How to Estimate Your 1st Provisional Tax Payment

Written by Patrick

Posted 8 August 2025

So, it’s that time of year again and SARS wants a payment. But how much are you actually supposed to pay, and how do you even begin to figure that out? That’s where this guide comes in. We’ll walk you through the full process of estimating your income, calculating what you owe, and understanding what it all means, step by step.

Quick tip: Don’t confuse your total income with your taxable income. You’re only taxed on profit, what’s left after you subtract business expenses.

It’s the amount left after you subtract your business expenses, the actual costs you had to pay to earn that income...

Read more →

Important Tax Filing Reminder: Don't Miss the Deadline

Written by Nicci

Updated 17 July 2025

If you're a salary-only employee (i.e non-provisional taxpayer), your tax filing deadline is 20 October 2025. But, if you do fall into the provisional taxpayer category, your deadline extends to 19 January 2026.

However, it's super important to note that if you were auto-assessed, then your deadline is 20 October 2025 even if you qualify as a provisional taxpayer.

Now, if you're thinking about waiting until the later deadline next year and consider yourself a ...

Read more →

Understanding the Assets and Liabilities Section in Your Tax Return

Written by Alicia

Updated 7 May 2025

The assets and liabilities section in the annual tax return (ITR12) needs to be completed if you:

- earn self-employment income or are an independent contractor

- earn foreign income (e.g foreign rental income or foreign business income)

- are a Director of a company or a member of a Close Corporation

Each asset should be reported at its original cost — the amount you paid at the time of purchase or investment. According to SARS, these entrie...

Read more →

Foreign Employment Exemption Letter

Written by Nicci

Updated 24 April 2025

COMPANY LETTERHEAD

Date

Employee's Full Name

Address

To Whom It May Concern,

Subject: Confirmation of foreign employment

This letter serves to confirm that____________________________(Name of employee) _______________________(ID number) is employed by __________________________(company name) in the capacity of__________________________(position).

He/she is contracted to work overseas in _______________ (country) from ______________dd/mm/yy to ________________dd/mm/yy. ...

Read more →

FAQ: Provisional Tax

Written by Nicci

Updated 23 April 2025

1. How many returns should I file each year if I am a provisional taxpayer?

You are required to file 3 returns i.e. 2 provisional tax returns (IRP6s) and one annual return (ITR12). The reason you need to file the annual return, too, is that your provisional returns are based on an estimate of your taxable income, while the annual return reflects your actual taxable income. Any provisional payments you have made for the year will be deducted from your final tax liability, which is calculated when you submit your annual tax return for assessment.

2...

Read more →

I missed filing the first provisional return - what should I do?

Written by Alicia

Updated 22 April 2025

Provisional tax can be confusing, especially when it comes to the timing of payments. If you miss the first payment, do you need to catch it up, or can you just pay the second one? And what happens if you become a provisional taxpayer halfway through the year - are you still expected to file a first provisional tax return? In this post, we’ll attempt to clear up the confusion around first and second provisional tax payments.

Brief summary

Read more →

Why your estimated provisional tax may differ from your SARS Statement of Account

Written by Alicia

Updated 22 April 2025

TaxTim uses the financial information which you entered to work out the payment due on your provisional tax return (also called an IRP6). However, there may be some information we don’t have access to, which won’t be included in the estimate of your provisional tax payment. To see what SARS has on record, you will need to request a Provisio...

Read more →

Where can I find my provisional tax payment details?

Written by Alicia

Updated 22 April 2025

During the final days of the provisional tax season, high traffic volumes may cause delays in submitting provisional tax returns to SARS—even after you've clicked 'submit' on our website.

To avoid late payment penalties, we recommend paying the estimated provisional tax amount shown on our website. Once your provisional tax return (IRP6) appears in eFiling and your SARS provisional Statement o...

Read more →

What to do if your SARS document is blank

Written by Elani

Posted 2 April 2025

Unfortunately, some of the SARS documents cannot be viewed online (i.e. from within your internet browser). You can work around this issue by downloading the SARS document to your computer. You will then be able to view the document when opening it directly on your device.

Steps to follow if the SARS document is blank on your browser:

- Choose the option to download the document.

- Open the "Downloads" folder on your computer **.

- Sea...

Read more →

How to request a Provisional Tax Statement of Account on eFiling

Written by Alicia

Posted 27 March 2025

If you're a provisional taxpayer, you can request a statement of your provisional account on eFiling. However, instead of finding it on your Income Tax workpage, you first need to go to the Provisional Tax workpage. This can be tricky if you don't use eFiling often, so we've listed the steps below to help you.

