The Deduction of Home Office Expenditure

Written by Neo

Updated 13 November 2023

Nowadays, work culture has evolved massively and “Flexible employment” has become the new buzzword. This is especially relevant at the moment, where many employees are still working from home due to the global Corona virus outbreak of 2020.

Read more →

FAQ: Home Office Expenses

Written by Neo

Updated 7 November 2023

Flexible employment is becoming increasingly popular, many taxpayers spend some (or all) of their time working from home. If certain conditions are met, taxpayers are allowed to claim a portion of their office running costs as a tax deduction on their tax return. However, please note that SARS usually flags these returns for audit. If you do work from home, take a read of our home office blog and also check out our handy decision tree to make 100% sure you are claiming this expense correctly.

Read more →

How to Submit a Request for Reduced Assessment via SARS eFiling

Written by Alicia

Posted 6 November 2023

If your 2023 individual income tax return was auto-assessed by SARS earlier this year, and you intended to include extra income or expenses/ deductions but missed the deadline, don't be dismayed, there might still be a way to fix things!

Is SARS rejecting your tax return submission and your dispute too?

Have you requested an extension, but SARS granted it for a day before they replied to you? i.e, you asked for an extension till 10 November 2023, but SARS gave you an extension...

Read more →

Is My Life Insurance Claim Taxed in South Africa?

Written by Patrick

Posted 5 October 2023

A pressing concern for many South Africans is whether or not the taxman gets a chunk of the money when the life insurance policy pays out. It’s a big stress factor to wonder how big the tax portion will be and how much will be left over for your family especially in a time when they need it the most. But here's some good news as of 2023: life insurance payouts usually don't get taxed. That means your loved ones get to keep the whole amount, giving everyone a bit of comfort.

&nbs...

Read more →

Tax-Efficient Wealth Protection: Understanding Life Insurance with TaxTim

Written by Patrick

Posted 5 October 2023

While it might seem like a morbid topic at first, understanding life insurance is pretty important to safeguarding your family's financial future. Life insurance is about more than just providing for your loved ones after you're no longer around, it is the cornerstone of financial stability during hard times like illness or disability as it protects your income. Think of it as a protective bubble that will ensure your family's financial well-being, no matter what life throws your way.

Read more →

How Does Tax Work on a Life Insurance Policy in South Africa

Written by Patrick

Posted 5 October 2023

Delving into tax laws and understanding their impact on life insurance doesn’t have to be headache. At TaxTim, we're here to simplify the world of tax and ensure you stay informed about the key tax implications when it comes to your life insurance. Without diving into too much detail, let's get straight to the point and focus on what you really need to know about the tax implications on your life insurance premiums.

First off, it's essential to know that life insurance premiums ...

Read more →

Recent updates to the Company Tax Return (ITR14)

Written by Alicia

Posted 4 October 2023

The updated ITR14 on eFiling has some new sections, and one that often raises questions is the part about share classes. Although it might seem confusing, it's actually quite simple. SARS is just asking you to tell them more about your shareholders in the company.

When you begin your ITR14, please have the balance sheet, income statement, and also the share register ready. A share register is is a list of all active and former owners of a company's shares. To complete the capita...

Read more →

Here is the process to follow if you have a dormant company

Written by Alicia

Updated 11 August 2023

It seems that dormant companies are on SARS' radar.

If you registered a company with CIPC some time ago and forgot about it, that company could land you in hot water with SARS. Read more to find out what the financial repercussions could be and why you should get a hold on the situation.

What is a dormant company?

A dormant company is classified as a company that has not actively traded for the full year of assessment. Because there is no activity in the compan...

Read more →

How to set up a payment arrangement with SARS

Written by Alicia

Updated 2 August 2023

With the end of the tax year looming, SARS tax collectors are on high alert to collect taxes and meet their revenue targets.

If you owe SARS, you should be receiving constant reminders to pay your debt. This may be in the form of SMS's, phone calls or even posted letters.

If the debt is unfamiliar or if you are not in agreement with the debt, you can File a dispute with SARS , howe...

Read more →

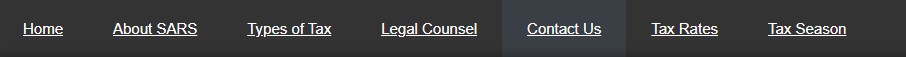

Track your tax return on the SARS website

Written by Alicia

Posted 20 July 2023

SARS have recently introduced a new way to track your tax return online via the SARS website.

