Written by Vee

Updated 30 May 2023

Written by Vee

Updated 30 May 2023

You’ve been diligent with your tax obligations, you’ve paid your PAYE (employees tax) each month without fail, you’ve kept all the supporting documents for your deduction claims and you’ve carefully filled out your tax return, making sure you’ve put all the right amounts in all the right places, against all the right codes. (Pssst, if you used TaxTim to help you complete your tax return, you wouldn’t have had to worry about all the right places and codes because that’s all automated for you). You file your tax return, somewhat impressed with yourself and, by your calculations, you can look forward to a reasonable tax refund amount, but then you receive your assessment notification.

You are surprised to see that SARS has disallowed certain expenditure and what looked to be a handsome tax refund, has in fact resulted in a sizable amount payable to SARS.

If you’ve been through the verification and / or auditing process already, without a favourable result, you may want to consider filing a Notice of Objection at this point.

It should be noted that a Notice of Objection is a last resort action, and should only be filed when you’re absolutely certain that you qualify for your deduction claims and you feel that SARS has been erroneous in their calculations. If you’re confident that your tax return is correct and the assessment is incorrect, then proceed to file a Notice of Objection.

The dispute must be lodged within 80 days from the date of the assessment, or after SARS sent you a reply to a Request for Reason.

If you have no idea why you owe SARS, it would be best to first click the button on your Income tax workpage called Request for Reason. SARS will then send you the reason your refund was reduced.

How to File a Notice of Objection on SARS eFiling

Step 1

Select the "Returns" button at the top

Step 2

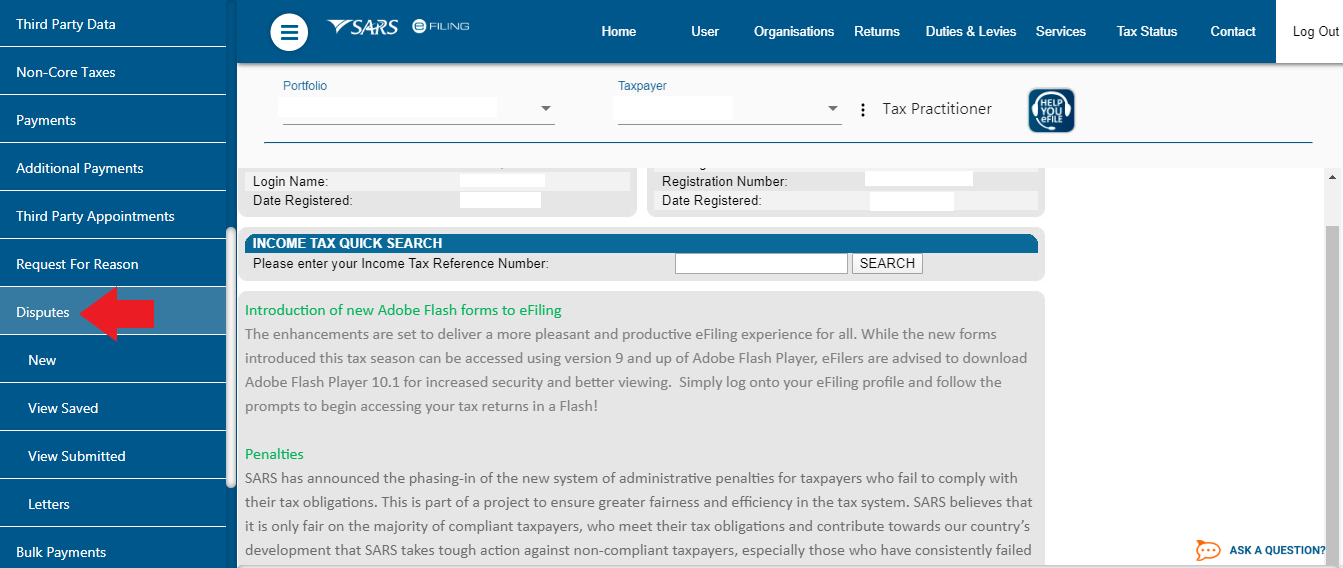

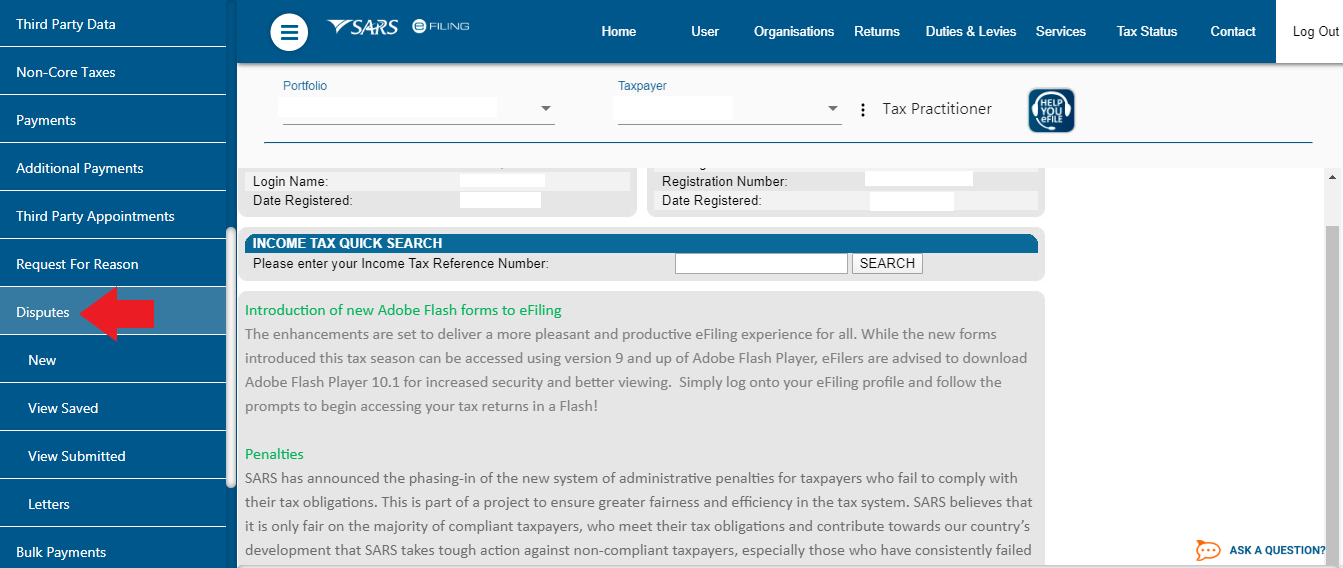

To the left click on "Disputes" and on the dropdown select disputes "New"