STEP 1: Log into SARS eFiling

Read more →

Provisional Tax Penalties

Written by Nicci

Updated 1 February 2025

Seasoned provisional taxpayers – those people who earn income from sources other than, or in addition to a regular ol' salary or traditional payment from an employer - are all too familiar with the process of estimating taxable income and submitting provisional tax returns. Not once - but twice a year!

Yes, it's a bit painful (although TaxTim makes it super easy) but entirely necessary if you don't want to be lumped with penalties from SARS...

Read more →

Sole Proprietor or Company: What's Best for Tax?

Written by Vee

Updated 21 November 2024

Getting a new business venture off the ground is an equally exciting and stressful time. You’re enthusiastic about getting your new product or service out into the market, but you face quite an administrative process to get it off the ground legally.

Read more →

The 3 R's: Returns, Rebates and Refunds Explained

Written by Marc

Updated 16 July 2024

When it comes to tax jargon, most people prefer to bury their heads in the sand instead of trying to understand all the confusing terms that tax practitioners use. Taxpayers just want to do their tax quickly and easily, and if they’re due - receive some money back from SARS. A lot of confusion surrounds the process, but by understanding three simple terms you can make tax season a little bit easier.

Read more →

Navigating around your Easy Equities tax certificate (IT3c)

Written by Nicci

Updated 29 April 2024

1. This is the gross base cost of all shares you bought through the institution. You must NOT use this value on your return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

3. This is the...

Read more →

Navigating around your Allan Gray tax certificate (IT3c)

Written by Nicci

Updated 20 March 2024

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

Do You Need to Ring-Fence Your Business or Rental Losses for Tax?

Written by Vee

Updated 19 March 2024

When pursuing a business activity, trade or renting out a property, you’re no doubt doing so to make some money, but the reality for self-starters

Read more →

Top Tips for Sole Props

Written by Nicci

Updated 22 January 2024

1. Keep an accurate record of revenue and expenses

You can draw up these records by way of a simple spreadsheet based on your invoices and then confirm these amounts by cross-checking them against your bank statement.

Read more →

Provisional Taxpayers: Unpacking Your Tax Season Deadline

Written by Nicci

Posted 19 October 2022

Tick-tock, time is running out for non-provisional taxpayers to submit their 2022 tax return. The filing deadline of 24 October 2022 is just around the corner.

Provisional Taxpayers: your tax return filing deadline is 23 January 2023. Breathe easy.

If you ‘think’ you are a Provisional Taxpayer, we strongly suggest you make 100% sure you me...

Read more →

Calculate interest on late provisional tax payment

Written by Evan

Posted 28 December 2021

SARS charges interest on late payments made toward provisional tax deadlines.

To calculate this late payment penalty, use the formula below:

Provisional tax amount x Loading...% x (days after deadline / 365)

Use the calculator below:

Read more →

SARS can now fine you or take you to jail for these tax mistakes

Written by Patrick

Posted 18 June 2021

In the past SARS needed to prove that a taxpayer had committed a tax crime “willfully and without just cause” but the legislation has just been changed. The court can now find you guilty of a tax crime even in cases of negligence or even in a case where the taxpayer may have made a mistake.

The amended law separates non-compliance into two groups: the first is where the taxpayer’s intention is not considered, and the other group is where the taxpayer’s intentio...

Read more →

IRP5 FAQs

Written by Nicci

Posted 22 February 2021

What is an IRP5?

An IRP5 is the employee's tax certificate that is issued to him/her at the end of each tax year detailing all employer/employee related incomes, deductions, and related taxes. The employee uses it specifically to complete his/her income tax return for a specific year.

Do I need an IRP5?

Yes, you do if you were employed during the tax year.

Can I submit a return without an IRP5? OR Am I able to submit returns without my IRP5? OR Are you able to submit without the IRP5?...

Read more →

Top Tips for Provisional Taxpayers

Written by Nicci

Posted 9 February 2021

1. Estimate your taxable income for the whole tax year

Remember that both your first and second provisional return (IRP6) must reflect an estimate of your taxable income for the full 12 months of the tax year.

Read more →

Navigating around your Capital gains tax certificate (IT3C)

Written by Alicia

Posted 15 May 2020

If you have shares (financial instruments) , there is important information on your IT3C tax certificate which needs to be included in your tax return.