See TaxTim's step-by-step guide to help you nagivate this new process:

1. Please go to the SARS website www.sars.gov.za click on "Contact Us"

2. Scroll down the page then click o...

Read more →

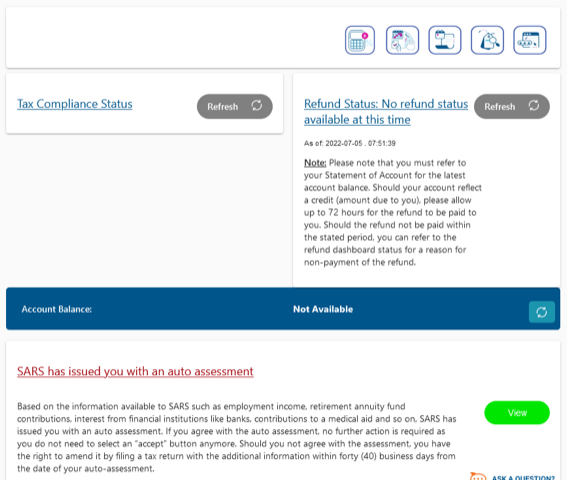

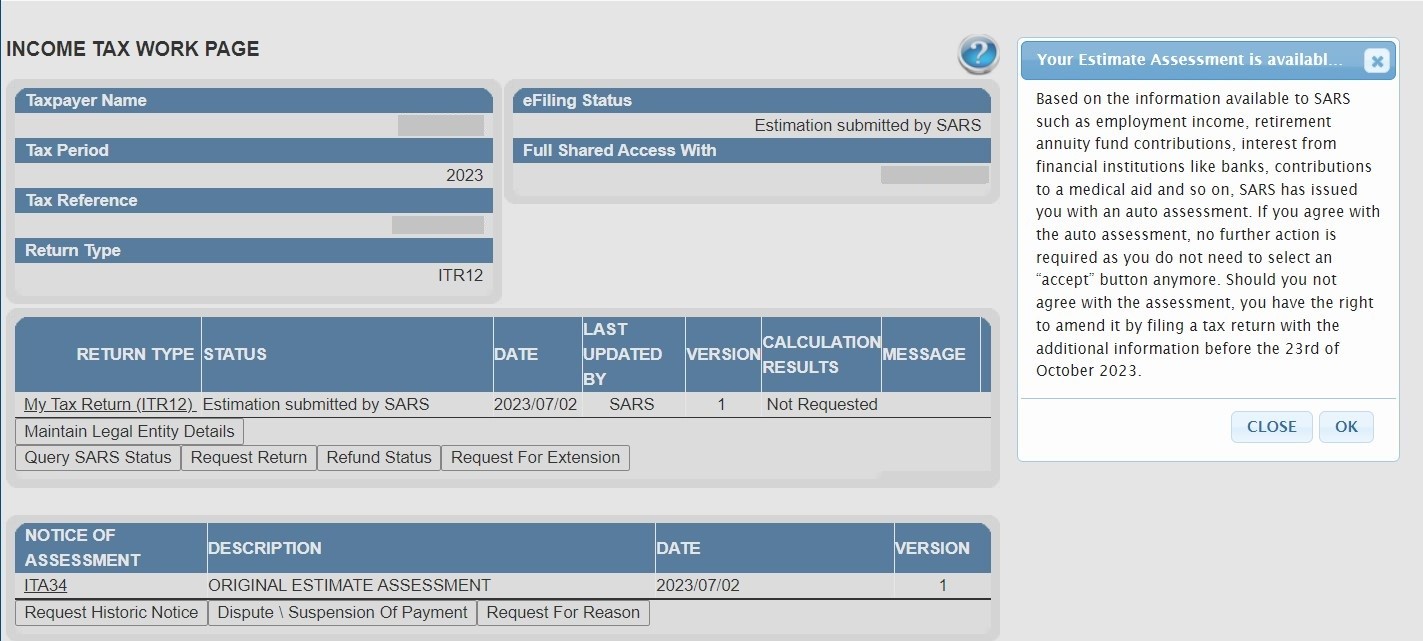

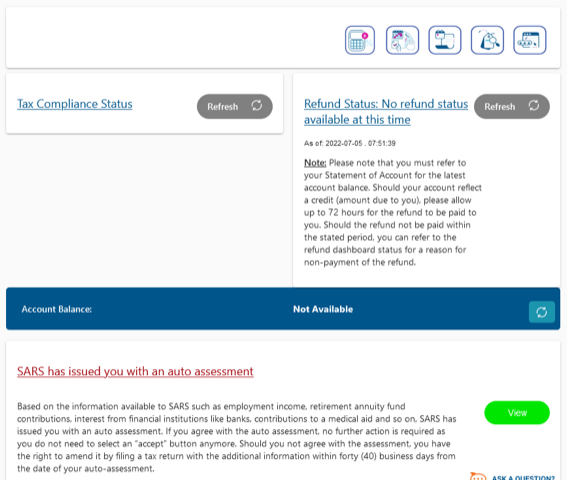

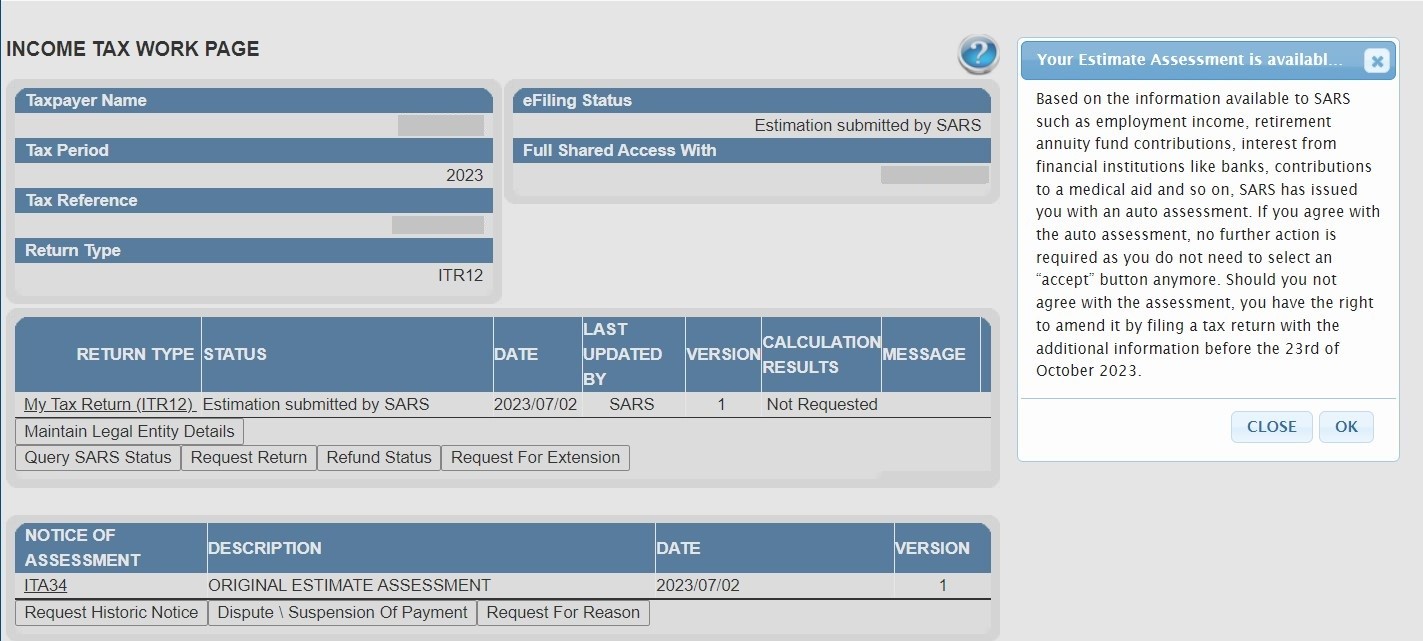

The new SARS auto-assessment

Written by Alicia

Updated 10 July 2023

Step 1:

If you have been auto-assessed by SARS, you may see the screen below when you log into SARS eFiling.

Please click on "View".

You may also see this screen:

If you ...

Read more →

Payment for asking a Tax Question

Written by Nicci

Updated 6 July 2023

Why am I receiving a request for payment for asking a tax question?

During the process of assisting taxpayers with the completion and submission of their tax return, we sometimes receive tax related questions to our Helpdesk which fall beyond the scope of the tax return and therefore requires some more of our time. This is because documents may need to be reviewed or calculations to be performed or even in some cases, external experts to be consulted.

For this reason, you may receive a request for a payment in response to your tax question...

Read more →

A beginner's guide to investing in South Africa

Written by Evan

Posted 5 July 2023

You are doing well. You are earning enough money to cover your monthly expenses, and have some extra cash remaining at the end of each month. You could keep that money in the bank for a rainy day, or you could invest it, with the hopes of growing your savings significantly. This guide aims to help you understand why investing is important, how investments differ and what options are available to you in South Africa.

Why investing is important

Your money does not keep it's va...

Read more →

After all my documents submissions to SARS, they disallowed my expenses, why?

Written by Neo

Updated 4 July 2023

We are starting to see some common trends whereby taxpayers’ expenses are disallowed because the documents submitted are falling short of SARS’s requirements. To avoid unnecessary frustration and time wasted in raising disputes, read on to see if any of these areas apply to you.

Travel deduction

In prior years, the submission of a logbook detailing your business mileage used to be sufficient to justify your travel claim. In recent years howev...

Read more →

Tax-Efficient Wealth Protection: Understanding Life Insurance

Written by Evan

Posted 3 July 2023

Life insurance: it sounds about as exciting as watching paint dry, right? However, just like that fresh coat of paint protects your walls from wear and tear, life insurance is all about protecting your loved ones from the financial burdens that could pop up in your absence.