Step 3

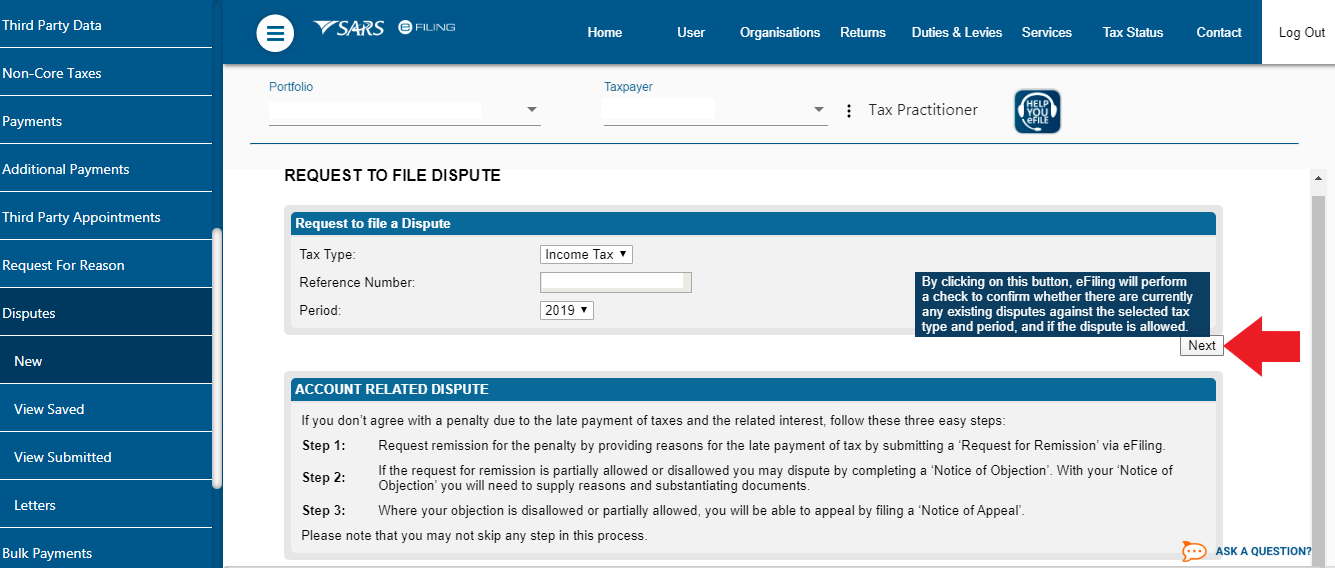

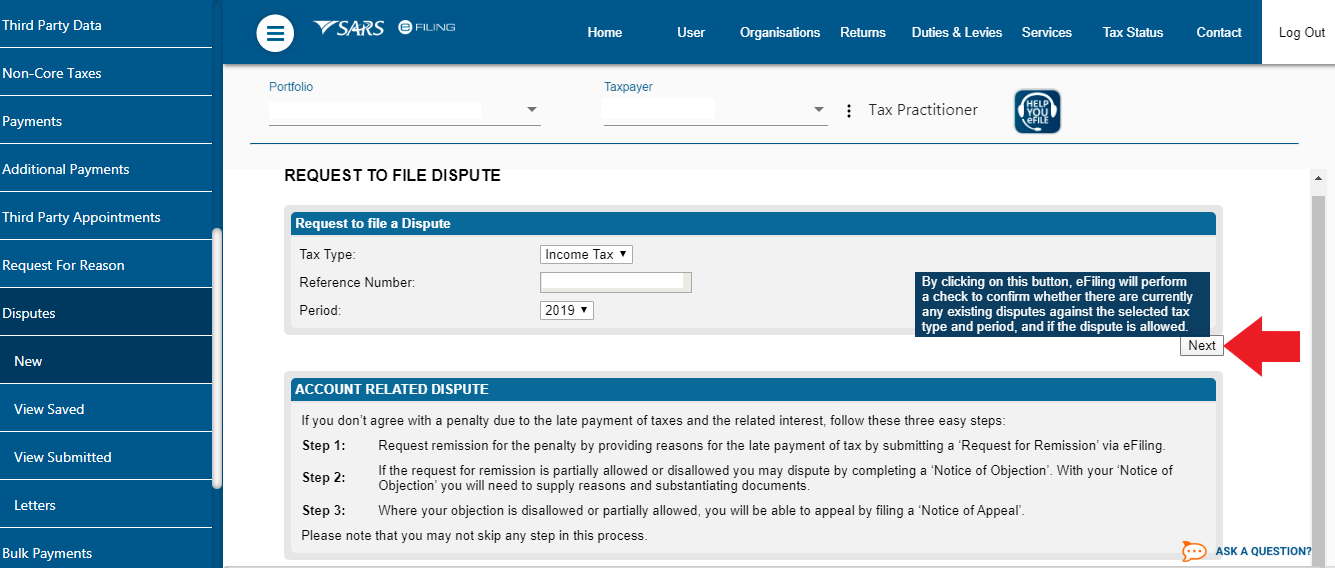

This will bring up a box titled ‘Request to file a Dispute’.

