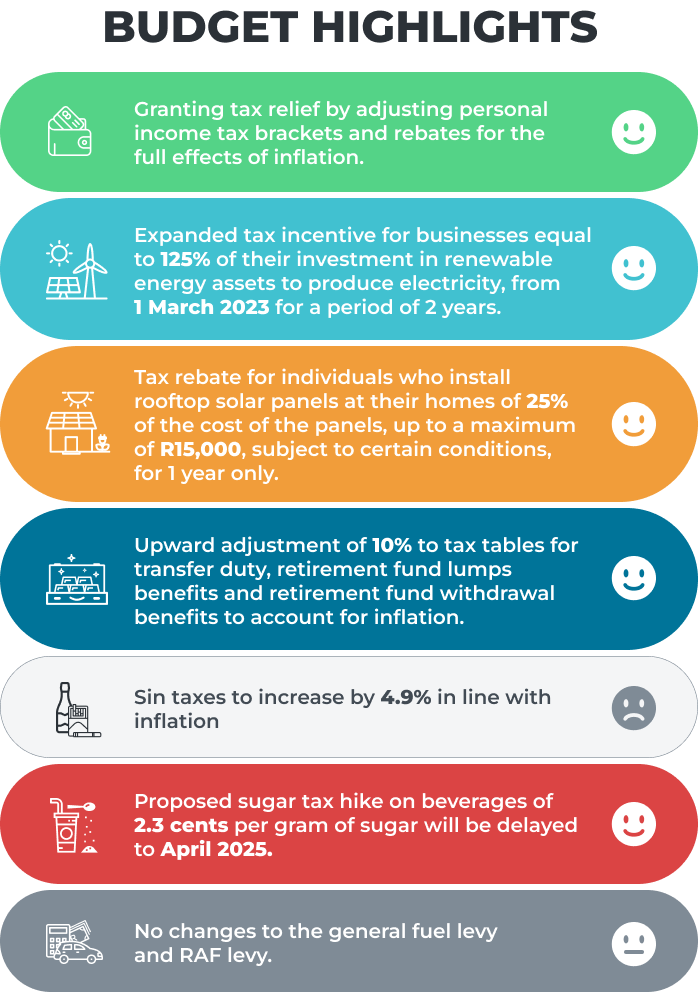

Finance Minister, Enoch Godongwana, delivered his second budget speech to South Africans yesterday. The energy crisis played centre stage with the minister announcing that the government will take over a large part of Eskom's debt. He also outlined two major tax incentives to encourage individuals and businesses to invest in renewable energy and independent electricity generation. Much to everyone's relief, he went on further to announce that there would be no major tax proposals for the year ahead due to revenue projections exceeding budget, which he attributed to a higher collection in corporate and personal income taxes and customs duties.

Let’s look at each type of tax in more detail.

Personal Tax Rates

The personal income-tax brackets will be fully adjusted for expected inflation of 4,9%. The tax brackets are often manipulated by Treasury to sneak in some ‘hidden’ taxes, so this is good news!

The tax-free threshold for taxpayers under 65 years has increased to R95 750 (previously R91 250).

Taxpayers over 65 and below 75 years of age will have their first R148 217 tax-free (previously R141 250) and those taxpayers over 75 years of age will have their first R165 689 tax-free (previously R157 900) of income.

Please click on our updated take-home pay calculator to see how these changes will impact your net salary.

|

Taxable Income (R)

|

Rate of Tax (R)

|

|

1 – 237 100

|

18% of taxable income

|

|

237 101 – 370 500

|

42 678 + 26% of taxable income above 237 100

|

|

370 501 – 512 800

|

77 362 + 31% of taxable income above 370 500

|

|

512 801 – 673 000

|

121 475 + 36% of taxable income above 512 800

|

|

673 001 – 857 900

|

179 147 + 39% of taxable income above 673 000

|

|

857 901 - 1 817 000

|

251 258 + 41% of taxable income above 857 900

|

|

1 817 001 and above

|

644 489 + 45% of taxable income above 1 817 000

|

Tax incentive for businesses investing in renewable energy assets

From 1 March 2023, there will be an expanded incentive for businesses who invest in renewable energy assets to produce electricity. They will be able to reduce their taxable income by 125 per cent of the cost of an investment in renewables. For example, a renewable energy investment of R1 million would qualify for a tax deduction of R1.25 million, which could result in a significant tax saving of R337 500 (i.e R1,25 million x 27%)

Tax incentive for Solar PV

Individuals who install rooftop solar panels at their homes from 1 March 2023 will be able to claim a rebate of 25% of the cost of the panels, up to a maximum of R15 000. Individuals will need to obtain a certificate of compliance dated between 1 March 2023 and 29 February 2024 to qualify for this incentive which will be available for the 2024 tax year only.

