FAQ: Stock Options

Written by Nicci

Posted 8 March 2021

Companies issue stock options (also called share options) to key employees in order to attract and retain talent.

A stock option is different from a share – a stock option is the right to acquire a share at a specific date in the future at a set price.

For example, when John joins Company A, he is granted 5000 stock options at a price of R55 per stock option. Assume that Company A’s share price rises to R75, he will make a profit of R20 per option when he is allowe...

Read more →

Budget 2021: No Tax Hikes

Written by Patrick

Posted 25 February 2021

The Minister delivered some welcome news to South Africans yesterday when he announced that plans to hike taxes by R40 billion rand over the next four years, have been scrapped. This is largely attributed to a surge in tax revenue from mines, as well as a faster than expected recovery in VAT collections towards the end of last year.

He went on further to say, that there would be no significant tax increases at all in the year ahead. Contrary to speculation, the much-anticipated Covid-19 vaccination programme will not be funded by tax hikes...

Read more →

IRP5 FAQs

Written by Neo

Posted 22 February 2021

What is an IRP5?

An IRP5 is the employee's tax certificate that is issued to him/her at the end of each tax year detailing all employer/employee related incomes, deductions, and related taxes. The employee uses it specifically to complete his/her income tax return for a specific year.

Do I need an IRP5?

Yes, you do if you were employed during the tax year.

Can I submit a return without an IRP5? OR Am I able to submit returns without my IRP5? OR Are you able to submit without the IRP5?...

Read more →

FAQ: Provisional Tax

Written by Nicci

Posted 9 February 2021

1. How many returns should I file each year if I am a provisional taxpayer?

You are required to file 3 returns i.e. 2 provisional tax returns (IRP6s) and one annual return (ITR12). The reason you need to file the annual return too is because your provisional returns are based on an estimate of your taxable income, while the annual return reflects your actual taxable income. Any provisional payments you have made for the year will be deducted from your final tax liability, which is, calculated when you submit your annual tax return for assessment.

2...

Read more →

Top Tips for Provisional Taxpayers

Written by Neo

Posted 9 February 2021

1. Estimate your taxable income for the whole tax year

Remember that both your first and second provisional return (IRP6) must reflect an estimate of your taxable income for the full 12 months of the tax year.

Read more →

New South African Expat Tax Changes in 2021

Written by Neo

Posted 4 February 2021

In a bid to meet its tax revenue quotas, SARS began introducing changes to the expatriate laws which took effect on 1 March 2020, which saw the launch of the Foreign Employment Unit.

Read more →

Having problems with Adobe Flash Player forms on SARS e-Filing?

Written by Patrick

Posted 24 January 2021

As early as July 2017, Adobe announced that Flash Player would be discontinued by 31 December 2020 and that Flash Player would block its Flash content by 12 January 2021

Read more →

Possible tax hikes to cover the cost of Covid-19 vaccines

Written by Patrick

Posted 24 January 2021

As many countries around the world are already in the process of distributing the Covid-19 vaccine, the National Treasury of South Africa is proposing the possibility

Read more →

Tax on Bonus Payments: How Does it Work?

Written by Vee

Posted 18 January 2021

For those fortunate enough to receive bonus payments as part of your remuneration, you’ll understand the

Read more →

"Emergency Notification System" - it's a scam!

Written by Neo

Posted 14 October 2020

There is a new scam going around this tax season, SARS has made us aware of it and we would like to make sure you know about it too.

Read more →

What is Gap Insurance & why is it so valuable to have?

Written by Neo

Posted 7 October 2020

When you are in the process of selecting a medical aid, the question of adding gap cover to your plan is likely to come up. More than 1 million South African families understand the importance of gap cover, which is why they have opted in. But should you? First things first…

Read more →

SARS asked for my documents again. Why?

Written by Neo

Posted 3 October 2020

We are seeing many cases where taxpayers submit their documents to SARS, wait 21 working days (sometimes longer) only to receive a second letter on eFiling which requests the exact same documents again.

