Written by Neo

Posted 14 February 2019

Written by Neo

Posted 14 February 2019

Guest Blogger: Albertus Marais Director of AJM tax consultants and an independent director of 12Cape Ltd, a registered VCC.

10 Years on: Is the VCC Tax Incentive (STILL) living up to the hype?

The Venture Capital Company (VCC) regime was introduced to the Income Tax Act 10 years ago. But has the hype surrounding this tax incentive lived up to its promises? The incentive was introduced by National Treasury to direct passive retail capital into targeted areas of the economy (like SME and tourism) to generate jobs and stimulate economic growth. In its most simple form, investors (individuals, trusts or companies) can claim a full deduction of their investment in SARS approved “VCC funds” against their taxable income in the year of investment, which deduction becomes permanent if investors remain invested for five years.Capital Company (VCC)

Although the incentive was always extremely lucrative, it had a slow start. Not only were the requirements and tax consequences linked to Section 12J investments initially onerous, but the market also indicated that it was commercially unrealistic. Investor sentiment changed markedly in 2015 when significant relaxations to the regime were introduced. Most notably, the recoupment of the initial tax deduction was removed if the investor remained invested in the VCC for at least 5 years. As a result of this and many other legislative changes, the incentive gained significant traction with the establishment of a raft of new Section 12J VCCs since.