This will ensure your taxable income is calculated accurately with the correct capital gain or loss included.

Do you have shares at any of the following institutions?...

Read more →

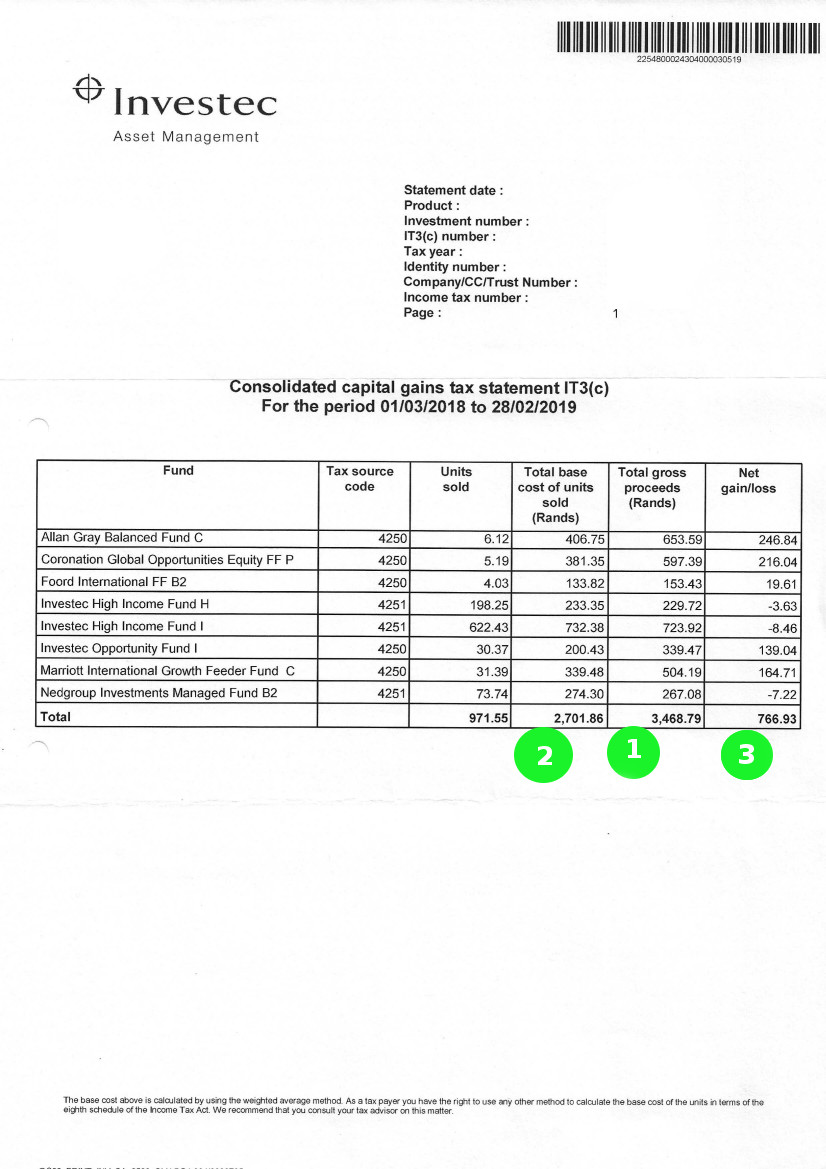

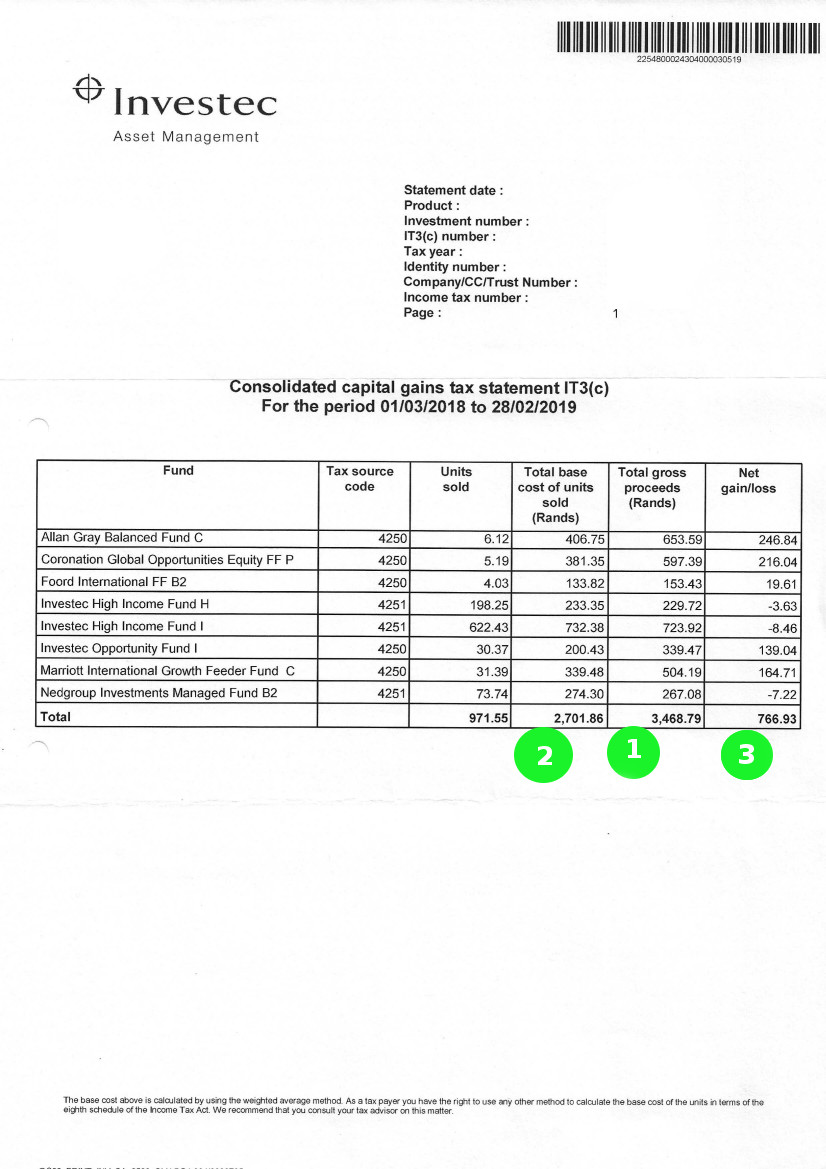

Navigating around your Investec investment tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