Read more →

FAQs: Tax Refunds

Written by Neo

Posted 4 August 2020

As the tax season is approaching, many of our users are asking whether or not they will be due a tax refund.

Read more →

2020 Supplementary Budget Speech

Written by Neo

Posted 30 June 2020

On Wednesday, 24 June 2020, Minister of Finance, Tito Mboweni, addressed parliament to announce the 2020 Emergency Budget Speech.

Read more →

FAQs: Tax Directives

Written by Neo

Posted 24 June 2020

A tax directive is super useful when you earn commission, variable income or are going to receive a large bonus or a lump sum.

Read more →

How is Commission Taxed? 3 Ways Your Company Taxes Commission

Written by Vee

Posted 23 June 2020

Our helpdesk receives hundreds of questions related to tax where commission is involved. A misconception that comes up time

Read more →

FAQs: Tax Clearance or Tax Compliance Status (TSC)

Written by Neo

Posted 22 June 2020

1. I need an actual tax clearance certificate, but each time I apply I am sent a PIN. Can you help me print the certificate?

Read more →

FAQs: Retrenchment

Written by Neo

Posted 15 June 2020

Thousands of people have lost their jobs as a result of the Covid-19 pandemic and the nationwide lockdown to slow the spread of the disease.

Read more →

Navigating around your Capital gains tax certificate (IT3C)

Written by Alicia

Posted 15 May 2020

If you have shares (financial instruments) , there is important information on your IT3C tax certificate which needs to be included in your tax return.

This will ensure your taxable income is calculated accurately with the correct capital gain or loss included.

Do you have shares at any of the following institutions?...

Read more →

FAQs: 'Other Deductions' that you may be able to claim in your tax return

Written by Neo

Posted 13 May 2020

There is a section in the tax return called ‘Other Deductions’ which often causes confusion for taxpayers