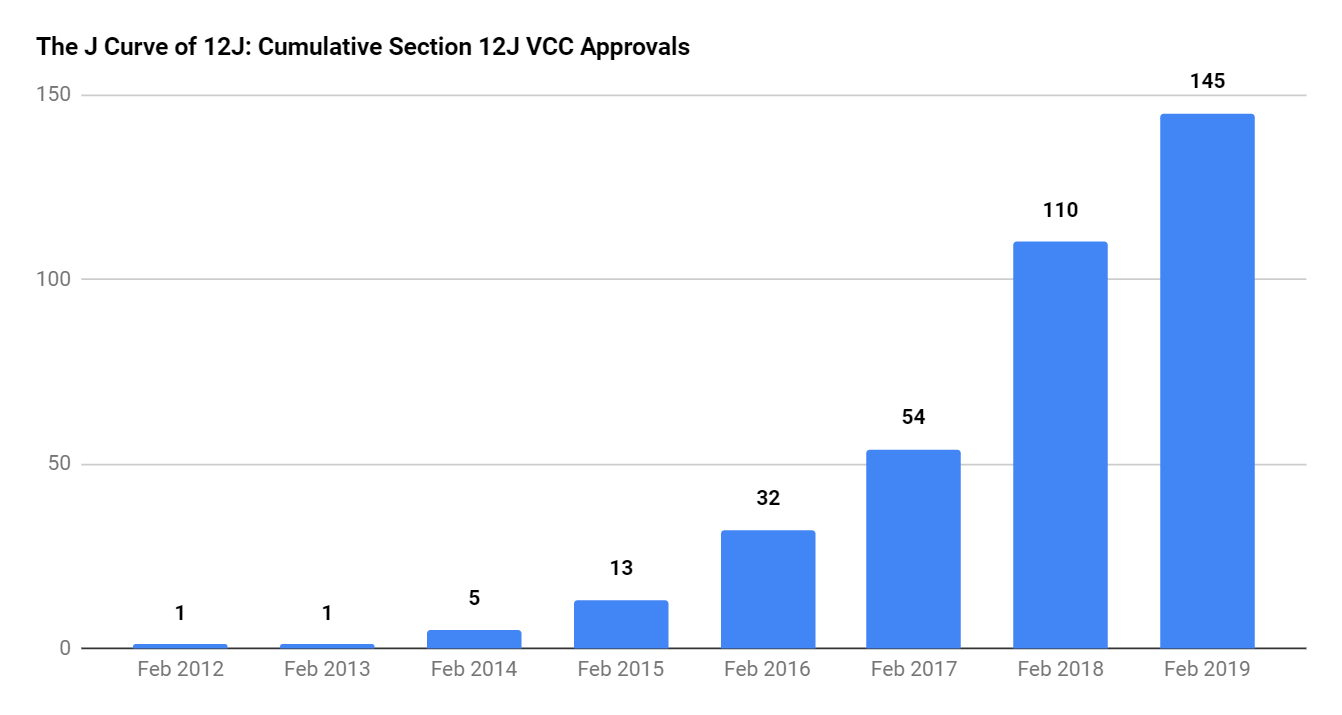

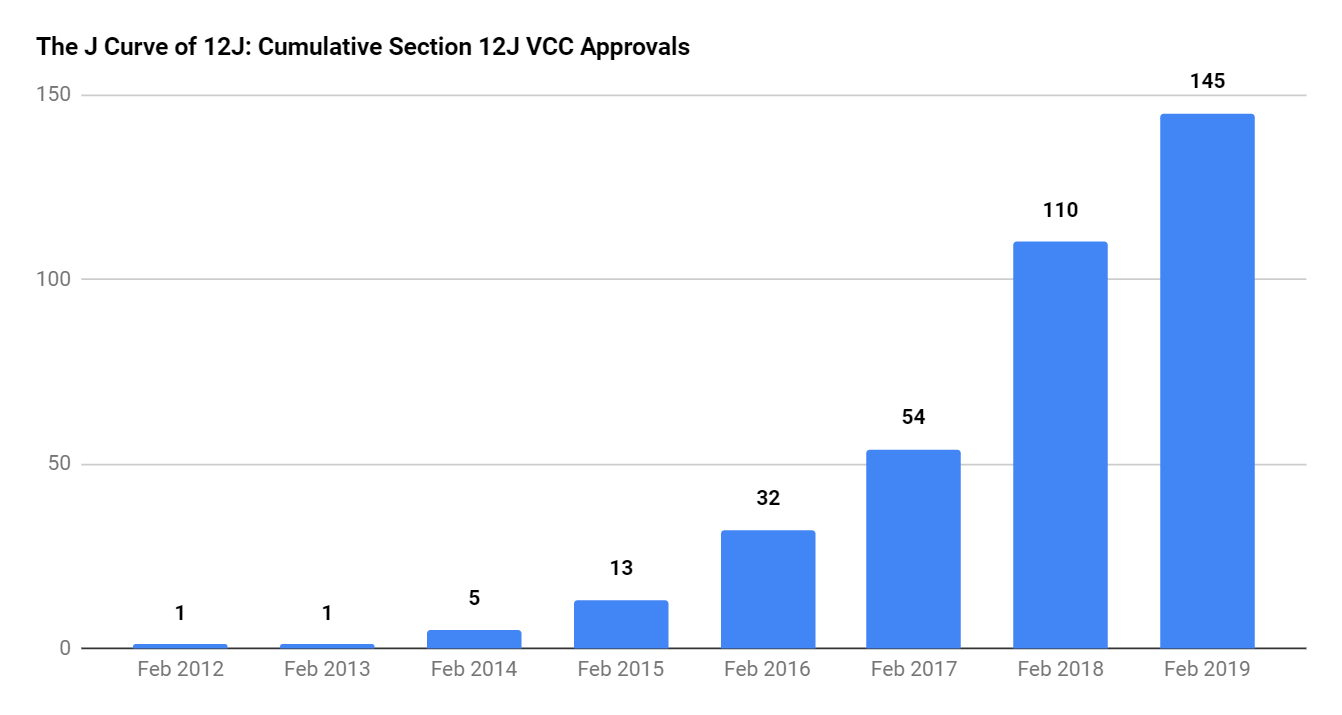

SOURCE: SARS

Initially, many thought the incentive would not last until its review date in 2021. Yet the venture capital company market is thriving as shown on the chart above.

In June 2018, National Treasury reinforced the regime by introducing new anti-abuse provisions which were widely interpreted as a vote of confidence in the sustainability of the incentive. VCCs which therefore still take on new investments present a unique opportunity: not only do they allow for investors to qualify for the tax benefits which National Treasury seeks to encourage through section 12J, but those VCCs unaffected by the new anti-abuse rules were obviously also structured in such a way to present genuine benefits to both the South African economy and investors alike. They are, after the latest amendments, truly “genuine” VCCs meeting the policy objectives envisaged by Treasury.

The simple example by which to explain the tax relief afforded by Section 12J is that of a salaried employee (earning income at the highest marginal tax rate of 45%). Assume that our employee has R100,000 of investable capital left in February at the end of her tax year. If she invested this amount into a suitable Section 12J fund, this amount would be deducted from her taxable income and she would be eligible for a cash refund from SARS of 45% of her investment, or R45,000. Her assets would now amount to R145,000 (being a R100,000 Section 12J investment and a cash refund of R45,000). If she decided to exit her investment after five years at zero percent growth (which is assumed for simplicity, although realistically, the investment itself may also have grown since) the tax deduction will become permanent and the CGT (capital gains tax) due on the investment made would amount to R18,000. And government encourages this: instead of investing in passive capital, government would have achieved an incremental R100,000 directed towards SME & Tourism with concomitant job creation (and an increased tax base!) to boot.

In light of the above, compliant VCCs also provide an elegant rebalancing mechanism for investors with investments overconcentrated in a single asset class. Many taxpayers may feel overly exposed to a certain asset class (e.g. certain listed shares), yet are wary to exit those investments for fear of the significant CGT consequence that would arise as a result. The VCC model presents an excellent solution to this problem for these prospective investors: CGT consequences arising from a sale of investments will be more than offset if the proceeds from sale of those assets are invested in a registered VCC. Not only will the investors have rebalanced their asset class risk exposure, but they will also have achieved a tax deduction over and above the CGT cost neutralised. Investors should seriously consider such a rebalancing of asset class exposure where such a latent CGT exposure is present, especially in a fiscal environment where a further increase in CGT inclusion rates in the upcoming budget on 20 February 2019 is not unexpected.

Assessing the potential of the underlying assets of the VCC is obviously even more important. It is accordingly notable that National Treasury is explicitly promoting much needed capacity-building in the employment-hungry tourism sector through Section 12J investments. Conservative investors can accordingly benefit by gaining exposure to growth assets with a fixed property underpin (such as “bed and breakfast” establishments), whilst creating employment and filling the fiscal coffers from foreign tourism spend.

Ten years on, is the Section 12J VCC tax incentive still living up to the hype? Considering that the regime is better regulated and healthier than ever in its short history, the answer must be “yes”. The industry is still nascent with less than R5bn*** invested into S12J VCCs over the past 10 years, and the use of the incentive equates to less than 0.1% of all direct taxes collected over the same period. Given the low base and significant benefits to both the investor and the economy, the robust growth in the number of regulated VCC funds and investment rates come as no surprise.

** for the taxpayer at the highest marginal tax rate, and an inclusion rate of 40%.

*** Market estimates. SARS does not disclose these numbers.

This entry was posted in TaxTim's Blog

and tagged Guest Blogger .

Bookmark the permalink.

Written by Neo

Written by Neo