Click on the period drop down box and select the applicable tax year

Click on the "Next" button in the bottom right hand corner of the box

Step 4

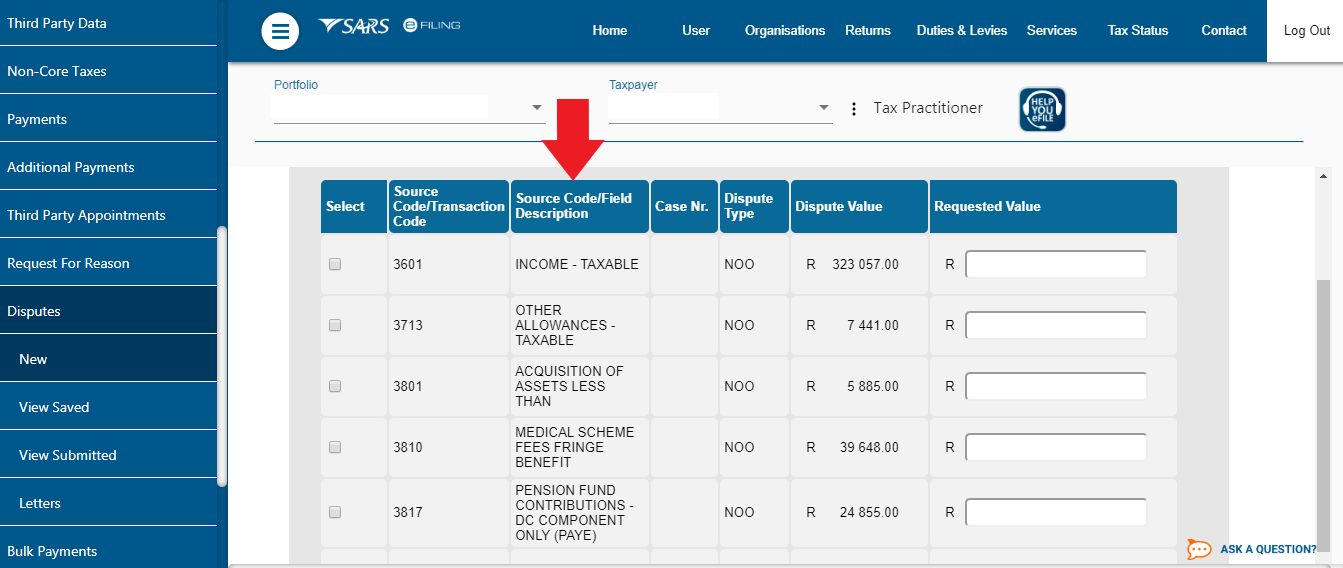

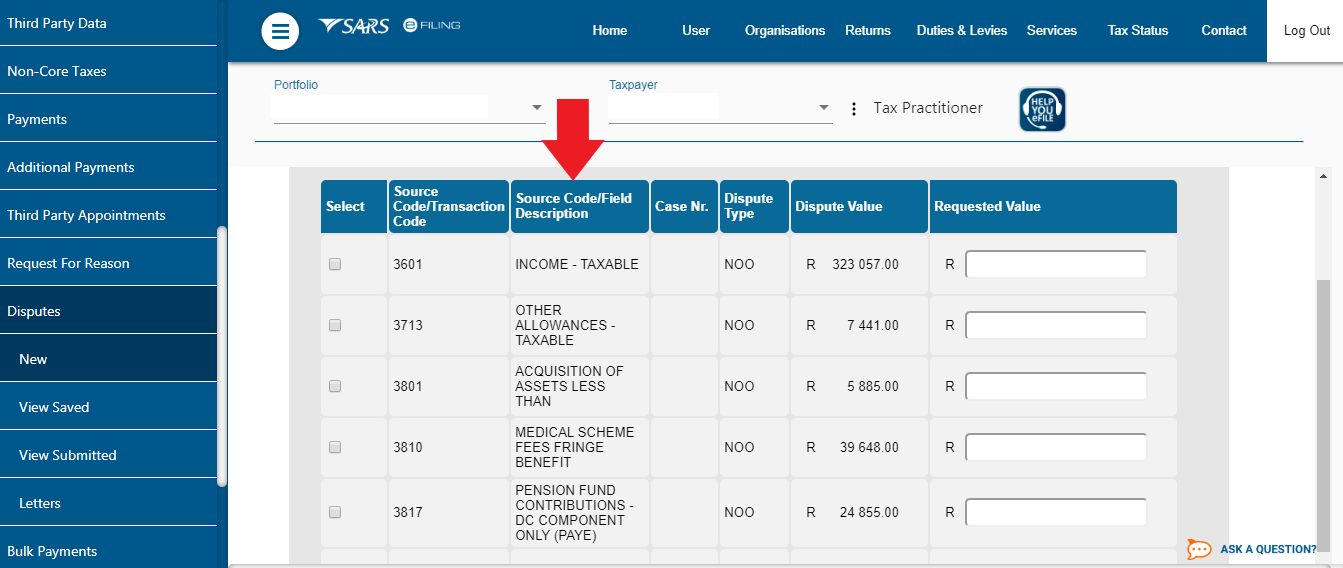

This will bring you to a box entitled "Dispute Item List (Assessment)".

Here you’ll have to find the amounts as reflected on your assessment and where you disagree with the amount, please select the source code you would like to update and you need to put what you think it should be in the ‘Requested Amount’ field next to the applicable row.