Example:

An individual spends R80 000 on installing new solar panels in his home. His tax rebate will equal 25% of the cost (i.e 25% of R80 000 = R20 000), capped at R15 000. This means that the individual will be able to reduce his tax liability by R15 000 in 2024.

Capital Gains Tax

There were no changes to CGT this year. Individuals still have to include 40% of the gain in their income while companies and trusts still have to include 80% of the gain into their income. The overall maximum effective tax rates for individuals remains unchanged from last year at 18% and for companies and trusts it is 21,6% (previously 22,4%) and 36% respectively.

Dividends

The Withholding Tax on Dividends remains the same at 20%.

Estate Tax and Donations Tax

Donations Tax remains unchanged – it is levied on amounts over R100 000 in total per year at 20% and at a rate of 25% on donation values exceeding R30m. Remember that donations between spouses are still tax free!

The Estate Duty threshold also stays the same - above R3.5m, and up to R30m, estates will be taxed at 20%, and then at a rate of 25% above R30m.

Interest and investment exemptions

The interest exemption thresholds stay at R23 800 for those under 65 years of age and R34 500 for those over 65 and older.

The annual contribution limit for tax-free savings accounts remains unchanged at R36 000 with the total contribution life time limit capped at R500 000.

Medical Tax Credit

The medical tax credits have been adjusted again this year for inflation. You and your first dependent will be allowed a tax credit of R364 (previously R347) and thereafter R246 (previously R234) for all other dependents.

Lump sum payouts and the retirement deduction

For the first time in many years, there will be some welcome tax relief for retirees when they withdraw from their funds. The retirement tax tables for lump sums withdrawn before retirement, and for lump sums withdrawn at retirement will be adjusted upwards by 10 percent. This means that the once-off tax-free amount that can be withdrawn at retirement will increase from R500 000 to R550 000.

The retirement laws, which allow for the deductibility of provident, pension and retirement annuity contributions remain the same. The regime allows for a capped 27.5% of the greater of remuneration (i.e., your gross salary and benefits) or taxable income (income after deductions) to the maximum of R350 000 per year.

Retirement fund lump sum withdrawal benefits

|

Taxable Income (R)

|

Rate of Tax (R)

|

|

0 - 27 500

|

0% of taxable income

|

|

27 501 - 726 000

|

18% of taxable income above 27 500

|

|

726 001 - 1 089 000

|

125 730 + 27% of taxable income above 726 000

|

|

1 089 001 and above

|

223 740 + 36% of taxable income above 1 089 000

|

Retirement fund lump sum benefits or severance benefits

|

Taxable Income (R)

|

Rate of Tax (R)

|

|

0 - 550 000

|

0% of taxable income

|

|

550 001 - 770 000

|

18% of taxable income above 550 000

|

|

770 001 - 1 155 000

|

39 600 + 27% of taxable income above 770 000

|

|

1 155 001 and above

|

143 550 + 36% of taxable income above 1 155 000

|

Small Business Tax

There’s some good news for small businesses which qualify as a SBC – they also benefit from an inflationary adjustment to their tax brackets to bring their tax in line with the tax threshold for individuals.

1) Income Tax: Small Business Corporations

|

Taxable Income (R)

|

Rate of Tax (R)

|

|

1 – 95 750

|

0% of taxable income

|

|

95 751 - 365 000

|

7% of taxable income above 95 750

|

|

365 001 - 550 000

|

18 848 + 21% of taxable income above 365 000

|

|

550 001 and above

|

57 698 + 27% of the amount above 550 000

|

2) Turnover Tax for Micro Businesses

Turnover tax rates have remained unchanged.

|

Taxable Income (R)

|

Rate of Tax (R)

|

|

0 - 335 000

|

0% of taxable income

|

|

335 001 - 500 000

|

1% of taxable turnover above 335 000

|

|

500 001 - 750 000

|

1 650 + 2% of taxable turnover above 500 000

|

|

750 001 and above

|

6 650 + 3% of taxable turnover above 750 000

|

Corporate Tax

As already announced last year, there will be a reduction in the corporate tax rate to 27% for companies with years of assessments ending any date after 31 March 2023.

Sin Taxes

Smokers and drinkers will be hit again with pricing hikes.

Beer will set you back an extra 10c per can, wine an extra 18c per bottle, spirits, a whopping R3,90 per bottle. Smokers will have to cough up an extra 98c per packet and an extra R5,47 per 23 grams of rolled cigar!

Sugar Tax

The minister announced that the proposed sugar tax hike on beverages of 2,3 cents per gram of sugar will be delayed to April 2025.

Fuel levy

A little bit of good news is that the general fuel levy and Road Accident Fund (RAF) levy will remain unchanged for the new tax year.

This entry was posted in TaxTim's Blog

Bookmark the permalink.

10 most popular Q&A in this category

Written by Nicci

Written by Nicci