If you've ever been out to dinner with friends and spent more time figuring out how to split the bill than actually enjoying your meal, then you'll understand why some people might find life insurance a tad...compl...

Read more →

How to buy your first property

Written by Neo

Updated 3 July 2023

The thought of buying a house can be daunting. It might seem almost impossible when you are just getting started. But like any financial goal, you can achieve it if you understand what's involved, and break the process up into small, bite-size steps.

Buying your first home is also exciting! Choosing where you will live, how many rooms you need, what colour to paint the walls, and what furniture to fill it with are part of the fun. Use that excitement to get you through the admin involved....

Read more →

Tax Season 2023

Written by Nicci

Posted 14 June 2023

The 2023 filing season opens this year at 8pm on Friday, 7 July. The countdown's on, it's almost here!

It is important to be aware that the season is shorter than prior years. This means that SARS are giving you less time to file your return.

Important Filing Deadlines

23 October 2023: non-provisional taxpayer (i.e. salaried employees)

24 January 2024: provisional taxpayer (i.e self-employed, rental earners, freelancers, ...

Read more →

Don't file on SARS eFiling before 7 July

Written by Alicia

Updated 14 June 2023

Last year, we noticed that many taxpayers filed their tax returns before the tax season officially began (i.e July). However, doing so caused delays and problems with their tax refunds.

There are only three specific instances where you can file your tax return (ITR12) directly on eFiling before tax season starts:

- If you have been declared insolvent / sequestrated or,

- If you need to file a tax return for a deceased estate or,

- If you are em...

Read more →

Why refund/tax liability estimations may differ from the SARS calculator and final SARS ITA34 assessment

Written by Evan

Updated 8 June 2023

TaxTim and SARS use all the financial information you provide to work out the most accurate estimate of your potential refund (or tax liability) for the current tax season. However, there may be some information we don’t have access to that won’t be included in the estimate of your tax refund or tax liability.

Information from previous tax seasons

Just like the SARS eFiling tax calculator, TaxTim doesn’t take into account provisional tax ...

Read more →

9 Steps to File an Objection to Your Tax Assessment

Written by Vee

Updated 30 May 2023

You’ve been diligent with your tax obligations, you’ve paid your PAYE (employees tax) each month without fail, you’ve kept all the supporting documents for your deduction claims and you’ve carefully filled out your tax return, making sure you’ve put all the right amounts in all the right places, against all the right codes. (Pssst, if you used TaxTim to help you complete your tax return, you wouldn’t have had to worry about all the right places and codes because that’s all automated for you)...

Read more →

Auto-Assessed Taxpayers Alert

Written by Nicci

Updated 22 May 2023

SARS has given you just 40 working days to submit your tax return. If you received your auto-assessment at the beginning of July, your time to submit has already expired. Auto-assessments issued on 4 July 2022, expired on 30 August 2022. Count your work days carefully. SARS is applying this rule very strictly. If you do nothing, your auto-assessment will very soon become FINAL.

For more on auto-assessments and their deadlines, please read

Read more →

Should I file a dormant return?

Written by Alicia

Posted 26 April 2023

Are you confused about whether your company should file a dormant return or a normal ITR14 for companies? It's understandable - dormancy can be a tricky concept to navigate. It's important to understand that the type of tax return you need to file depends on when your company became dormant. But don't worry, we're here to help you figure it out!

First things first, what is a dormant company?

A dormant company is a company which is registered with the ...

Read more →

Dormant Company Tax Returns

Written by Patrick

Posted 26 April 2023

If you've registered a company with CIPC some time ago and forgot about it, that company could land you in hot water with SARS. Even if the company is not actively trading and has no assets or liabilities, you still have a duty to submit its tax returns to SARS. Failure to do so can result in administrative penalties that ...

Read more →

11 Types of Tax Directives

Written by Neo

Updated 14 April 2023

Imagine you’re an estate agent or luxury car salesman. Chances are that you don’t earn much (if anything) as a basic salary and you rely on a few big deals and commission payments to keep you afloat during quieter months.

Read more →

Section 12H Learnership Allowance

Written by Neo

Updated 14 March 2023

Training and development for employees plays a vital role in the growth and success of your business. But, finding affordable and correct tools might be where the concerns start creeping in. Suddenly you’re left thinking… “They’ll learn on the job. Resources are limited.”

Fortunately, you’d be pleased to know that the learnership allowance is intended to be an incentive for employers to encourage skills development within their workforce, with the hope to create jobs and economic growth....

Read more →

Older posts →← Newer posts

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Written by Neo

Written by Neo

Written by Alicia

Written by Alicia

Written by Patrick

Written by Patrick

Written by Nicci

Written by Nicci

Written by Evan

Written by Evan

Written by Vee

Written by Vee