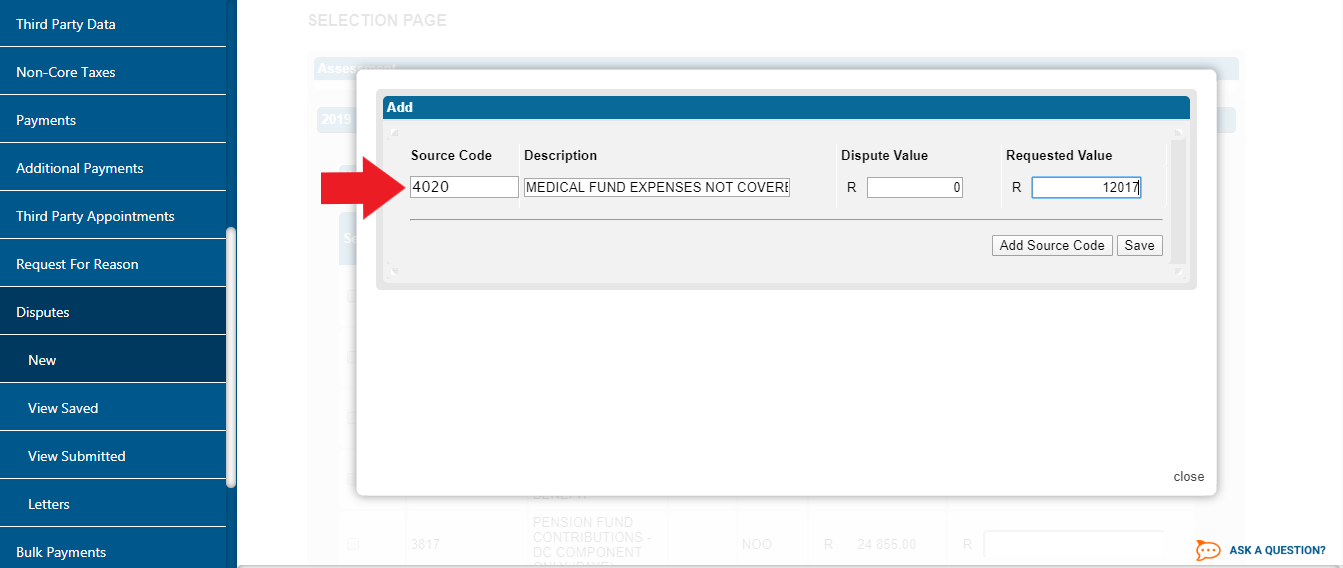

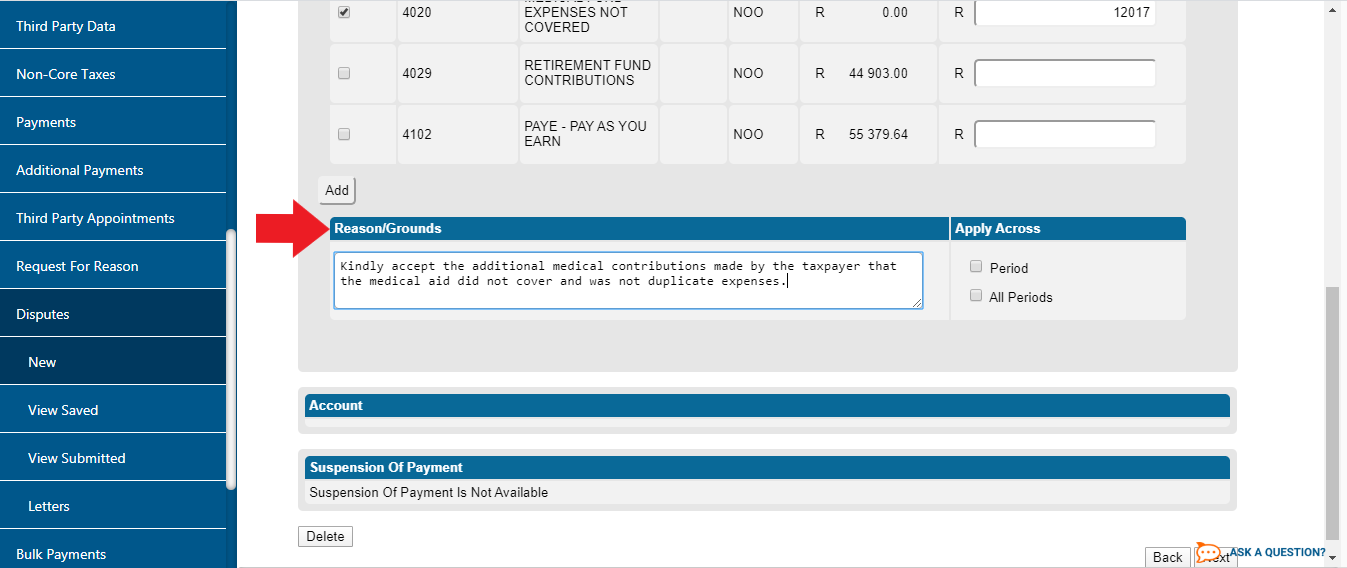

Step 5

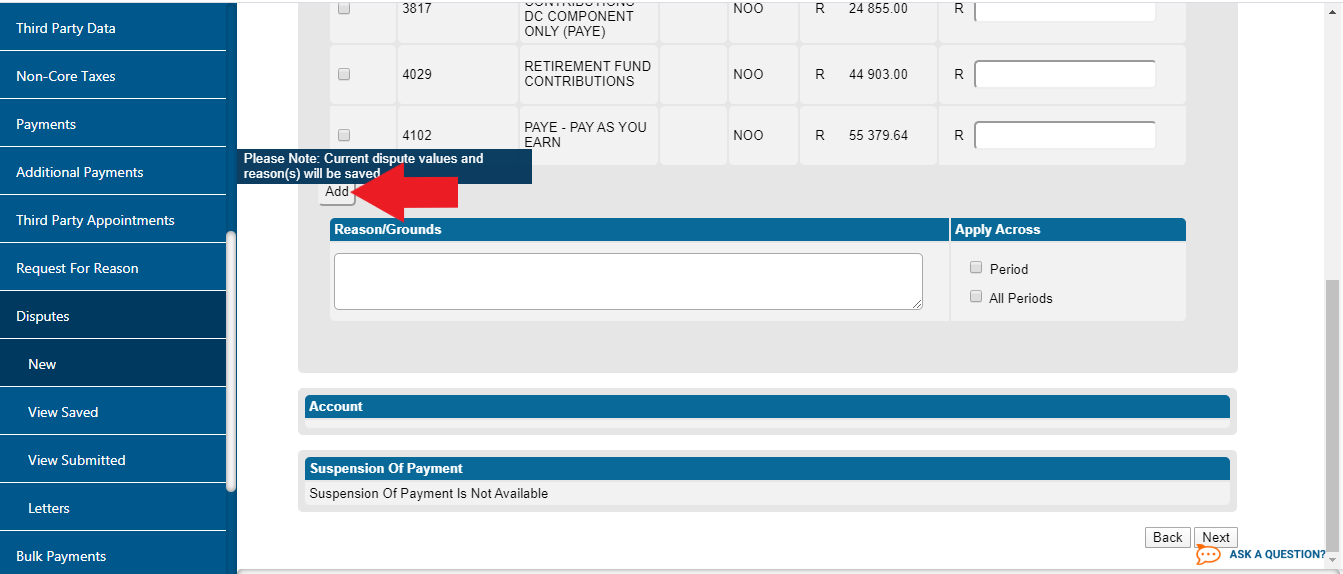

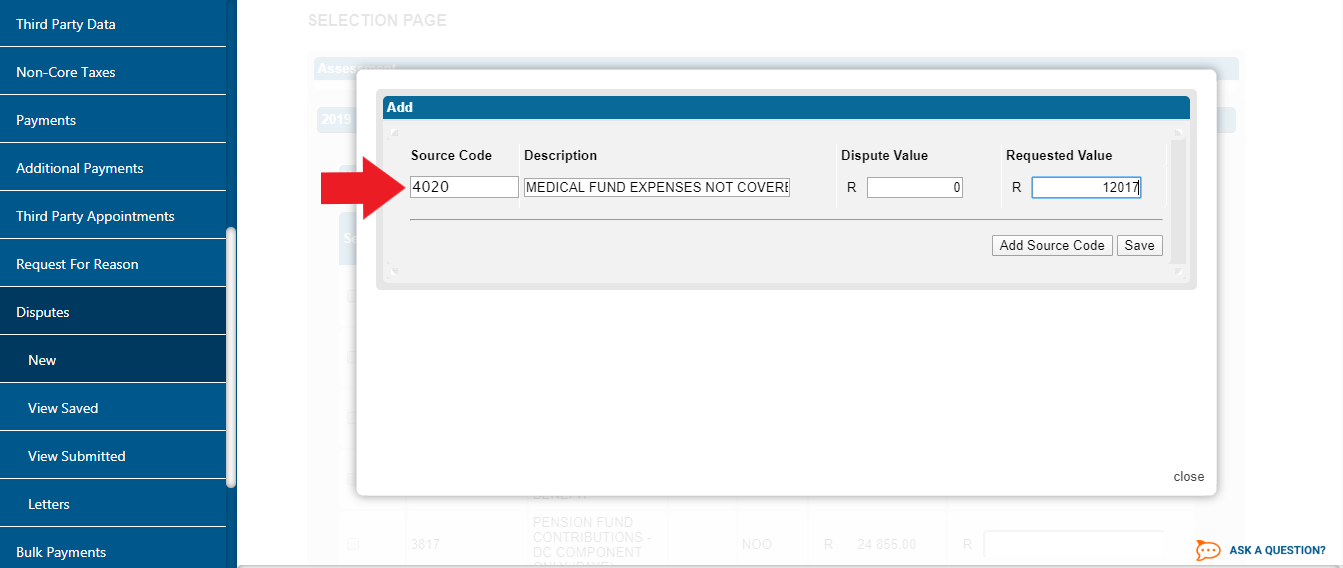

If the code does not appear then you will need to add it.

Enter a valid code and amount that was not accepted by SARS.