Read more →

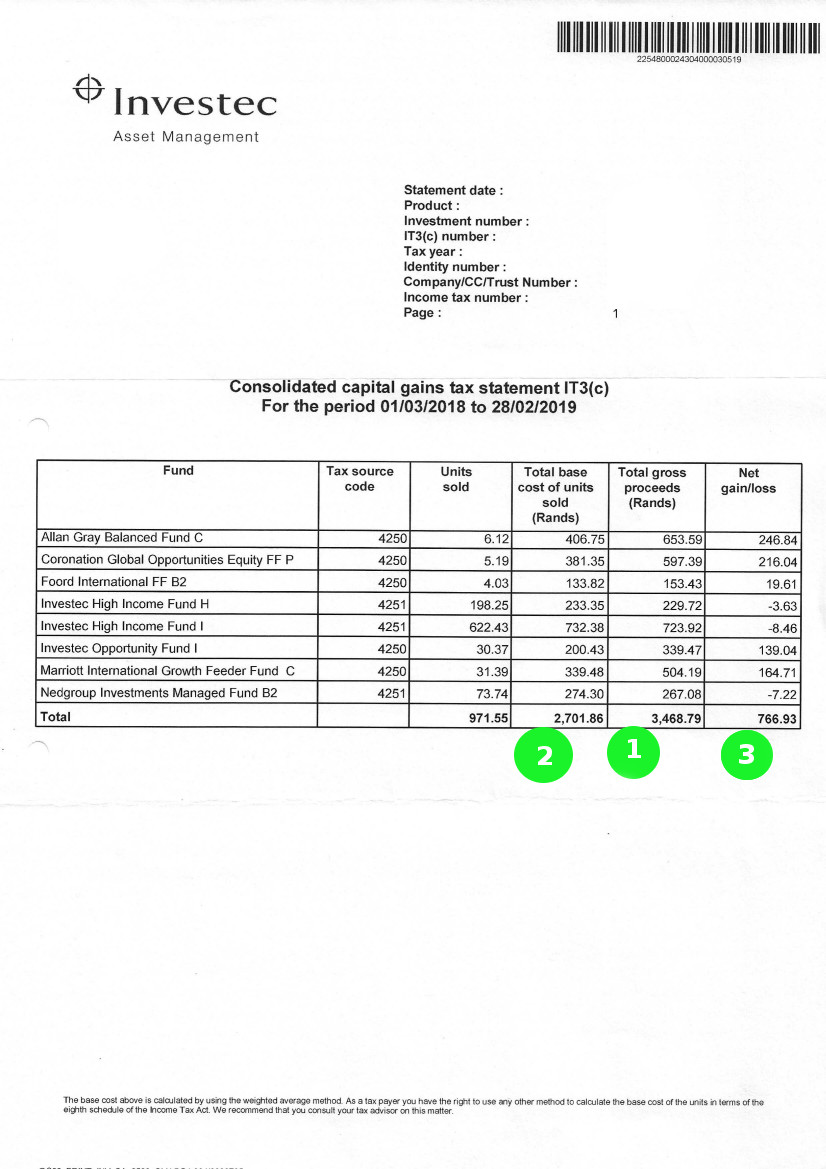

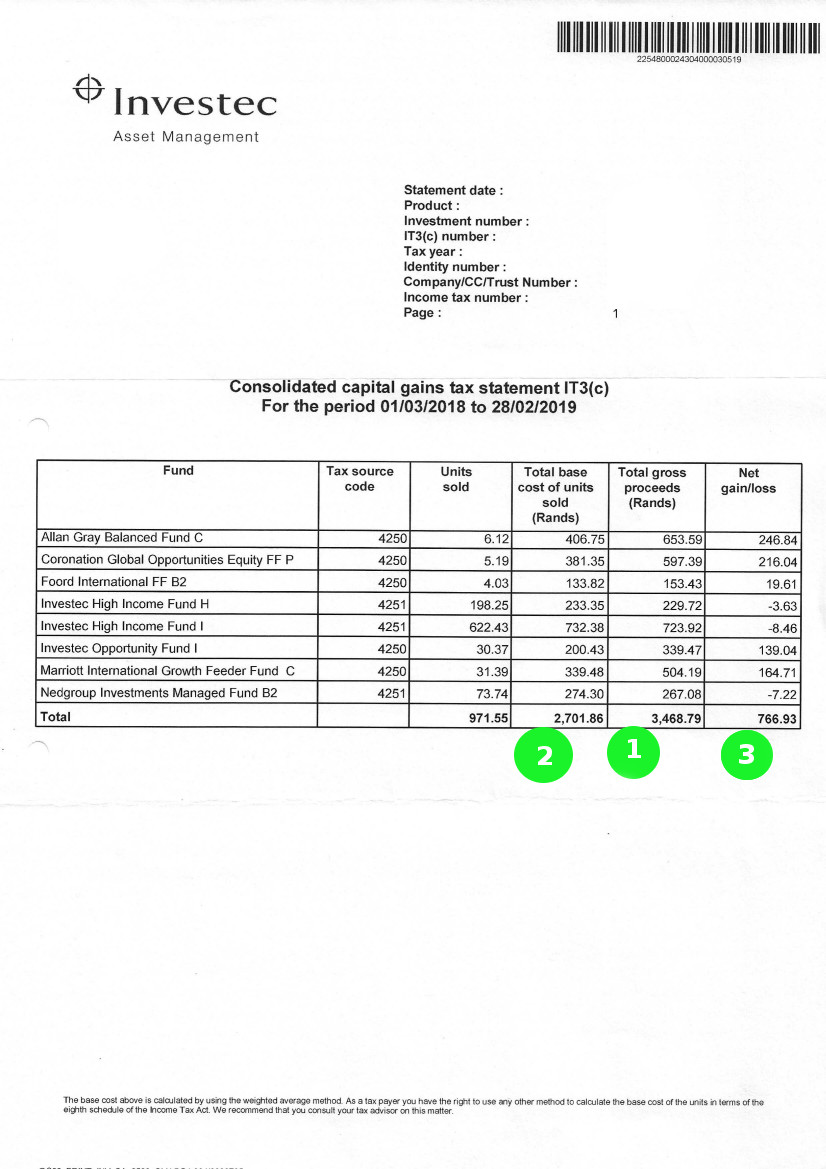

Navigating around your Investec investment tax certificate (IT3c)