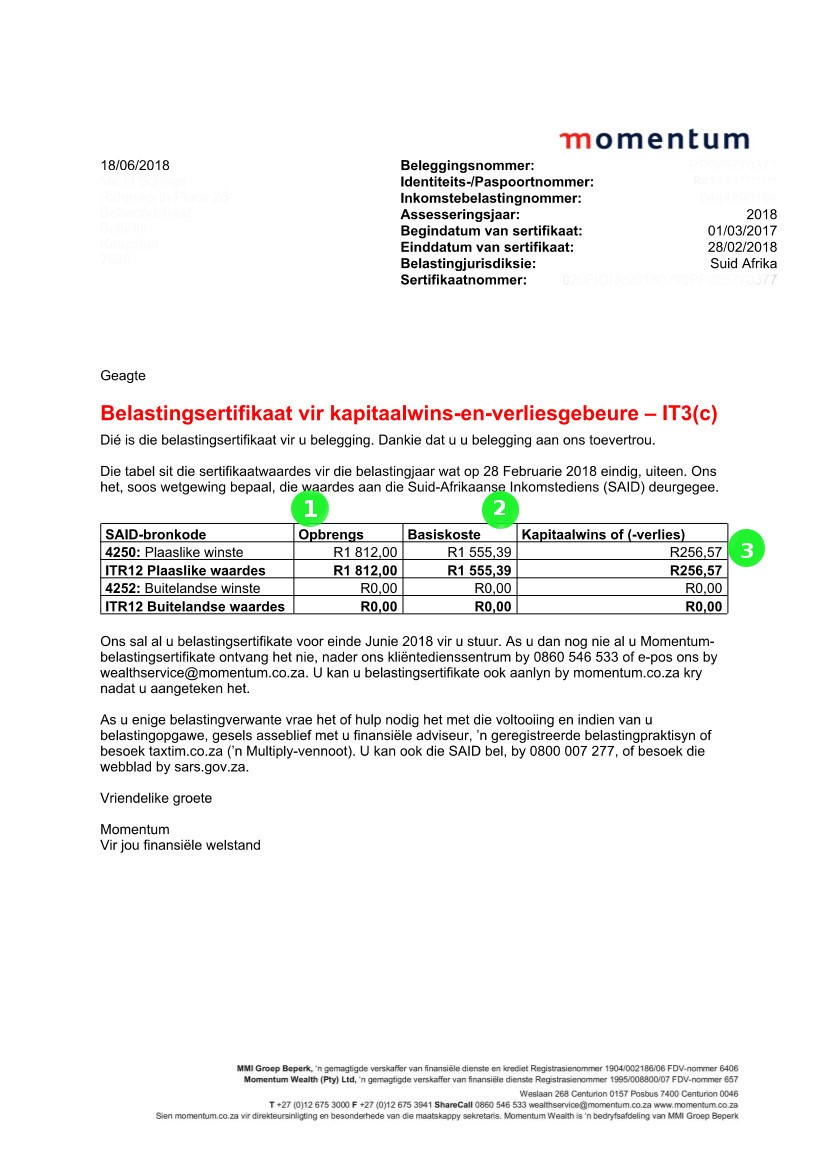

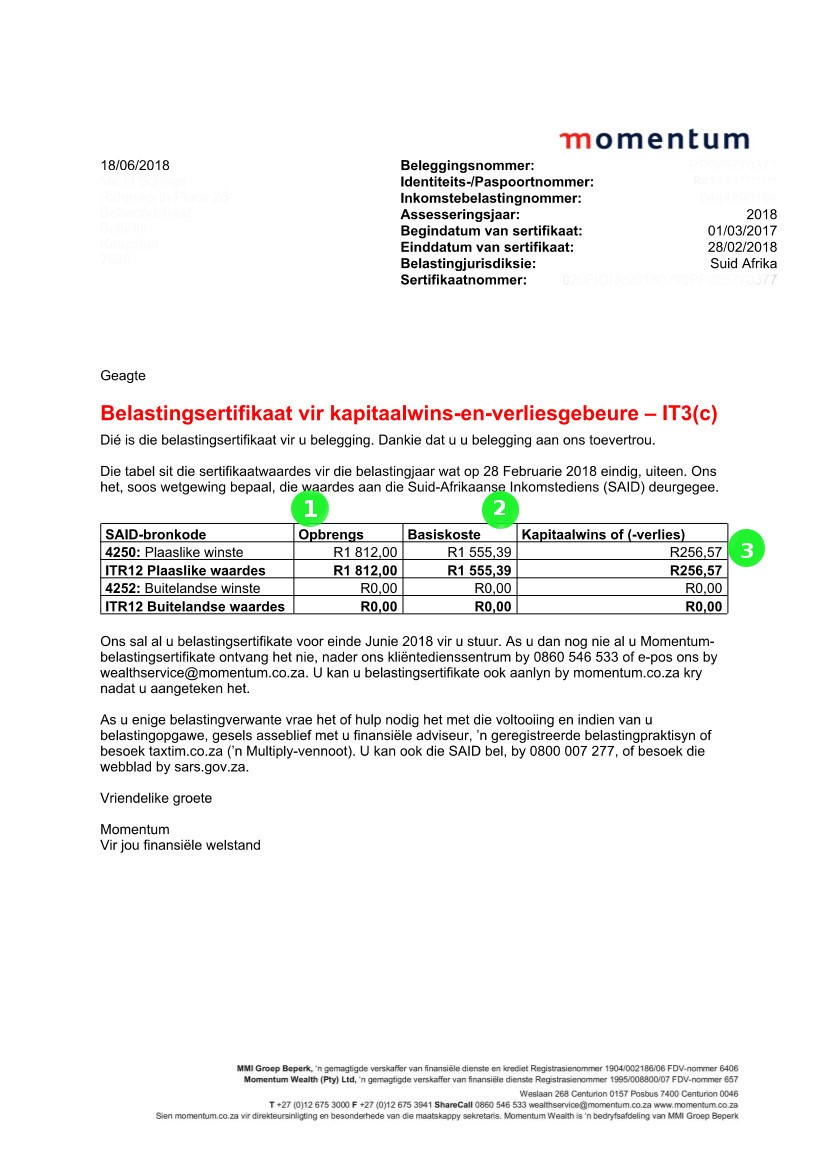

Navigating around your Momentum tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

Older posts →

1 2

Written by Patrick

Written by Patrick

Written by Nicci

Written by Nicci

Written by Alicia

Written by Alicia

Written by Elani

Written by Elani

Written by Vee

Written by Vee

Written by Marc

Written by Marc

Written by Evan

Written by Evan