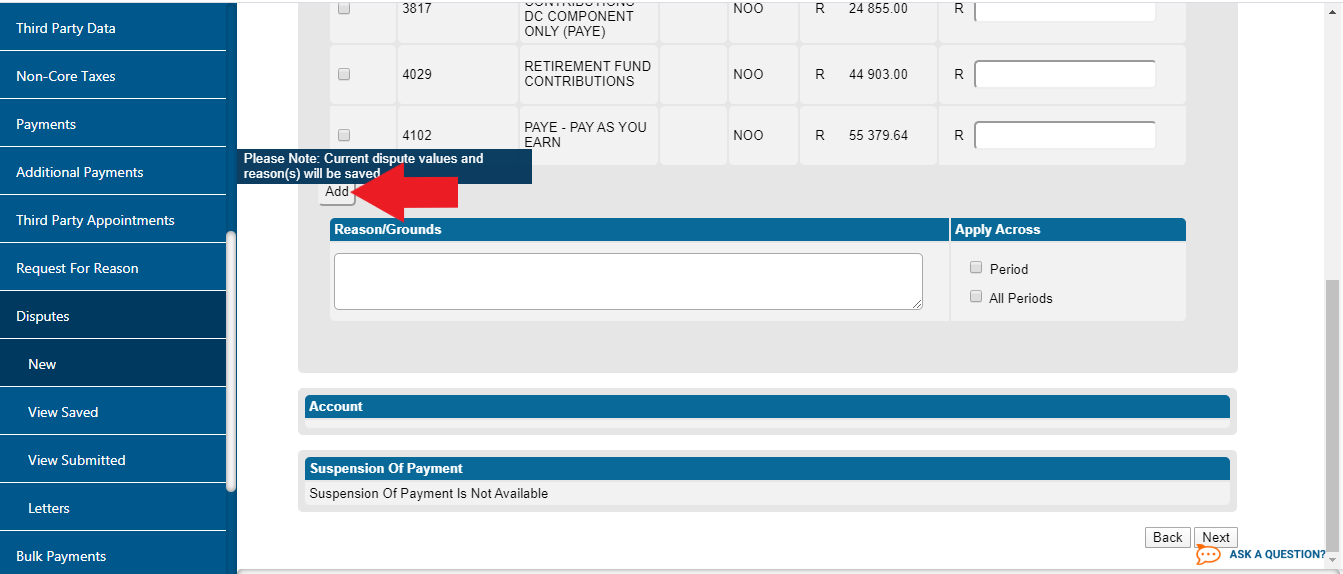

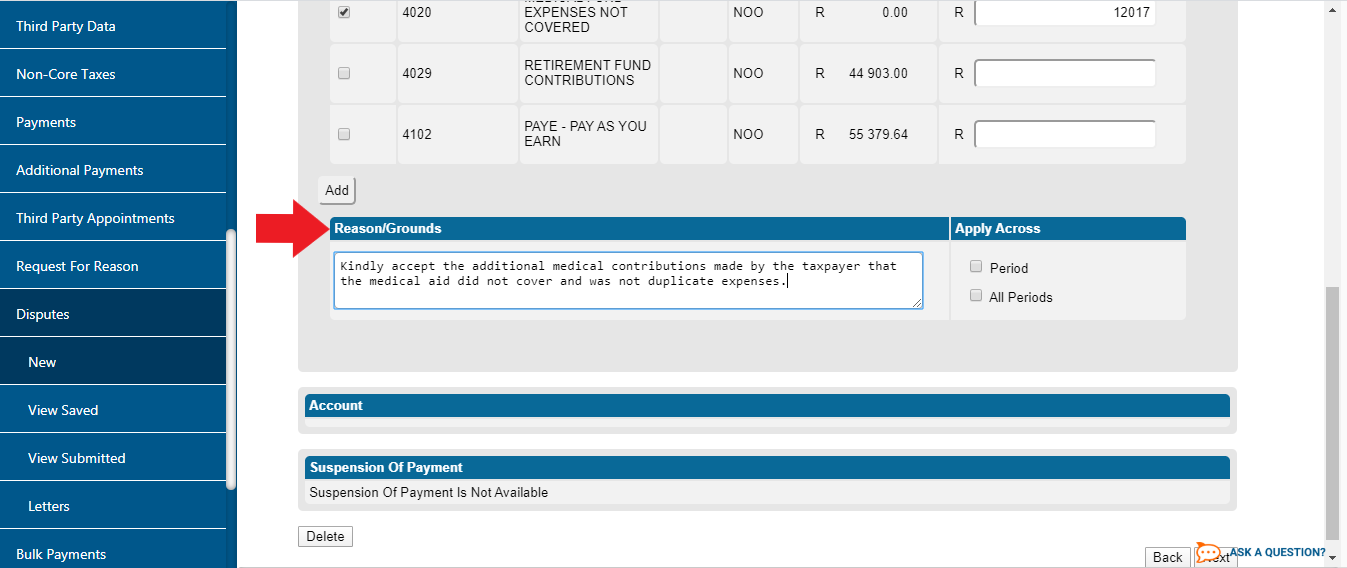

Step 6

Complete the reason you think this amount should be different under Reason/Grounds.

**Please note, if there is an amount due to SARS there will be an option for a "Suspension of Payment". You need to select this option and duplicate everything that you entered for your dispute on the "Suspension of Payment".