Written by Neo

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

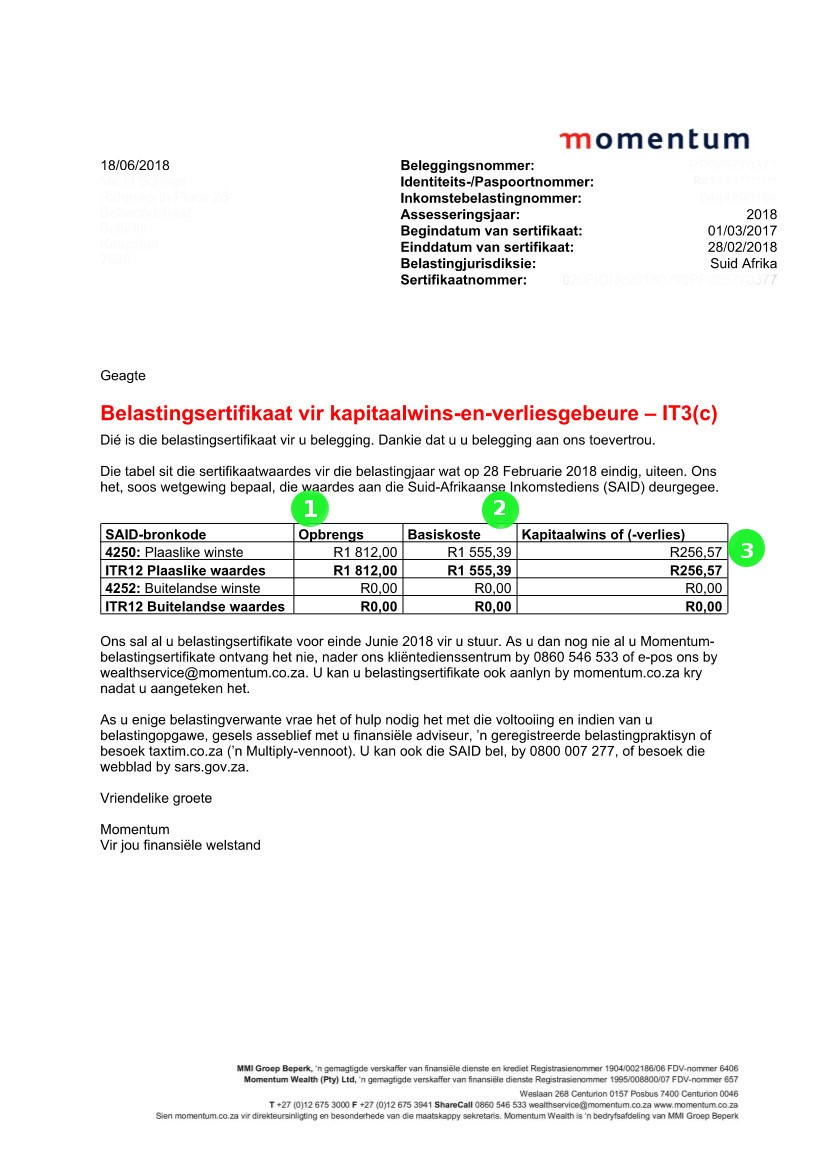

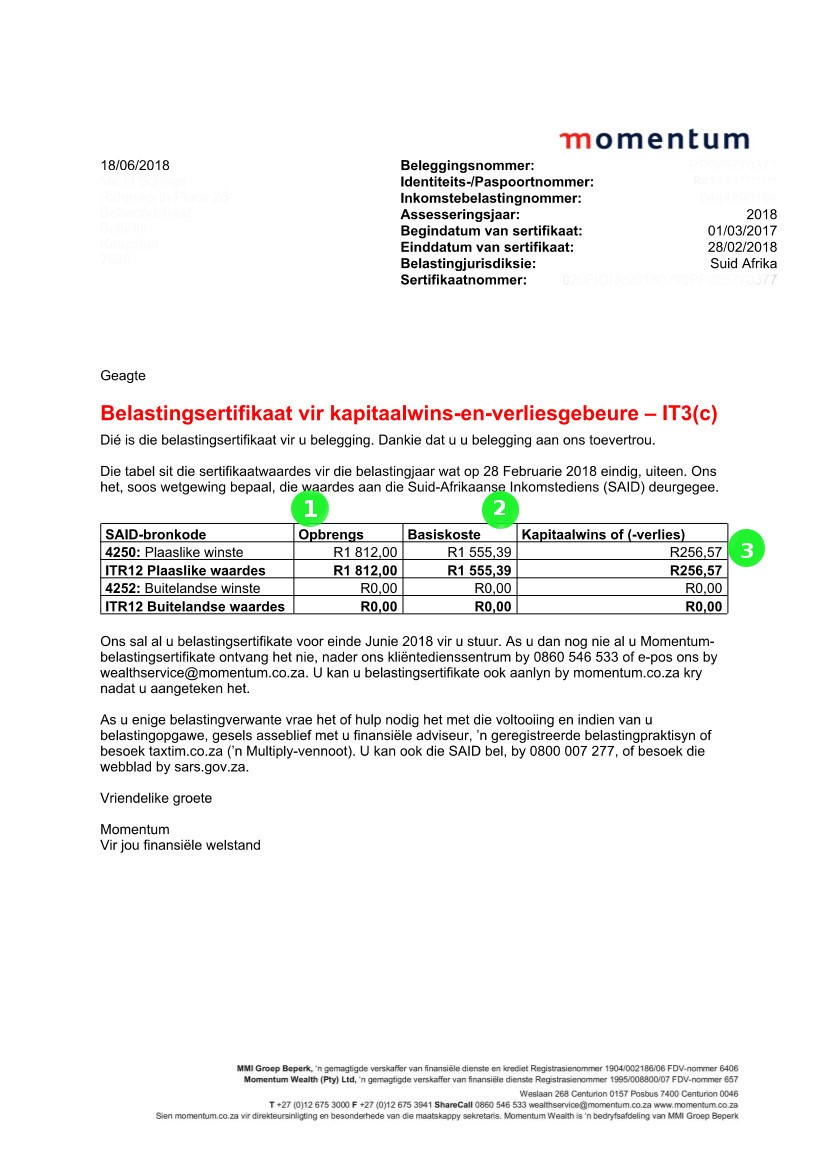

Navigating around your Momentum tax certificate (IT3c)

Written by Neo

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

News Alert: Tax Season 2020

Written by Neo

Posted 8 May 2020

On Tuesday evening, the SARS commissioner, Edward Kieswetter, held a media briefing to talk about the challenges that SARS is facing due to Covid-19.

Read more →

Do I earn enough to have to pay tax?

Written by Marc

Posted 23 April 2020

Why must I pay tax, I don’t earn enough! Will I get a penalty if I don’t disclose all my income to SARS?

Read more →

FAQs: Travel expenses and Tax

Written by Neo

Posted 22 April 2020

Travel expenses and their tax impact are a complex issue for many. It’s no surprise that it’s a common theme on our Helpdesk.

Read more →

Older posts →← Newer posts

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Written by Nicci

Written by Nicci

Written by Patrick

Written by Patrick

Written by Neo

Written by Neo

Written by Vee

Written by Vee

Written by Alicia

Written by Alicia

Written by Marc

Written by Marc