Step 7

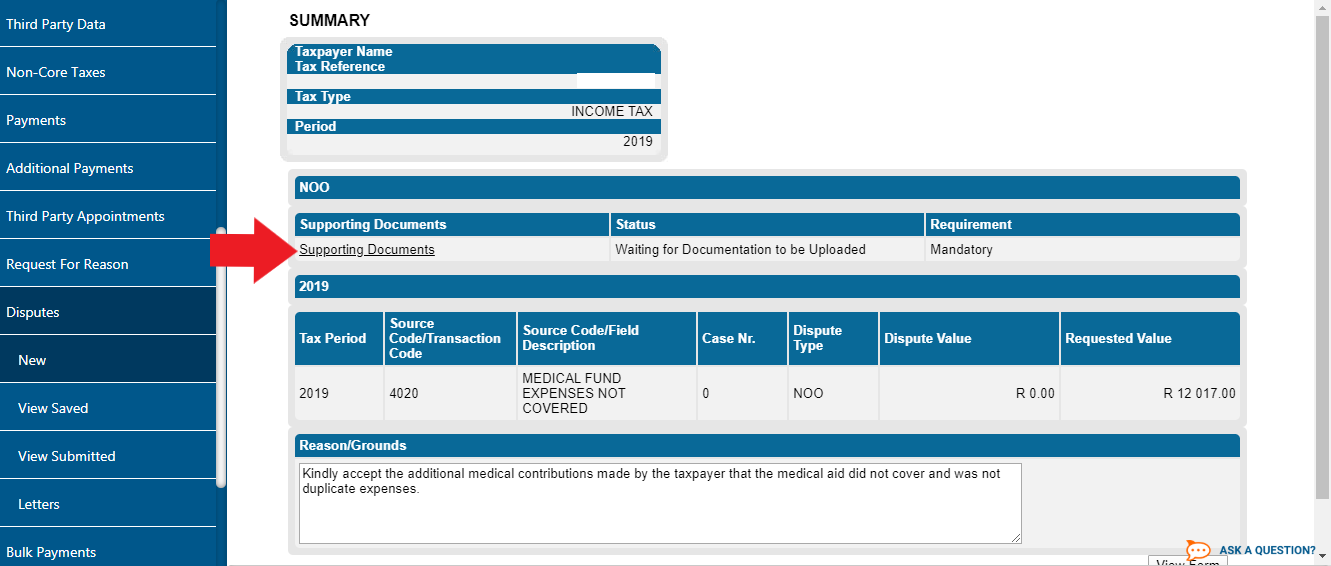

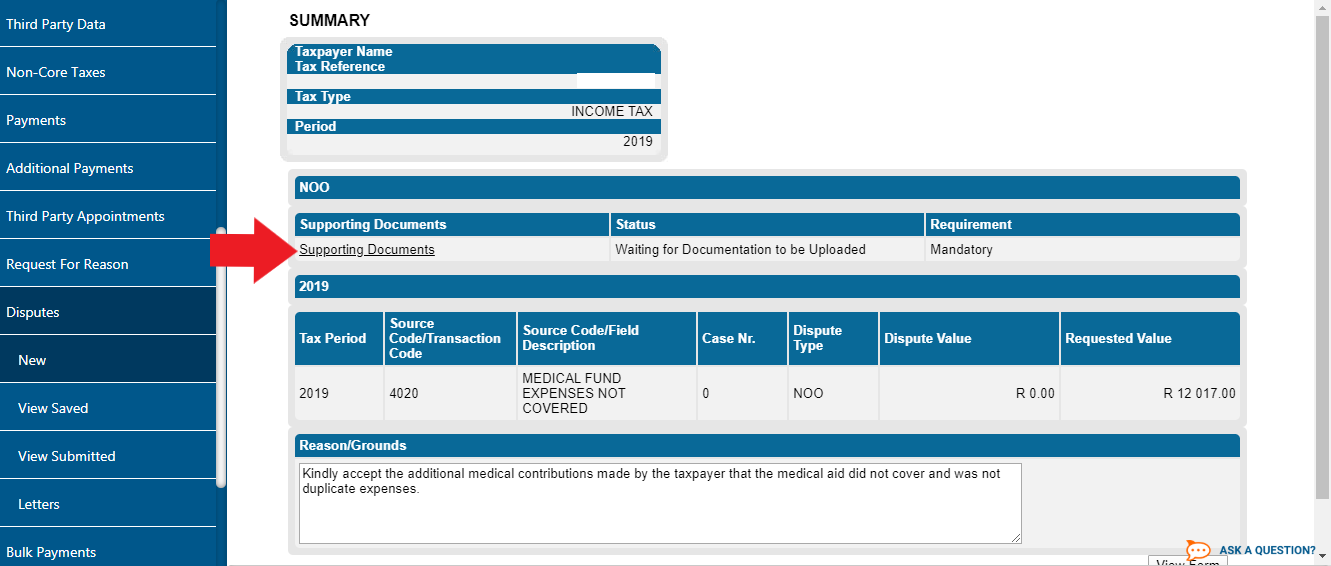

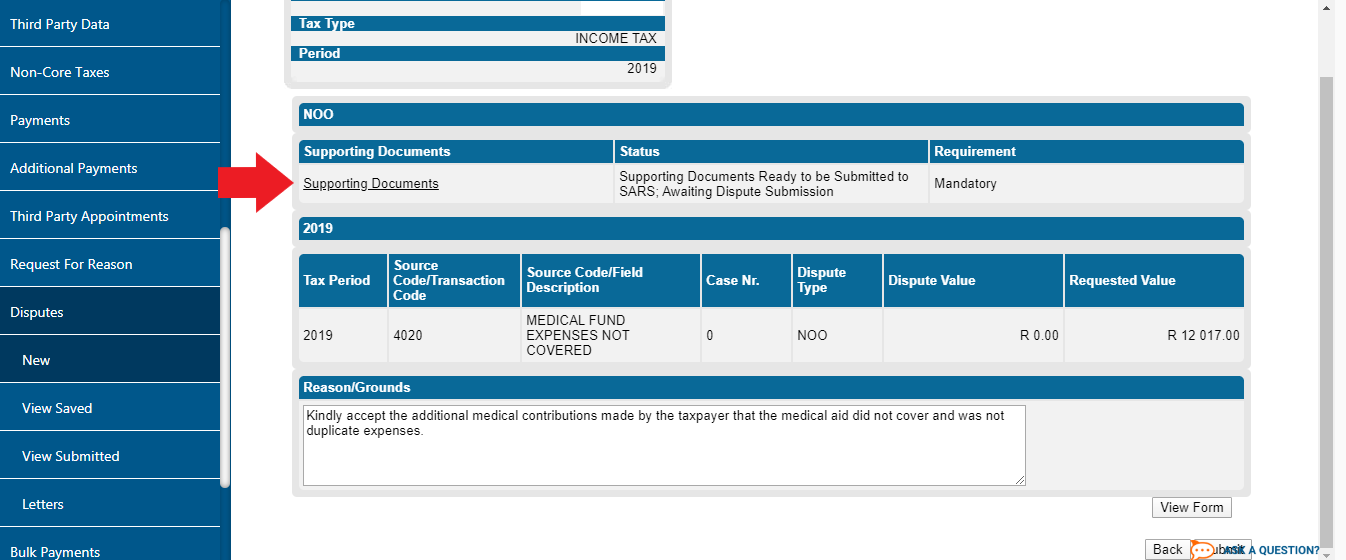

Upload supporting documents: Lastly, you’ll need to attach supporting documents for the dispute that shows SARS why you believe the assessed amount is incorrect. Once your objection is received, SARS will review your disputed amount against the supporting documentation provided. It can take up to 60 working days for this process to be completed and your notice of completion to be issued.

It's worth to bear in mind that SARS is under no obligation to overturn any previous assessment. It’s not a sure-fire way to ensure that the assessment is in your favour, but it can help when qualifying documentation has been overlooked.

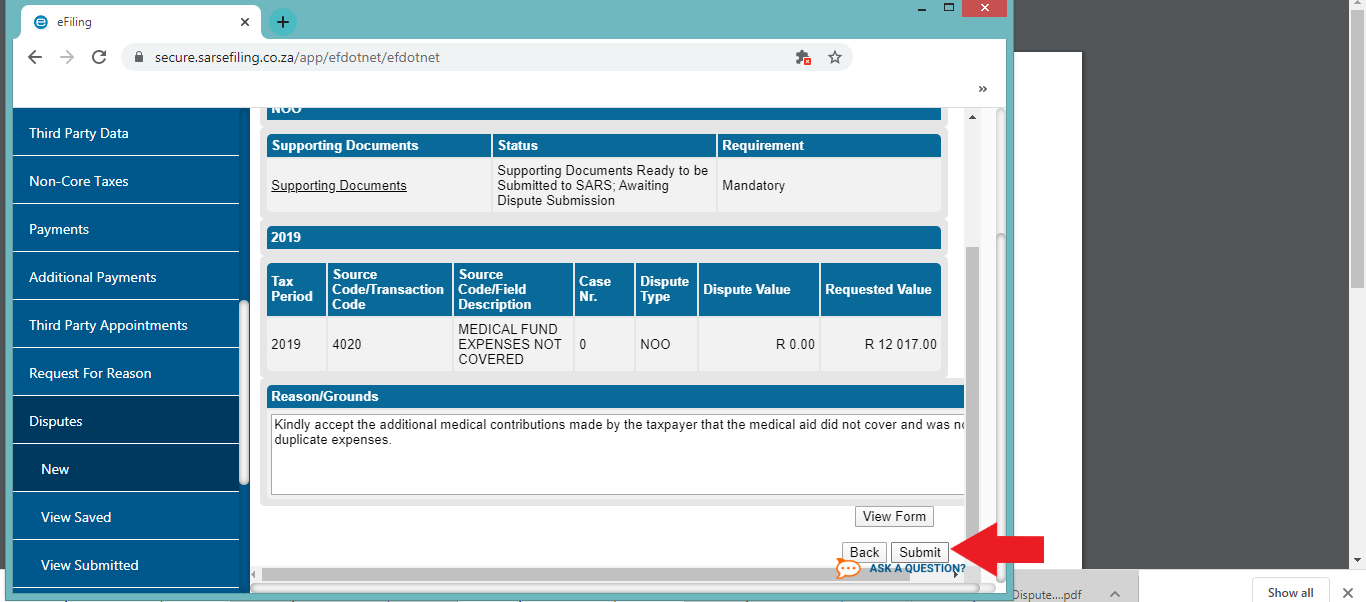

Once finished it should look like:

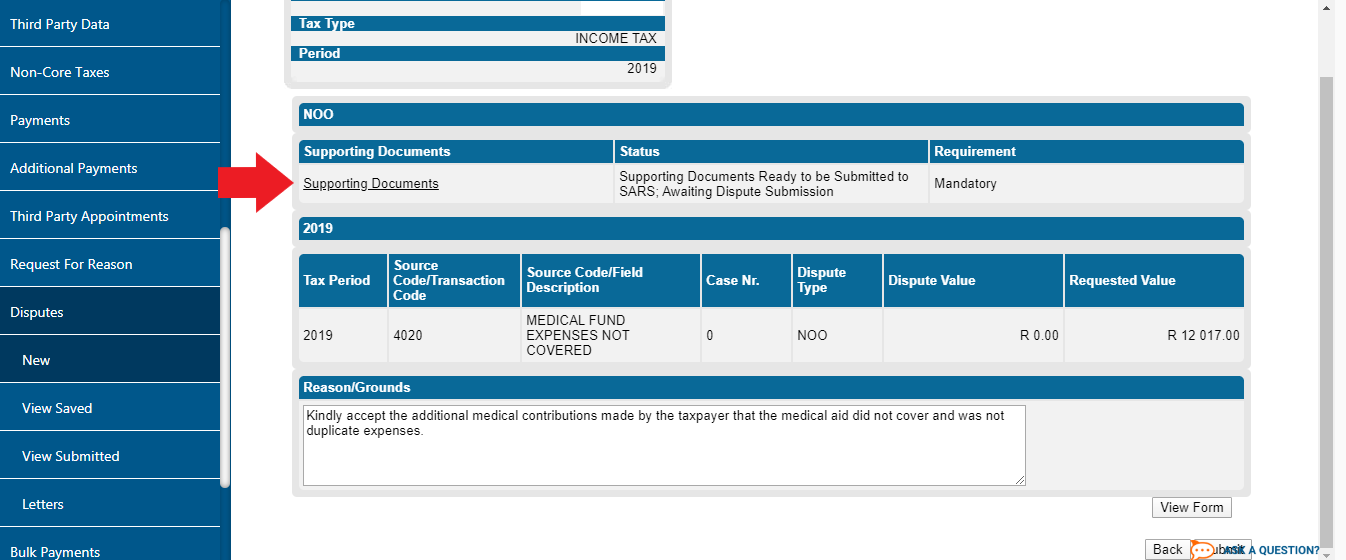

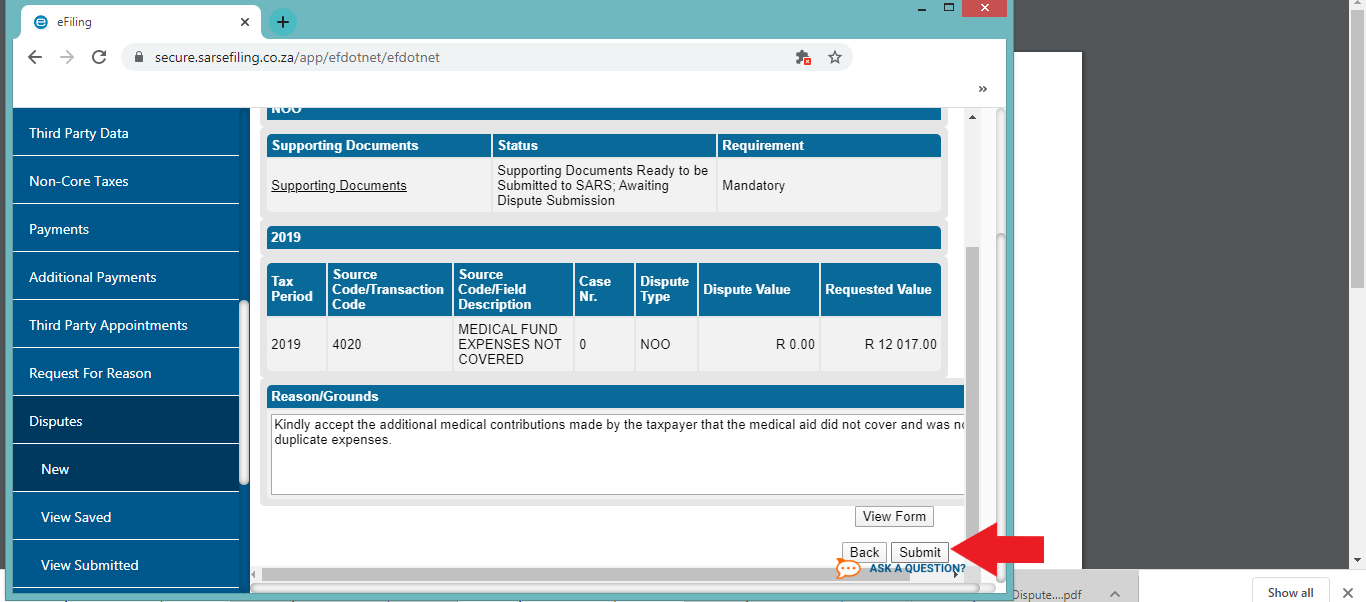

Step 8

You will then need to select "Submit" If you can't see this button, you may need to change the screen size to make it easier:

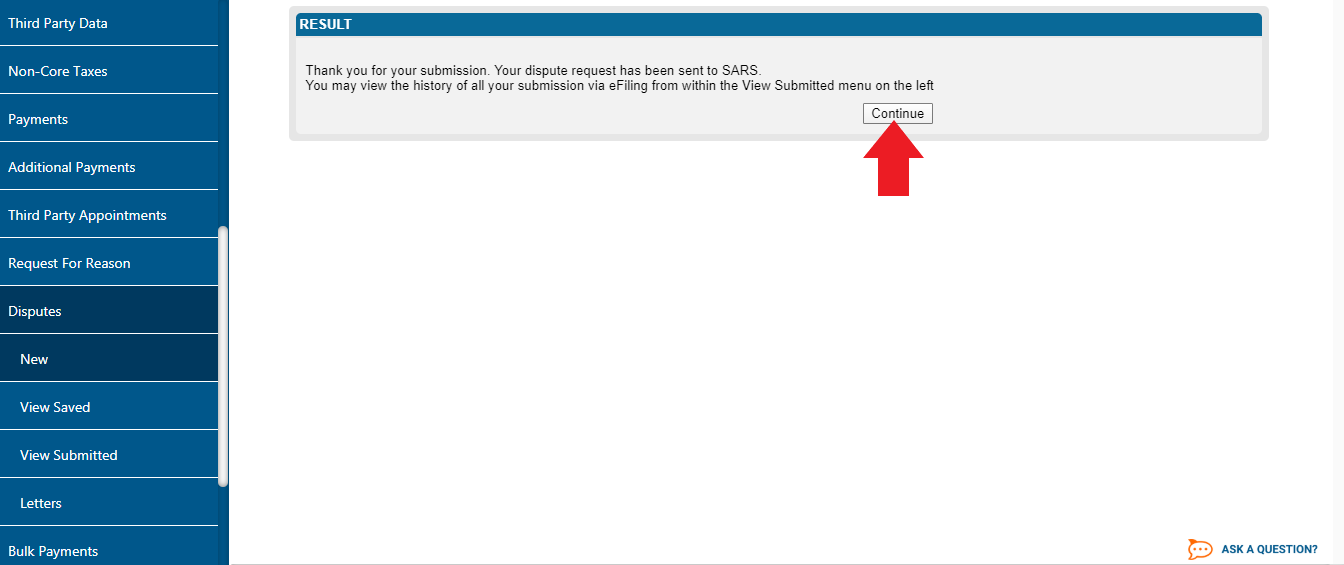

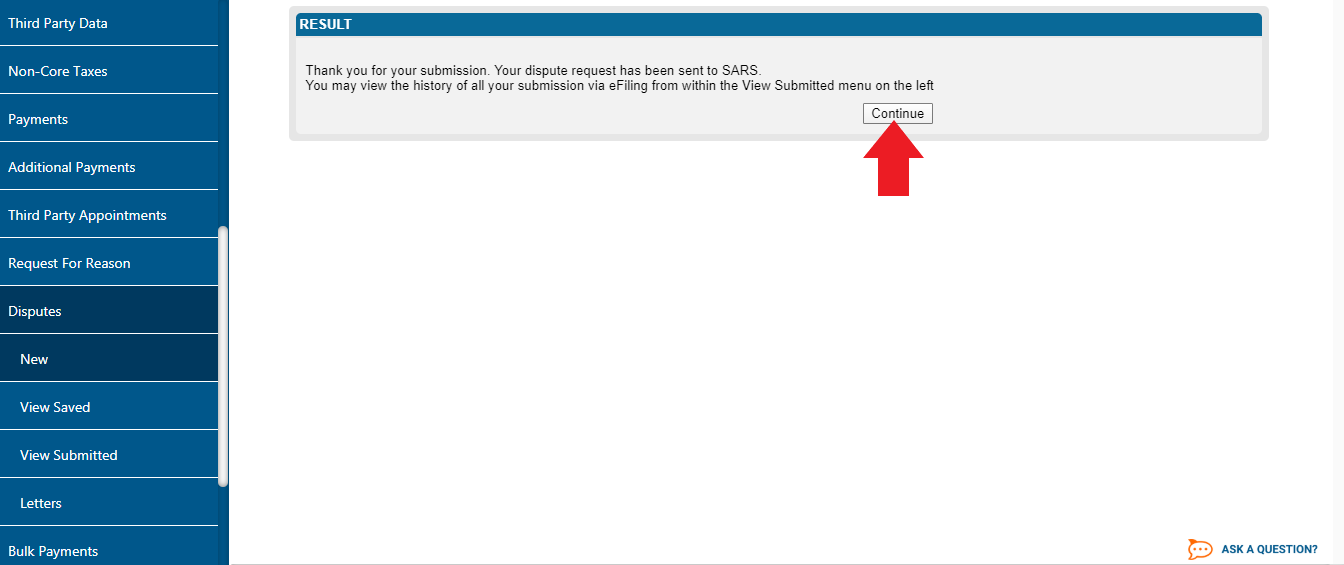

Step 9

Select "Continue" and you are done!

Your dispute has now been sent to SARS and they have 60 business days to give feedback on the dispute:

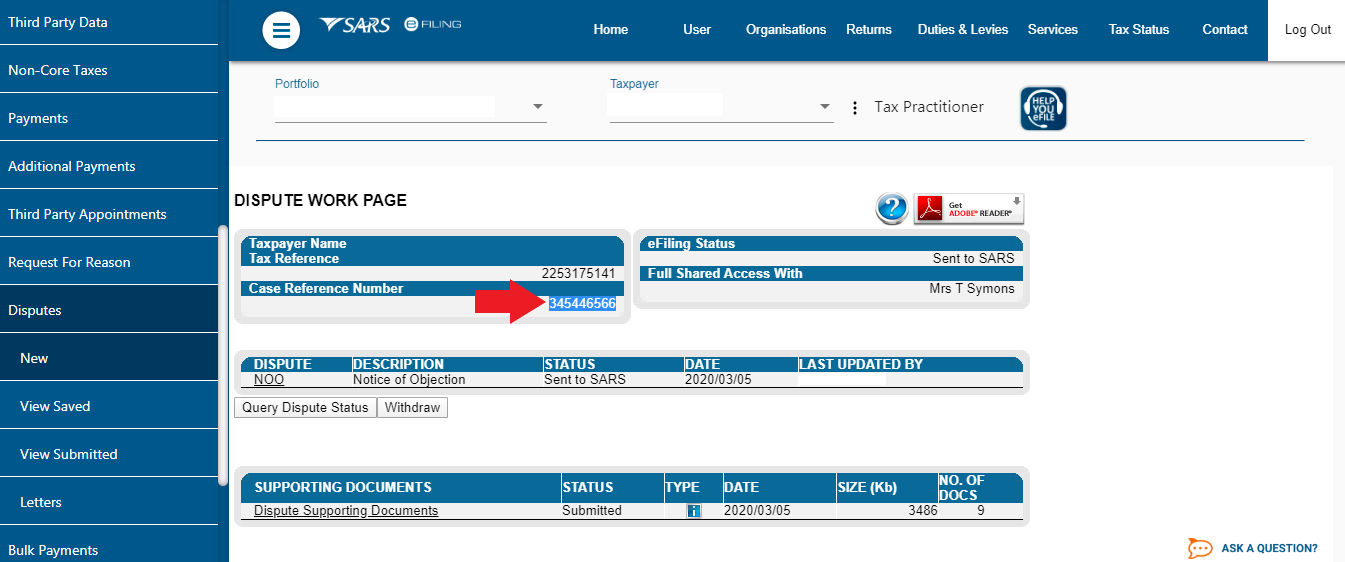

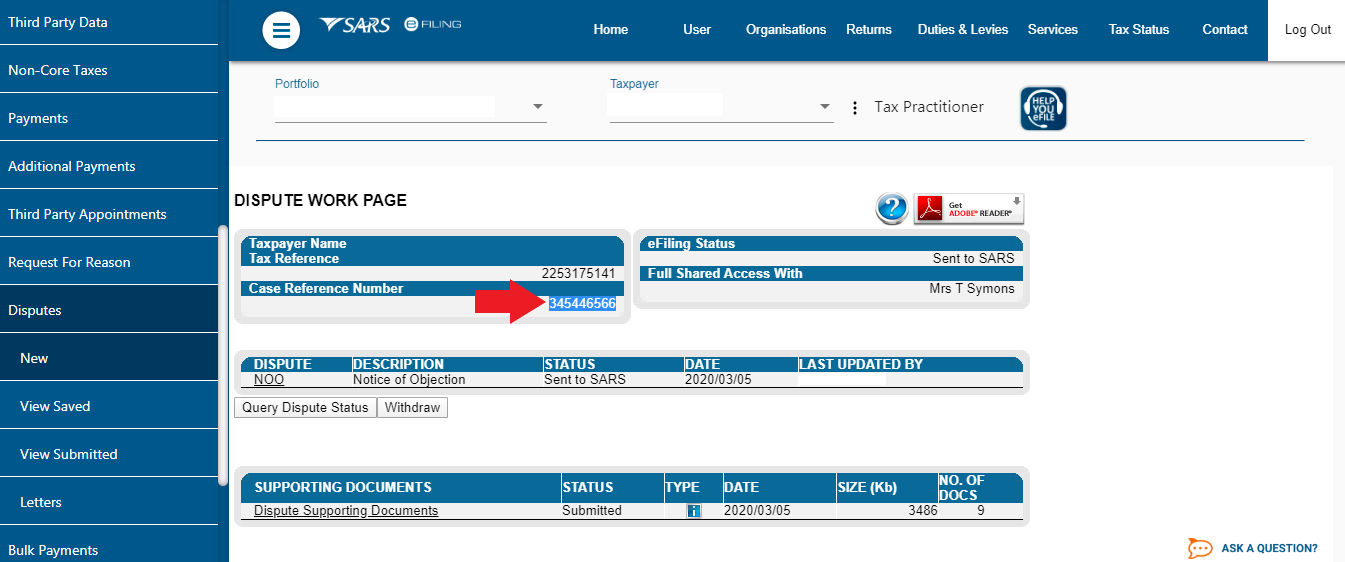

If you need to follow up on your dispute you will need to use the case number as highlighted below:

Important time periods to be aware of:

- SARS has 60 business days to get back to you,

- if they need extra documents, SARS can take another 45 days to review the documents.

- If they accept or reject your dispute, SARS has 30 days from the date of your submission to notify you of this.

- If SARS needs more than 60 working days to review your dispute, they need to notify you of this, before they reach the 60 day deadline.

This entry was posted in TaxTim's Blog

and tagged Audit / Verification, SARS & eFiling.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Vee

Written by Vee